A: If you are with IG Index it's well worth spending some time experimenting around with their new toy (free of charge to clients, just open an account).

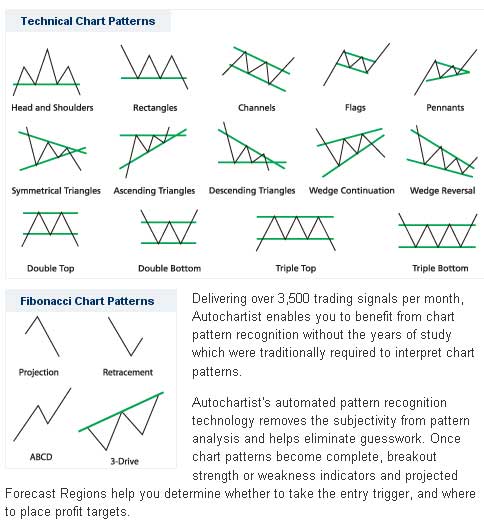

Most traders who base their trades on technical analysis will look for patterns to try to forecast how the market will move; the only problem with this is that it is very time-intensive to be looking at so many markets and individual patterns. IG Index attempts to offer a solution by offering Autochartist; basically an automated pattern recognition tool that monitors various markets on your behalf and flags up when certain criteria are met. IG's Autochartist is in effect a tool that will scan a chart in real time looking for almost any pattern you would wish, either technical analysis or Fibonacci related. You can set the application to look for patterns such as double tops, double bottoms, heads and shoulders...etc. A double top chart pattern happens when a market rises to the same or similar level a couple of times but fails to break through (usually seen as a sign that the market may be about to fall). A double bottom on the other hand is when the market falls to a same or similar level a couple of times without falling any further (seen as a bullish signal), a pattern that many view as a buy signal. In any case the video demo on the IG site is clear enough. Start with their settings and have a play. Put your own in and have even more fun.

|

The scanning software will keep analysing price and volume in your chosen trading instruments throughout the day, alerting you to any new potential trades as they arise, the time you spend in analysis can be greatly reduced and more opportunities can be found. Users can use customised search criteria to filter out patterns that do not conform to their personal trading style or time frame.

Some of you will find that IG's Autochartist doesn't do quite everything you need. For example I can't seem to use it to differentiate between overlapping and non-overlapping patterns other than by doing a visual check. Even if this is true, it's a minor price to pay for what is IMO a major improvement in their services provided to traders.

What an amazing resource this is to anyone interested in technical analysis or wanting to learn about it.

You can set up searches in all sorts of combinations, for example:-

High Quality for Every Pattern,

Medium+ Quality for two or more Specific Patterns,

Low+ Quality for just a Single Pattern.

Short term/Long term

Fuzzy/Sharp

Etc., etc. etc...

I have been playing with the filters this morning, and not being too selective with the filters seems to work best for me as I am looking to use it to pick up the "best looking" emerging patterns out of hours that I can then transfer over to my own charts for further study.

Very happy with this as a big part of my trading now is to only trade low risk, high probability trades. This should now shorten the time I spend trying to find them as well as helping me to find a wide range of patterns.

The pattern alerts should be quite useful whilst day trading. You can look at completed examples of a few rare 'perfect' cases. Then lower the quality and see the more frequent but increasingly imperfect ones. The facility to look at patterns that have recently met your own criteria for formation is very useful IMO, as is the one to set visual/audio alarms as they occur.

The ONLY fault I can find with it at the moment is that when you do a general search the results can only be sorted by the time they occurred. Pity you can't do it by Quality, Pattern, Market etc...but I'm sure they will put that right when it has been in use for a while and they get feedback.

I was reading a magazine that was showing a number of patterns for stock trades. Most of you know and have seen Head and Shoulder formations, Ascending and Descending Triangles, Double Tops and Triple Tops, and every conceivable Candlestick pattern there is.

The problem with this article and with many of these patterns is that they do not provide the reader with any rules to find these patterns and lack specific entry, stop and exit points.

How do you test a method with these vague pictures? You cannot. Now please don't get me wrong. I have no issue with pattern recognition in trading. My issue is with subjective patterns.

I am sure if I showed 100 people the picture of the Head and Shoulders pattern, there would not be a consensus by all 100 as to if it was a Head and Shoulders pattern and certainly not when and where the trade should take place.

If I said that a trade would be entered when the close of the current day is higher than the close of the last 20 days, an 8% stop placed, and an exit if there is a close below the low of the last 3 days, I feel confident that I could 100 people to agree if the chart meets those criteria. This pattern can be tested by any system-testing program.

If I further provided the stocks to trade as the top 5 Nasdaq 100 stocks with highest Beta, anyone would know which stocks to trade.

Be careful about using vague patterns that are in magazines that show a winning trade with patterns that you cannot find objectively.

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.