|

First Direct (www.firstdirect.co.uk), the branchless bank, is going to start charging a monthly fee of £10 to some of its customers.

The fee will apply to those paying less than £1,500 into their account each month or those who have an average monthly balance below £1,500.

This new practice only affects First Direct customers that:

The bank says that this is so that only customers with dormant accounts will be targeted. Meaning that they are charging £10 a month only to those low maintenance customers who presumably don't use up as much in the way of resources, which then serves to subsidize those that do.

|

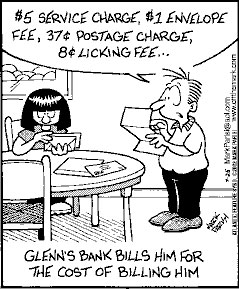

This is being touted by consumer groups as a first step towards an end to free banking, a football that the banking community kick around with relish from time to time. But banks are supposed to make money by using the money that we bank with them, giving us a small amount of interest and keeping the rest. The other source, is debt, hence first direct waiving the £10/month fee for customers who take out loans, or (I suspect) have overdrafts. The banks are in profit, so why the need for a pay banking service? First Direct tell us that it is so they can focus their attentions on their more important customers. Yeah.

Recently the banks raised the idea of introducing charges for the use of ATMs. This, they said, was necessary to cover the costs of ATMs. But ATMs are there to replace bank tellers. Clues in the name, children. The introduction of ATMs saved money, and because of the flawed way in which they work, they also encourage debt, as anyone who has gone over their overdraft limit following an incorrect balance statement will testify. If they do start charging, people will start queuing up for the humans, and then in ten years time the banks will probably start considering charges for peak times (like, y'know, lunchtime) for the extra staff they will have to take on to make up for the drop in ATM use. Lookin' busy, makin' money...

An end to free banking would be unethical for a further reason, and that is that there is now no real alternative to having a bank account. The powers that be have slowly made it more and more difficult to live without one, citing their usual list of bogeymen (benefit fraudsters, tax evaders, etc.) as a reason. So soon, every life will come with a £93 surcharge + extras (for the NIR) and a further £10/month fee from the age of 16 for the rest of your life.

Grr, and, needless to say, arg

This does make me cross...

HSBC has a new account called Current Account Plus or something. It offers around 5-6% interest on balances up to £2500. This big interest figure is written large in their advertising.

In smaller print, the monthly fee of £10 or so as an introductory offer. That's £120 per year

And what's 5% interest on 2500 over a year? About £125!

An HSBC employee tried to sell this account to me... "It's a great deal, over 5% interest!" He proclaimed

"Yes... but that's only just enough to cover the fees" I retorted

"You're right, it is" he said, and moved on... shameless as you like

First Direct could teach their daddy a bit about clarity and honesty, if this fees debacle is anything to go by

"...First Direct tell us that it is so they can focus their attentions on their more important customers..."

All I ask is that are equally honest in amending the responses given by their call centre machine:

Important customers being duly told "Your call is important to us.. You are third in the queue..."

and the humble low-value customer being told:

"Your call is not very important to us actually.. which is why you are 323rd in the queue. Try banking elsewhere if you don't like it..."

First Direct are part of HSBC group. They only earned £10Bn PROFIT last year... did you expect any less?

The government is aware that if banks shut unprofitable accounts, a lot of people who are nowadays forced to process their bill payments and wages via banks, will be put in difficulty. The government has tried to force the banks to meet these 'social needs' by providing a type of account that enforced users can utilise but which lose the bank money. The government would obviously like the banks to subsidise those accounts themselves, using profits made from profitable accounts. The banks, naturally, would like to tell the government to get stuffed, or to subsidise the accounts using treasury (i.e. taxpayers) money if the service is considered a social need.

As long as the big banks do make big profits (which they do) the government knows there will be little public sympathy for the banks argument that provision of social services is not their job. The banks, having been forced into doing so, are understandably turning the screw in whatever way they can.

The treasury wants to make the banks do something which the Treasury knows is socially needed, but doesn't want to fund with taxpayers money. The banks will do whatever they can to force the government to set up banking facilities for the poor at state expense - whether via bank accounts subsidised by the state, or via accounts outside of the main bank network. And so it goes. Each attempt at enforcing charges and insisting on minimum balances is part of the ongoing battle.

Ultimately the banks, together, probably have more clout than the government, and the government will eventually be forced into subsidising low-value accounts with taxpayers money. But while the banks are making fat profits, the government can presumably play the fat-cats card for a few more years yet.

Isn't it great though that with the rise in bad debts some are finding their profit margins disappearing, well for what they call 'the retail spending sector'. They can write a lot of it off against profits in other sectors.

Egg are really struggling, announced a loss for first half of the year, promised the city a profit for the 2nd half and then dreary doldrums they posted a loss again!

The banks have pushed the public too far and now they are getting bitten on the arse as more people either opt for IVA's or bankruptcy.

Comments on how your bank is treating you or would you like to express an opinion of the banking system?

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.