A: Spread bets are geared products that magnify the returns on share price movements but can also result in the loss of big amounts of money if the price goes again you. Thus, a spread betting provider needs to protect itself by capping the amount of risk you can expose yourself to. A way to limit this risk is by requesting you to make a deposit, known as a 'margin' before being able to place a bet. This deposit is refunded, as long as the spread bet goes your way, and backs up your bet while it is 'open'.

Betting on margin is when you utilise some of the spread betting providers's money to place a spreadbet. Margin Requirement denotes the deposit required in respect of each open bet on your account. When you place a spreadbet you must have sufficient funds to cover the Margin Requirement applicable to that trade. Margin is the equivalent of a 'good faith' deposit. It's a small percentage, usually between 2% and 30%, of the value of the contract that is deposited with a provider and is required to open a position. The amount varies according to the financial asset you're betting on - volatile assets require a larger margin.

Note also that some markets/stocks are not permitted to be margined or otherwise comes with high margin levels - this is normally due to their volatility and the desire of spread betting providers to refrain from lending out money when there is a high potential for default.

Financial spread betting is a margined product. Margin trading is an efficient use of your capital because you only need to allocate a small proportion of the value of your position to secure a trade, whilst still maintaining full exposure to the market. This means that you can trade big positions by only depositing a fraction of the normal capital outlay and in effect here what you're doing is to magnify the potential returns on investment. Spread betting on margin however does mean that if a position turns against you, your losses can also be magnified; and it is very dangerous if you leverage yourself to the tilt as all losses still have to be repaid. Also, if you trade the markets regularly through a broker, you will know how commission charges can affect your bottom line.

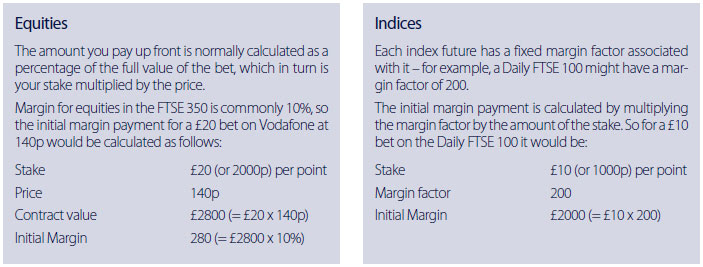

When you spread bet, the provider will quote you a bid-offer spread for a share or the level of a financial index at a given future date. The 'margin factor' relates to the 'deposit' retail traders must hold with a spread betting provider to cover potential losses - as you can lose more than your original stake.

For instance, if the margin factor on a particular share is £200 then a spread better wanting to bet £10 per point movement would need to deposit a margin of £2,000 (200 x £10). With the margin factor increased by 10% to £220 then the deposit margin would need to increase to £2,200. The initial margin is initially deducted from your cash balance after which the position is then continually market to market with the running profit or loss updating in real-time. Every point the share moves automatically increases or decreases the free cash resources.

Margin requirements are a good comparative of a market's volatility, whereby the more you need on deposit to open a position, the more volatile the market generally is. For instance, most clients tend to start trading the FTSE 100 index or blue chip shares as they tend not to require too much margin. The margin requirement for a £1 bet on the FTSE 100 index could be as low as £30 (although different providers have different margin requirements), whereas a £1 bet on the Nikkei might mean a deposit of £300 to £500 is required.

The minimum deposit of funds that you need to have in your account to open a new trade is known as the minimum margin requirement. Different spread betting companies will have different policies in relation to margins and placements of stops.

For instance on the InterTrader platform, you can find the minimum margin requirement for each market by clicking on the "i" information button to the right of each market on the platform. If, for example, the Margin Requirement on your desired market is 30 - 150 and you want to place a £2 a point trade, you will have to have at least £60 (30 x £2) in your available Trading Resources. The minimum margin requirement varies depending on the market.

|

The minimum margin requirement allows you to get into a trade with a low balance of Trading Resources. However, a lot of the time, you will have more than sufficient available Trading Resources. In these cases, the amount that will be used as margin will be the maximum margin requirement. With sufficient resources, if the Margin Requirement is 30 - 150 and you want to place a £2 a point trade, you will be margined £300 (150 x £2). The maximum margin requirement varies depending on the market.

You may amend your stop-loss to whatever level you desire, assuming you have the funds available and that your required stop is outside the minimum stop distance allowable for that market. Although stop-loss orders do go some way towards limiting your risk on your open trades you must be aware that your stop-loss order is not guaranteed. This means that should a market gap, you may lose more money than your initial deposit (see clause 10 in the terms and conditions).

A: When you trade in the world financial markets, like for example buying shares you put up the money and buy the shares.

For example if you wanted to buy some shares in Vodafone because you think they are looking cheap and will go up then you could call up a broker, and if you wanted to invest £1000 he would buy as many shares as he could for you and take a small commission all out of your £1000.

Or you could do a margin trade, like a spread bet.

Take InterTrader. On Vodafone the margin rate is 10 percent (no commission) .

So if you wanted to buy your £1000 worth of Vodafone you would only need to deposit £100 (10 pct of £1000) with the spread betting company and leave the rest in your bank! So margin trading enables you to leverage.

You could use your entire £1000 in a long spread bet and effectively control (buy) £10,000 worth of shares. Thus leveraging yourself a lot.

In effect, when opening a spread trade you are in a similar position to owning the physical. For example, buying £20/point in BP is the equivalent to being long 2000 shares. If BP was trading at 500-501:

2000 x 501 = £10,020.00.

Worth of stock. If the margin for BP is 10%, then your margin requirement is £1002.00. You will notice that different products and markets will have different margin factors.

So margin refers to the deposit or available credit needed on your account in order to open and retain your position. Different contracts have different margin requirements. The required margin on each contract is defined by the IMR (Initial Margin Required).

If for example you were to trade £2 per point of FTSE Daily Future typically the margin required is 30. So you would multiply your stake of £2 by the Margin which is £60. So to place this trade you would need £60. This amount of money needs to be maintained in the account at all times, meaning if the position was to move against you, you would have to top up your account.

Note: Leveraging yourself a lot is not recommended. With margin trading you must keep your account in credit. So if for example the price fell a little and you had bought it then you need to have this extra money in your account so that you always have the necessary 10 pct margin (there is some flexibility on this but in principle that is how it works).

Also, with margin trading you do not 'own' the shares, so you cannot vote with them. But you would get any dividends payable.

Margin trading is like trading with someone else's money. If you make money on your spread bet, you get to keep the profits. But if the market moves against you and you lose, you have to pay the company what you've lost them...

A: There are two types of margin in spread betting. One is initial margin and the other variation margin. Initial margin can be viewed as a kind of deposit 'to open the trade. The initial margin is basically the amount of money you are required to have in available funds in your account in order to open a trade, variation margin is the amount of money you are required to deposit to keep the trade open should your account run into negative. It is easiest to explain using an example:

Additional margin is required if hold open positions and exceed your credit allocation or initial deposit because of -:

a) Open position losses marked to market.

b) Realised losses.

c) Excess Notional Trading Requirement (NTR).

d) Or any combination of the above three.

The amount of margin required is the total of the above factors minus the amount deposited or the credit allocation. If you have a deposit account, when the aggregate of open position marked-to-market losses and any NTR requirements exceed the amount deposited, the

difference is immediately due to the spread betting company as margin from you.

Example: Suppose that for the FTSE rolling future the IMP (initial margin rate) is 30. This means that you are required to have 30 times your stake in your account to open a position, so let's say you want to buy £5 per point, you need £150 in your account to open this trade. This amount is taken out of your 'available funds' until the position is closed.

Once you open this position, you are then required to cover any negative balance in your account.

You have £150 in your account. You open a £5 trade on the FTSE. £150 initial margin is taken from your available funds. Your account balance is now £0. Your FTSE trade is losing £50. You are required to pay £50 in 'variation margin' to keep this position open. Let's say after 2 days your trade is losing a total of £75, you have paid a total of £75 in variation margin and you decide to close your position. You close your position with a loss of £75 and the £150 initial margin is returned to your available funds. Your account balance is £150, but you have deposited an extra £75 to cover the loss from the trade.

Spread betting companies will contact you if you owe them variation margin but it is your responsibility to monitor your trades. If variation margin is not paid they will close out your position after sometime (usually 2 or 3 days).

A: IMR is Margin so a 50 IMR means 50 times your stake.

A: NTR stands for Notational Trading Requirement. In order to open a trade you must have a minimum amount of free capital in your spread trading account. This is because any spread betting provider will insist on a minimum margin requirement so as to ensure that you have sufficient funds in your account to cover any possible losses. NTR is a risk figure applied to each individual market that the provider quotes and which the provider considers being a fair reflection of the potential daily volatility applicable to the market in question. It is thus important that, prior to trading, you familiarise yourself with the levels of NTR applied when you are considering what is the suitable size of your stake.

|

Example, NTR for the Dow Jones Index: So for instance if you wanted to open a spread bet for a stake at £1 per point and the Dow Jones were currently trading at 13500, with a notional requirement of 2% you would need to hold £270 in your account to open the trade.

The £270 would be the minimum amount you would need to hold in your account to open a £1 point position on the Wall Street Index. This minimum amount is referred to as the NTR (Notional Trading Requirement). In general, the more volatile the market the higher the NTR will be.

So, if you decide to buy £5 per point on the Wall Street Index when this is trading at 13500, your NTR would be £1350 given a 2% NTR [2/100 x 13500 x 5]. NTR x Stake is the minimum value you must deposit before being allowed to trade a certain stake size in a particular market.

Single shares are usually calculated based on share value x 'v%' where 'v' is an amount your provider considers as the reasonable potential movement in a given market.

Example, NTR for Gold: Spot gold may have an NTR of 80 points which means for every £1 a point you bet you will need £80 on deposit.

Example, NTR for an Individual Stock: You buy £20 of British Petroleum Amoco at £5.60. As such this is a FTSE 100 stock so the NTR is worked out as (£20 x 560)*10% = £1,120 (£1,120 is therefore the NTR required on the spread betting account to open the trade. The typical NTR for FTSE 100 stocks is 10 % of contract value. For non-SETS stocks the NTR is a larger percentage while for companies outside the FTSE 350 the NTR may be greater than 25% of contract value.

The Notional Trading Requirement is sometimes also referred to as the Normal Margin Requirement by some providers.

The NTR can sometimes be reduced depending on where you place your stop loss; i.e. the closer you place a stop to your position the less margin is required. For instance, ODL Markets has a standard Normal Margin Requirement of 2% on the DOW JONES but this can be reduced to 0.6% depending on where you place the stop loss.

Example:

ODL Markets insists on a Minimum Margin Requirement for the Wall Street market of 0.6%.

Therefore taking the same example of the Wall Street Index, if you were to place a stop up to 0.60% (or 81 points) below 13,500 you would need to deposit a minimum of £405 for the same £5 per point position. [(13500 x 0.6/100) x 5].

A: First of all, do note that margins do vary from instrument to instrument and depend primarily on the asset's volatility and liquidity. At IG Index the deposit needed for a position is calculated differently depending on what kind of stop (if any) is on a position. Deposit requirements (margin) are calculated in one of three ways:

With a Guaranteed Stop, simply multiply your stake (amount/point) by your Stop Distance. This deposit requirement will not be subject to variation and will remain the same throughout the life of the trade (providing the stop distance is not edited. With such positions any running losses will not need to be covered by the funds on the account as the total potential loss is known in advance.

Guaranteed Stop

Amount per Point x Stop Distance

With a Non-Guaranteed Stop (this will be up to a maximum of what the deposit requirement would be if the bet had no stop), your margin requirements are calculated as follows: Deposit = [stake x stop distance from current level] + [(deposit for no stop) x slippage factor].

Non-Guaranteed Stop

Amount per Point x Stop Distance + (Slippage Factor x Deposit)

As current levels are used in the calculation this type of trade would be subject to variation margin although running profits and losses are added to or subtracted to the available funds on the account.

No Stop

With no stop it is calculated as follows:

For everything except shares:

Deposit = [stake x deposit factor]

This deposit requirement would not change with price fluctuations and running profits and losses are added to or subtracted to the available funds on the account.

For shares:

Deposit = [stake x price x deposit factor]

As the current price is used in this calculation, the deposit requirement will be subject to change and running profits and losses will be added to or subtracted to the available funds on the account.

No Stop

Amount per Point x Deposit Factor

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.