OANDA is the creation of Richard Olsen and Olsen Capital but we also know that Oanda manages forex accounts on behalf of investors...

Here at Financial-Spread-Betting.com we have an open policy of saying things as they are, even when things go bad and the OlsenInvest fund looked like the Dow Jones with a huge dip in 2008 - a dip in fact that looks beyond ever possible recovery. If past performance is anything to go by, it would take about 3 years to break even again. I doubt investors have appetite for more of that.

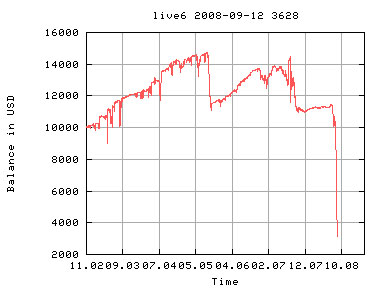

We know there were risks involved especially with Fund 6 (performance of which is displayed below) - for the record Oanda had different managed forex accounts with different risk profiles ranging from 1 to 6 with '6' being the most aggressive fund on offer, and hence the most risky as well. Looking at the performance of the forex managed funds, even the conservative ones it seems that their strategy appears to have been 'frontloaded' - many consecutive small gains with very infrequent massive losses. Good for the manager - performance fees on new equity highs and management fees - bad for the investor in the long run.

|

The OlsenInvest 6 fund looks like the Dow with a huge dip in 2008

The problem I see is whether we can feel at ease with a manager who is uncomfortable displaying the downturns of past years? When we queried these huge and very quick drawdowns with Richard Olsen his response was the following -:

'We are in the process of releasing new investment products. The new products have a much lower return objective than the previous products and therefore cannot be compared with the earlier products. Most important, the new products have a much better performance during periods of extreme volatility.

The performance graph that you have enclosed relate to models that we were operating in the third quarter of this year. In the mean time, we have completed our model development. We have succeeded in building models that can successfully trade in periods of high volatility. The new models have a much improved risk management infrastructure, which dramatically improves the risk adjusted performance. We plan to release our new products in the coming months and look forward to receiving your feedback.'

This is all very well but the fact is this is not Richard's money - he's dealing with other people's monies and he may do better day trading on behalf of clients which I'm sure he feels he is above all that. We know that Olsen is legitimate for a certainty, he is a university professor in Switzerland and is the Oanda co-founder. Now just because this fund lost 80% in a matter of days doesn't mean it's a scam, but it does mean there was something horribly wrong with the strategy. Just pretending it never happened on their new InvestatOlsen.com probably isn't going to bring much confidence in the new products.

This wasn't the only drawdown experienced by his fund either. In 2007 one of his funds was overwhelmed by volatility and lost 7% - wiping out the year's gains (see PDF). But he still urged investors to stick with his quantitative style then. 'When you have a drawdown, people say you shouldn't be in these strategies, and some of our investors did pull their funds. But the factors driving currencies are too complex for human traders. The right approach is quantitative,' he said. Here's some other lines of text from another site...read the very last paragraph...I think it should be a wake up call to all traders at any level.

The going was particularly tough for computer model-driven funds where managers don't step in to override their automatic trade instructions. Richard Olsen, who runs $100 million in computer-based currency funds at Olsen Invest in Zurich, said one of his programs was overwhelmed by volatility and lost 7% - wiping out the year's gains. But he's upping his models' tolerance for volatility and urging investors to stick with his quantitative style. 'When you have a drawdown, people say you shouldn't be in these strategies, and some of our investors did pull their funds. But the factors driving currencies are too complex for human traders. The right approach is quantitative,' he said. That view is echoed by George Dowd, a Chicago-based manager of $50 million in model-driven currency funds at Spectrum Asset Management. His investments ended up 'flatish to slightly down' in August, he said. 'It's difficult to tell which asset classes will perform well and when. But the performance in currencies will get better, and at the end of the day, it's still very good to diversify your portfolio,' he added. There were some winners from August's frantic trading, too. Keith Presbury, who runs a fund at Rhicon Currency Management, said his returns climbed by 3.7% thanks to successful opportunistic bets that the selloff would reverse towards the end of the month. Now Presbury is confident that there's morevolatility to come for the currency markets, which will throw up more opportunities to make money. 'A lot of the damage has been done, so we may not see the carnage of mid-August again, but there's still some unwinding to come. We feel fairly positive about the market,' he said. Presbury said that now the trick for investors keen to avoid too many highs and lows from currency funds is to spread their exposure. 'People look at recent performance and say that you shouldn't be in FX. I think you do want to be in FX, but you don't necessarily want to be with a single manager,' he said.

single manager = single dealer??

This fund for me is also living evidence on how hard forex trading can be. We know that Olsen Invest is very much into equations and algorithms and their tweaking rather than trading by hand and eye. If they were to sit there and take some risks at the screen they would probably do better, unfortunately they seem not to intervene in whatever model/s they have running! So this goes to show that mathematical trading and automated trading systems are not fool-proof...

Sobering thought: If the 'creator of Oanda' can't make any money at this stuff (using his own fxtrade platform, no less!) - how in god's name can the Average Joe? And remember it is vital to hold trading accounts with at least 3 or 4 different trading platforms...ideally in different countries...to guard against the unexpected...It is always a concern for me that large uncontrollable losses by a large client (in this case Olsen or a major client) could perhaps wipe out all or most of the Total client deposits held by the broker for All its clients...Segregation doesn't help much if trading deposits for All clients are held in just ONE 'segregated' bank account...

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.