A: No, no, no and no again. The only way to make money is small losses and big gains and until you learn to sell when you're wrong you will find it very difficult to make money. It's been said over and over and over again and if you're not going to do it...or you can't do it...then I urge you to stop before you lose all your money.

If you have 100,000 and you place 10000 on a trade and you lose 10% of it you will have 99,000 left. If on the next trade you place 9,900 and make 11% then you will be be in profit. You can keep going for a very long time before you're bust, even with a lot of bad trades.

Also, trading isn't about patience or impatience, it's about maximising opportunities. However, when it doesn't work out...the impatience can cost, I accept that. As you know, I take the view that if one is going to sell then sell at the top. For instance having not sold ALN at the top I followed my system and didn't sell. I did however have a profit-maximising-stop in mind.

A: OK... nobody can stop you impulse trading; only you can do that. The problem wasn't the impulse but the trade management. And all trades, whether planned or impulse should have some sort of plan, even if the plan comes after the trade!

First, who would have thought a yes vote would make the markets fall? Not me. I think your trade went wrong for more than just impulse buying. Imo it went wrong because you didn't have a strategy and without a strategy statistically you can't win. You are at the mercy of a 50% probability less the spread so over the long term you must loose. You were not using technical analysis but fundamental data/news. That's fine - each to their own. Having made your trade based on the news you then added to your position before there was any fresh confirmed news and at that point your money management goes to pot.

As soon as you placed that £10 bet you needed to be doing the maths. At £12pp you were going to lose your £500 paper profit in 41.66 points. Losing £500 paper profit isn't nice but it's not the end of the world. Of course, you might have wanted to extend the stop to a small real loss by giving yourself an extra 10-20 points, or whatever. The point is that from the moment that impulse trade was made you needed to be managing it.

Of course this is easier said than done especially at the moment due to volatility being extremely high which also means risk to reward ratio is out of the window. The day that Congress passed the bailout also happened to be US non-farm data release date, it's the first Friday of every month, on this day a lot of traders (short term) don't want to be in any positions at all. I've noticed myself that the indices even 30 minutes before the data release there is usually a batch of dreadful long ranging spikes/higher volatility/sometimes very quick reversals, be extra very careful on this day, in my mind even if things are lining up nicely it's still not worth the risk.

Another point is that there are dozens of indicators that are supposedly telling us when to buy/sell but not one telling us specifically when to refrain from trading - consolidations and narrow ranging-non trending markets etc. I have never seen a chapter in a book given over to "when not to trade". I have a few of my own rules for when not to trade but I think it is a much overlooked subject.

To conclude and address your question the way to prevent impulse trading is to adopt a defined profit and loss strategy and stick to it. Trading without a strategy is difficult and leaves you prone to impulse trades where you may end up entering or closing a trade prematurely. If fear or greed prevent you from sticking to your strategy then maybe it's the wrong strategy for you or maybe you just don't have the emotions/discipline to trade.

And remember - there's always another day to make up your losses and if you can get a good night's sleep in between times whilst you're not stressed by watching a trade then you will come back to it less emotional and best placed to make a better judgement.

Anyway, I'm really very sorry you had that bad experience.

|

Greed and fear are the base emotions that trigger psychological reactions.

A: Not at all an error but what you do have to do is decide on your criteria for buying and then take the trade with a stop and a target. That does away with all that 'tearing up' crap. If, however, you are just thinking I'll buy this that or the other wth no clear plan, you're going to find it difficult to press the button because there's no reason to one way or the other.

|

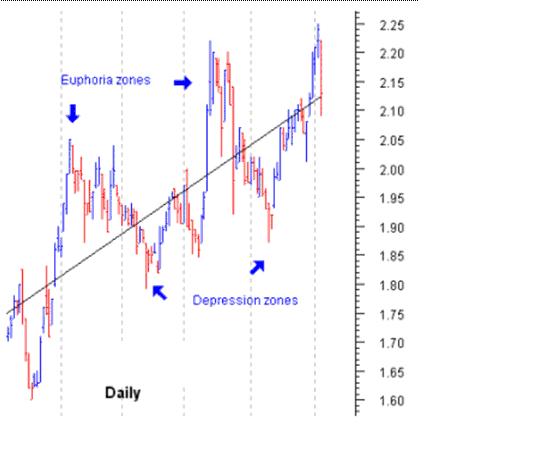

Looking at the above chart, the moving averages signalled a buy 26/1 and the pullback, such that it was, was 2/2 with the entry on 3/2 on clearing high of 2/2, stop low 2/2. All looks easy [to me] with hindsight...but trading the right hand side of the chart is much harder!

In any case these things happen to us all and are inevitable from time to time - getting into a rise too late, making a small unrealised profit, not taking that small profit quickly enough and ending with a small loss when the share price hit a stop. The real skill is to work on your timing so you are in earlier and not faced with the problem.

A: Some traders would try to avoid this but this really depends on your risk management profile. A small profit can become a small loss quite easily and that's just a badly timed or unlucky trade. Letting a big profit turn into a loss is more serious issue....

A: Sorry for your losses. Doesn't strike me that you have a system or proper risk management in place.

The starting point is to make good trades in the first place, then you have to have a trading plan, for which read a target and a stop. It's the most basic and important step to making money. Taking small losses is key if you hope of ever making money especially in this difficult market unless you are a buy and hold investor in which case you can disregard day-to-day market fluctuations.

1. turn off your puter

2. go to the pub

3. keep everything crossed

4. hope for the best (but hope is an emotion best avoided) ![]()

5. keep margins SMALL

I think much may have to do with your attitude and the fact you trade on emotion.

A: I think the pot as you put it is irrelevant and is different for every individual.

Two words - money management. Start by being honest and asking what is the maximum you are prepared to lose on a trade before you close out for a loss. It is different for everyone but suppose you set a limit of no more than pound;100 loss per trade. You must next work what size your stake must be to contain this loss. You cannot do this until you know where to set your stop loss. Best place to start is looking at the charts - it's fairly straight forward most of the times using support and resistance.

Once you know where your stop should be you can calculate how big your stake needs to be to contain your max pound;100 loss. So you trade from what is your maximum loss - not from how much profit you hope to make. There are other ways to trade but this way will help you preserve your capital and take the emotional stress out of the loosing trades.

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.