A: Some will say...um yes but unless you know a stock very well and are ultra confident then you simply face the prospect that what appears cheap today will be even cheaper tomorrow. This is because the possibility exists that if oil price and market keeps going down your 'star' stock will go down with the best of them ;-) There are times when contrarian investing is a good idea and bottom fishing pricing anomalies can be very profitable but it's only for the brave and on stocks you feel ;-) you understand.

When the market is heaving down it's not really smart to be buying anything because a lot of people will move into cash or take profits. Holders on forums will try and entice you to stay with calls of 'added', 'it's cheap', 'got to go up'...most of the time I doubt these people are doing anything more than trying to protect a falling investment. If you want an example of what can happen to your money, have a look at MDX from 1999-present day.

Another thought is that generally the busier the bulletin board the more likely you will see big price spikes. Another useful piece of advice (no advice...) is that it is always good to check when a trading statement is due. The date isn't always known but check news going back to see and then have a look at what happened. A stock like DGO will almost always go up before a trading statement and down on the day...this is not gospel.

One thing is for sure when sentiment turns negative it can have a impact on the very best companies, here is a true example: I researched a company that I thought was a winner, COL, at the time it was trading around PE of 7 and the share price was 185ish, I thought it was a winner however little did I know that the whole sector was about to get a big shake and the rest is history. I lost around 20% in total as I adhered to my stop wasn't easy at that time and still hurts but could have been a damn sight worse.

A: With spread betting you need the market you are trading to move up or down so high volatility with plenty of movement is generally good as this improves the risk-reward factor of your trades. In fact it is consolidation that kills spread betting accounts as the winning trades are not sufficiently big to overcome losing trades.

So with high volatility you can end up with big winners BUT only if you are able to control the risk when a trade goes wrong and the market moves against you. This is because leverage cuts both ways and losses can add up very quickly if you are on the wrong side. The key here is to use stop loss orders and generally manage your risk level as this caps your losses during market trading hours.

Example:

Assuming a normal trading day with low volatility and an average movement of 40 points, as a trader your potential returns are 40 points but you are unlikely to consistently take the full 40 points out of the market (as you would have to trade exactly between the high and low points of a trend) so we will assume that you are able to catch half of the 40, say 20 points when trades work out well.

Suppose that your target upside is 20 points with a 10 point stop. This gives you a risk reward factor of 2. Let's assume that you execute 10 trades.

So if you are right just 50% of the time you will lose 50 points (5 losing trades x 10 points) and make 100 points (5 winning trades x 20 points). This translates into an overall profit of 50 points.

If you were right just 40% of the time you will lose 60 points (6 losing trades x 10 points) and make 80 points (4 winning trades x 20 points). This again translates into a profit of 20 points.

In a high volatility scenario with say 200 points movement per day the returns can be impressive (assuming again that you are able to take 100 points out of the market on a winning trade) -:

If you are right just 50% of the time you will lose 50 points (5 losing trades x 10 points) and potentially make 500 points (5 winning trades x 100 points). This translates into an overall profit of 450 points. Here the risk reward ratio has been increased up to a ratio of 10 times which is really high but the advantage of this is that you can have very few winning trades and still end up ahead. In the above example even if you had 1 winning trade out of 10 you would still extract 10 points from your trades (1 winning trade x 100 points - 9 losing trades x 10 points).

A: It could be argued that a combination of fear, greed, herd mentality and investor expectations might influence price, without forgetting that supply and demand will play a significant part. Generally the price of a liquid stock will increase through greater buying pressure although plenty of sellers are available which tends to create a stable environment. However, news may affect that stock both on the upside and downside. An oil company that discovers oil may see its share price spike sharply up. Conversely, a report of a dry well may see the share price plummet as the buyers disappear. This can lead to panic and people selling at any cost (the valuation of the company may have been based on the expectation of finding oil and now has to be re-priced). The price will fall to a level that buyers believe is fair. And so it goes on...

A: The only time anything becomes a rip off is when you're not willing to put the time into it. If you don't want to learn about a stock, mortgage, loan, or anything it becomes a rip off because you don't know how it operates. You also won't know how to best use it to your advantage.

Let's get back to the basics here. Stocks are a little piece of a company. If you own a stock, you are one of the owners of that company! Really True! Is the company you work with owned by one guy? If so, he has 100% of all of the 'stock'. He gets to enjoy the profits, and suffer any losses, too.

Now, a company like General Motors, or Microsoft is way too large and costly for any one person to completely own. Geez, even the garbage company Waste Management is like this. So, they offer 'stock' to anyone who wants to buy a piece of the company. There is no set price for stock. The price depends on how many people want to buy it at a given time. That's why stocks go up and down. If today a lot of people wanted to buy a chunk of Microsoft, the price will go up. If tomorrow nobody wants to buy it, the price will go down. Why would people want to buy or not buy a certain company? They have done research and (think they) know what the company's plans for the future are, and if they think those are good plans or not.

A: Unfortunately a common mistake - I overcame the problem by not buying or selling first thing in the morning. If you do you will often see a high opening price followed by a big drop al a Tesco yesterday or rapid price rise with a wide price spread or just a slow drip drip drip as the price falls throughout the day. They are all very depressing. If you wait until the afternoon you will get a much tighter price spread and will have had time to make a more sober judgment...always best to follow price action. Another example was TAN yesterday or day before - not sure but good trading statement sent price up by 9% in the morning...by end of day the price was down below the opening price.

A: Response from a technical analyst: I'm afraid that you bought IPF when it was going down! I understand your rationale for buying when you did but the 'smart' timing, from a chart perspective, would have been to buy after a solid break of £3.25. Having bought at £3.23 I would have been out like a shot on gap down day. Loss taken on chin; no re-entry until it makes a new high or perhaps a solid bounce of some recognisable support level.

|

Now listen, a share off its high is going down until it breaks the previous high. Get it? Lower highs are not good. But it was going up you say and you are right. Sort of. Nevertheless, you were last man in before it started to go down. So you weren't right. Are you keeping up? I'm not sure I am but I'll plod on.

It went on to make a lower high; so it's going down. No, I don't think that would have been that clear on the day but the reality here is that until it breaks 3.25 it's going down, even when it's going up. That's the view a non-trader must take.

As a trader.well, it was going up but you bought off last trader selling.

There's now a double top (ish). Avoid unless you want to trade it back up again.

The problem is that when 'live' one doesn't know whether it's going to go higher or make a lower high; knowing that is the preserve of the cocky hindsight chartist who always seems to know what you should have done ;-). But seriously, because it's not clear, it's is wiser to be sure and sure is when it makes a new high. Failing that, you just have to quit the moment the assumption that the momentum will carry through is clearly wrong....or using some other visable and viable stop (even a sum of money will do).

I think what I'm saying is that the definition of up or down depends on whether you are a trader or investor. If you're an investor it was going down, if you are a trader it was going up. Both should have been out on gap down day (in my very humble and probably useless opinion).

Note: Gap down is where there is a gap between the previous close and the open (in whichever direction. Look at the chart above and you will see it gapped down shortly after you bought...a small candle but there's a gap between the close the day before and the opening the next day. No way you could have got out without losing the gap money and very hard to then take a loss. Gaps can be traded on the basis they will be filled...but let's not go there today.

A: Pyramiding is a trading strategy where you add to a winning trade, sometimes with equal amounts. Yesterday, for instance I increased the amount on each addition - so I started at 10 per point and added again at 15 per point and again at 20 per point so on average I was 45 per point long in the end.

A: When you start investing in a share you don't know how it's going to turn out. As the story unfolds in your favour it is a good strategy to buy more to make more (and obviously to cut your losers before they lose too much...)

If I bought a share at £2.50 that I believed could get to £5 and it did, and then I came to the opinion that having reached £5 it could now soar to £10 then I think I would buy in again. Were it to reach £10 I would have doubled my money on each separate purchase - and doubled it again in the case of the initial purchase.

The point is that I wouldn't have known the potential for the share to climb to £10 when I initially bought the share at £2.50 but when it reached that £5.00 target I reassessed its potential and having done so fully expected it to reach £10 so bought into it again! Phew!

These are the circumstances when it would make sense for me to buy more anyway. Just to add, from a trading perspective I used to think it was ridiculous buying a share that had already gone up a lot...now I find most of my shares in the new highs list. Why? Because I've learned that (ramped rubbish aside), when a share makes a new high it often just keeps going...and, joy of joys, I haven't had to figure out for myself that it's going to make a new high. I just jump on board for the next leg.

This strategy allows you to limit one's losses if one is wrong and still make loads if one turns out to be right.

BTW, averaging down is not scaling out of losers (with which I fully agree) but the buying of more shares on the way down. And averaging down is different (hopefully) from buying dips, which is another strategy I employ. That said, buying dips (or averaging down as it might turn out to be), is far higher risk...and requires a view that you are right to have confidence that the share will return to a previous high.

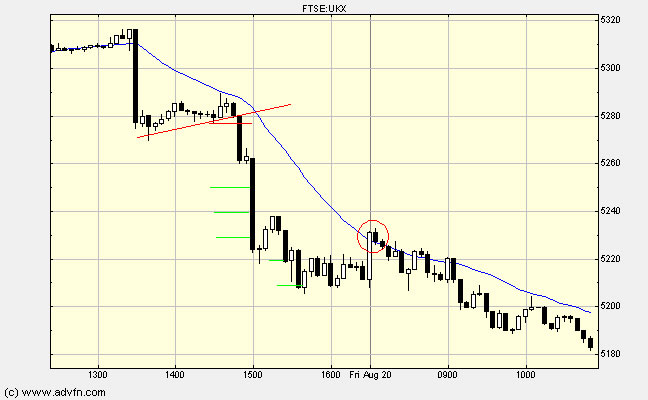

A: Answer by experienced technical trader Henry: Ok, so using only (!) £2 per point on the FTSE. You can turn that to your advantage by scaling in and out of a trend....

Here's how it would work on a particular day where the FTSE experienced a 100 point drop. Enter short at around 5290. Wait for 20 points profit and then add £2pp short at every further 10 points fall in the FTSE price. If the price pulls back against you to the entry of your last position you close that last position (£2pp). Keep adding positions every 10 points down until you reach you final exit where you close the lot.

Initial £xpp short 5290

added £xpp short 5270

added £xpp short 5260

added £xpp short 5250

added £xpp short 5240

added £xpp short 5230...pulled back by more than 10 points for a 4pt loss.

added £xpp short 5220

added £xpp short 5210

added £xpp short 5200...pulled back to close for 3pt loss.

added £xpp short 5190...pulled back to close for 8pt loss.

Finally the exit - 20ma in my case closes all open positions at 5205

Your 1st position makes 85pts, 2nd 65pts, 3rd 55pts, 4th 45pts, 5th 35pts, 6th -4pts, 7th 15pts, 8th 5pts, 9th -3pts, 10th -8pts. In practice it's not easy to get the trades on and off exactly where you want to, especially if the price is moving fast but the concept is the same.

So that gives a total profit of 290 points on a 100 point fall, so even on £2pp you gain £580. Trends like that don't come along very often but it proves that you can make decent profits from as little as £2pp if you scale in and out. I have been doing the same with end of day trading by waiting until a trade is in profit by 20% and then adding the original position size every 10% that the trend carries on moving into profit.

|

This explains the theory of adding to positions in order to run profits. I personally never trade the news announcements. The candles seldom react as they did on Thursday. More often than not they swing up and down on the 1 min chart taking out trailing stops, 2xATR stops and the previous breakout level. I took a breakdown from the pullback at 5274 and closed at 16:28 (I never trade after 16:30). The green lines show roughly where I actually added positions though I was using 1 min chart with a 2xATR trailing stop on the last entered position and 20 Wilder Smoothing moving average price cross as exit for all remaining positions. Bear in mind that nothing works well all the time and it's possible to end up taking a small loss instead of a small win by adding to a short lived trend break.

A: People seem to be divided on momentum investing, however you should not cross out this strategy without first trying it out. It is very easy to run a stock screener to spot shares that have fallen over a specific period of time but identifying recovery stocks is not easy as usually there is a good reason behind the fall which is rarely good news so you really need to do a lot of research on spotting the ones that could bounce back. It is far easier to find stocks that are moving strongly in one direction on high volume and ride the momentum train to a desired profit.

A: Recent studies have shown that it is very difficult to predict the market direction, so you don't need to know when the trend is over. You just have to close your positions when your trading strategy says that. By this I mean that when your trading system triggers an opposite signal for your entry or you have reached your profit target you should close your position. Trying to find tops and bottoms is impossible, or you may find that it's a very expensive lesson to learn.

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.