The role of a stock market index is to measure changes in the value of specific groups of stocks and help measure changes in the entire market. Indexes can provide a quick snapshot to see how a specific group of stocks performs compared to other groups of stocks. Because performance varies greatly from one sector to the other, it's very useful to know your way around the major Indexes. Traders use Market Indexes as important tools when trying to anticipate future movement in stock price. For example, it is not realistic to expect stock ABCD to perform greatly outside of scope of index it is part of. It is therefore important to know what index is representative of stock you are trading.

All major stock market centers around the world have key indices by which the economic performance of the region is evaluated. In the United Kingdom we have the FTSE 100 while in the USA the most commonly referred benchmarks are the Dow Jones and the S&P 500. The situation is similar in Europe with each exchange having its own main index indicator although some of these indices are now quoted on pan-European platforms. NYSE Euronext was the result of a merger of America's NYSE with Euronext and now houses the AEX for the Netherlands, Bel-20 for Belgium, CAC-40 for France and PSI-20 for Portugal. In Germany, the independent Deutsche Boerse quotes the DAX 30 index while in Italy the Borsa Italiana [now part of the London Stock Exchange Group (LSE)] quotes the MIB-30 index. In Spain, there is the IBEX-35 which is the benchmark of the Bolsa da Madrid, Spain's main stock exchange.

What are the different indexes and how do they differ? Here's a breakdown of some of the indexes that you'll probably use of in your trading efforts:

|

|

|

|

|

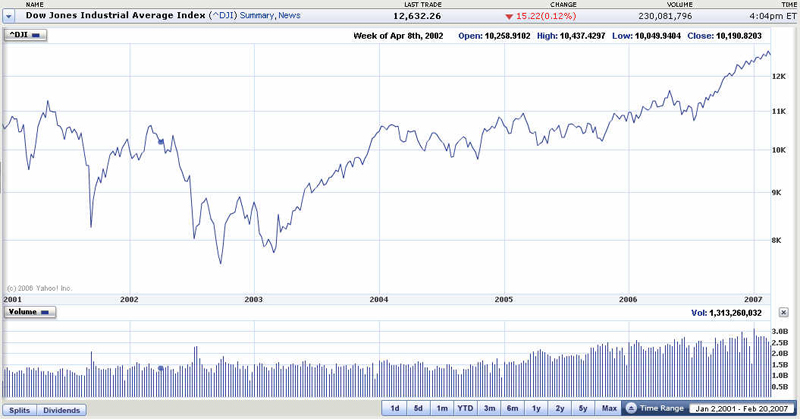

Popularly known as the "Dow," this index was created in 1896 as a 12 stock average. Today it is the best known and most widely followed market indicator in the world. It tracks the performance of 30 large, blue chip companies - all of whome are household names and leaders in their field. Companies are added on the list and subtracted from the list based on their importance and influence in the specific sector. Unlike most stock market indexes that are market capitalization weighed, the DJIA is computed by adding the stock prices of 30 participating companies and dividing by a factor that adjusts for differences caused by stock splits. At the time of writing the aggregate market capitalisation was around $3.8 trillion.

|

Companies that are currently represented in the DJIA are:

Alcoa (AA), American Express (AXP), Boeing (BA), The Travelers Companies, Inc. (TRV), Caterpillar Incorporated (CAT), Du Pont (DD), Disney (DIS), Eastman Kodak (EK), CISCO (CSCO), Home Depot (HD), Honeywell International (HON), Hewlett-Packard Company (HWP), IBM, Intel (INTC), International Paper (IP), Johnson & Johnson (JNJ), JP Morgan (JPM), Coca-Cola (KO), McDonald's (MCD), 3M Corporation (MMM), Philip Morris Co. (MO), Merck & Company (MRK), Microsoft (MSFT), Procter & Gamble (PG), SBC Communications (SBC), AT&T Corp (T), United Technologies (UTX), Wal-Mart (WMT), Exxon Mobil (XOM).

From the list above you can conclude that with selection of this 30 stocks, DJIA attempts to capture the market as a whole. It is worth noting that the Dow's 30 constituents also trade on both the NASDAQ OMX and NYSE Euronext platforms.

The other four important Dow Jones Averages are:

Average of 20 railroad, trucking and airline companies.

Average of 15 power, gas and electric companies.

Average of all 65 companies in the three previous averages.

Average of 25 Internet-service-oriented companies

Some other important market indexes are:

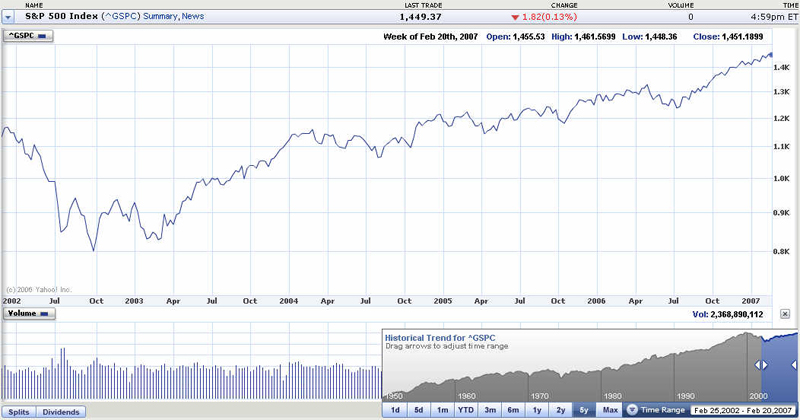

The S&P 500, compiled since 1957, consists of a very broad base 500 stocks. It includes 400 industrial companies, 40 utilities, 40 financial and 20 transportation companies and presently has a market cap approaching $12 trillion. As the name suggests, it tracks 500 large cap US companies, including the Dow-30 constituents. In this sense the S&P 500 offers a much broader range of sectors and industries than the Dow.

S&P 500 is capitalization-weighed index. It is calculated by multiplying outstanding shares by stock price of 500 stocks that are traded on NYSE, Nasdaq and AMEX. The benefit of capitalization weighing is that each company's influence is proportional to its market value. S&P 500 Index is followed more by large institutional investors than by average public that is more informed about much publicized DJIA. It is worth noting that the companies included in the S&P 500 also trade on the NASDAQ and NYSE.

|

If Dow Jones Industrial Average is the most popular index for general public and recreational investors, Nasdaq Composite Index is by far the most important index for active investors and day traders. It is made up of 3,000-plus constituents most of which are technology and growth stocks. It measures all Nasdaq domestic and foreign stocks. Like S&P 500 and unlike DJIA, it is market capitalization weighed. The market value, the last sale price multiplied by total shares outstanding, is calculated during market hours, and is related to the total value of the Index. Nasdaq Composite Index began on February 5, 1971 with a base of 100.

|

All of the securities that are part of Nasdaq Composite assigned to one of the following eight sub indexes:

The Nasdaq Bank Index consists of 625 banks and savings institutions and companies performing functions closely related to banking. It began on February 5, 1971 with a base of 100.

The Nasdaq Biotechnology Index consists of 202 companies involved in biomedical research and development. It began on November 1, 1993 with a base of 200.

The Nasdaq Computer Index consists of 906 computer hardware and software companies and companies that produce computers, office equipment and electronic components. It begun on November 1, 1993 with a base of 200.

The Nasdaq Industrial Index consists of 2,297 companies that are not classified in any other Nasdaq sub indexes and areas of their business include agriculture, mining, construction, manufacturing, services and public administration. It began on November 1, 1971 with a base of 100.

The Nasdaq Insurance Index consists of 73 insurance companies including life, health, property, casualty, brokers, agents and related services. It began on February 5, 1971 with a base of 100.

The Nasdaq Other Finance Index consists of 153 credit agencies, security brokers, exchanges and dealers, real estate, and holding investment companies. It began on February 5, 1971 with a base of 100.

The Nasdaq Telecommunications Index consists of 386 telecommunications companies. It begun on Nevember 1, 1993 with a base of 200.

The Nasdaq Transportation Index consists of 97 transportation companies of all types. It began on February 5, 1971 with a base of 100.

>> FTSE Spread Bet vs FTSE Tracker

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.