A: This question was responded by an experienced trader whom I have full respect for -:

Actually, yes I do...quite a few, and some are SERIOUSLY rich! One person in particular...

She started with £2k and over a period of 2 years nearly lost it and just about came out flat... then she made a few hard decisions, mostly about honesty with herself and discipline... she currently makes about £1- £2k a day and its a bad day is when its only £500. She trades just a few stocks and very rarely holds overnight.

I also know of people who have worked on the inside for years. They all say similar things. They do have massively successful clients who make seven figure tax free sums most years. This IS NOT done via scalping but by either position or swing trading. Some clients hold positions for two years!

Although I'm not rich I do quite nicely on the whole spreadbetting and that's just little old self taught me. Just because people don't make the hall of fame does not mean they have not made a lot of money trading be it spreadbetting, cfd trading, warrants whatever...

This is not to say that spread betting is a way for easy riches; it is a known fact that the majority of spread traders fail. At a GFT trading seminar we attended we were informed that it could take up to two years before you start consistently making money spread betting.

A: It is quite possible to turn £10,000 into £100,000 via spread betting but the odds are against you. You'd just have to be very lucky... Being this lucky, in my experience, wouldn't really do you any good. First of all, to have any chances of making it you would have to take really serious risks with leverage! Even if you somehow manage to turn £10,000 into £100,000 that amounts to an astounding 900% return on investment. By year end when you have your £100,000 you would start thinking why not turn £100,000 into £1,000,000 by the next year. Problem is that if you had been so lucky to achieve a 900% return what's the chance at being this lucky again? Chances are that one day your luck would run dry and you'd get trunked or struck by heavy losses - and you'd end up losing your capital and more...

Here's a trading system you could utilise if you are just about starting out and have £10,000 of available capital you are willing to risk (lose) -:

Most of the times I recommend only starting with £1000 after some months of successful demo spread betting. If you end up ahead after your first month of trading with real money, then simply add another £1000 to your trading account. If your second month is also successful, then add another £1000 for the next month. In this way you are proving (to yourself) that you are indeed successful before risking all of your hard earned cash.

If by any chance you end up losing all your money in a particular month, then you stop trading for the month. Do not deposit any more funds to your trading account until the following month and then retrace your steps and learn from your trading experience. As I said, you do not need big amounts of money to make it worthwhile. Say you are earning 8-10% per month and letting it compound. You take out 50% of your earnings each month to reward yourself and let the rest ride.

If you are starting with £10,000, then that would give you £400 each month the first year. The second year you would be starting with £16,000 in your trading account giving you £640 per month in earnings. etc. True, it's not a full-time income yet, but within 6 years you would be up to over £4000 per month and your trading account has increased to over £100k. After 10 years, your income would be over £27,000 per month.

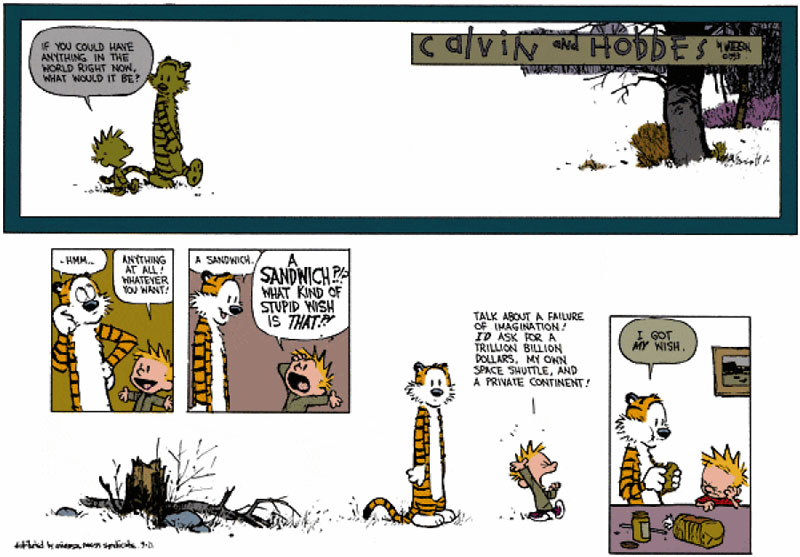

The important thing is to be patient and not avoid getting greedy. Greed and the rush for riches is rookie thinking.

A: Well, apart from the owners that run spread betting companies themselves ![]() , it is a fact that large fortunes can be made or lost from spread betting. It is documented that George Soros made almost $2 billion shorting the pound in September 1992 after betting almost all his wealth (however, in practice his profits amounted to some 10% since he risked a lot of his money on the punt). This episode earned him the unofficial title of the 'the man who broke the Bank of England' as the pound had to be devalued and withdrawn from the European Exchange Rate Mechanism.

, it is a fact that large fortunes can be made or lost from spread betting. It is documented that George Soros made almost $2 billion shorting the pound in September 1992 after betting almost all his wealth (however, in practice his profits amounted to some 10% since he risked a lot of his money on the punt). This episode earned him the unofficial title of the 'the man who broke the Bank of England' as the pound had to be devalued and withdrawn from the European Exchange Rate Mechanism.

But who exactly is George Soros?

George Soros is one of the living legends of financial investments. Today, his fortune runs into billions of dollars. His flagship is the Quantum fund and its various offshore offshoots.

George Soros was born on the 12th August 1930 in Hungary. He migrated to U.K. at the age of 17, and graduated from the London School of Economics. It was here that he became acquainted with the works of philosopher Karl Popper who had a profound impact on his thinking. He migrated to the U.S. in 1956, and started his own international investment fund – the Soros Fund Management LLC.

Soros actively invests a big portion of his assets in currencies and index-linked derivatives - but never for long. He flits in and out of these instruments incessantly, rarely holding a position for more than a few days. Soros is well-known for his generosity and started his philanthropist activities in 1979 when he provided fundis to help black students attend the University of Cape Town in South Africa.

A network of 20 foundations across Central and Eastern Europe organized most of Soros' philanthropic activity. The first was opened in Hungary in 1984. He pledged $100 million to support scientific research in the Commonwealth of Independent States last year, donated $50 million to Bosnia and financed a $25 million revolving loan to buy heating oil that helped Macedonia survive the winter. Soros has also authored eight books on various subjects.

Vince Stanzione is another well-known persona who raked in profits for more than £2 million spread betting commodities. However, a failed punt on the shares of HBOS cost Mike Ashley, an English millionaire retail entrepreneur some £300 million. This was when Mika Ashley opened a huge long position on HBOS expecting them to recover when in actual fact they kept going lower before finally being taken over by Lloyds TSB.

Another popular commentator and trader in the City, Simon Cawkwell, a trained accountant better known as 'Evil Knievil' made over a million-pound profit shorting Northern Rock in 2008. Now in his sixties, Evil Knievil established himself as a bear raider when he successfully shorted Maxwell Communication Corporation and Polly Peck International, two companies which went bust in the early 1990s.

|

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.