Section 5.1 – Zones of Support & Resistance, Lesson 5

Price/Volume Relationships

In lesson 4 we discussed the elasticity of markets. We also looked at the dangers associated with trading break-outs. If you are unfamiliar with these concepts you will find more information here: return to lesson 4.

Zones of Support & Resistance

We already know from earlier lessons that markets tend to move from one extreme to the next, but what is it that actually causes a trend to falter or stop, and why should we care?

The answer to the first part of the question is price congestion. This often kills off trends and frequently triggers reversals and the reason why we need to recognise it is twofold. Firstly if we are trading a trend this knowledge will help us make better exits and lock in more profit. Secondly if we are looking to open a new position an understanding of Support and Resistance will tell us if a move is likely to be immanent.

This is an area of trading that is most commonly misunderstood and where the majority of traders consistently make the same mistakes. Like sheep you will find them buying when the market has reached the ceiling of resistance and selling when the market is at the floor of support. These areas are also known as zones of accumulation or distribution (stages 1 and stages 3) and they are marked by the activity of professional traders feeding the trading herd contracts whilst they themselves reverse their positions. The zones can been seen on the price chart as areas of consolidation where the market trades in a tight range. More often than not the medium term Moving Averages (MA’s) will be flat which in itself is a sign of congestion.

How can we tell where to expect Support and Resistance?

A simple price bar chart will show the zones clearly. Let’s first define the two conditions. Resistance can be described in an up trending market as the point where supply eventually becomes equal to demand. If the supply of buy contracts and the demand for sell contracts become equal what is going to happen to the move? Newton’s law of gravity and motion would suggest that the move is going to stop simply because the forces that drive the markets have become equally distributed. Support conversely can be described in a down trending market as the point where demand increases and supply decreases to become equal. We will return to this later but if we use the house price analogy it may be a little easier to understand.

The Venturi Effect on Supply & Demand in the housing market

If I wanted to buy a house and there were plenty of others wanting to buy a similar property, when few were for sale, what direction would estate agents be expecting house prices to move in? “Arriba, arriba”! (Impression of Spanish Estate agent seeing prices move up). There is a great deal of demand and little supply, so it is likely that those who do have houses for sale are going to be greedy and hold out for higher prices.

Market Myth No 4 Markets Move the most on Volume

There is a common myth taught on phoney trading courses that volume drives prices. This is another poorly understood area of markets but it should be obvious that if demand is high and the supply is low then the volume of housing sales would be low to start off with. Paradoxically prices will accelerate upwards as the greedy owners hold out for higher prices for their homes. It is the strength of demand and lack of supply which is causing rapid price inflation. In other words it is the absence of willing sellers and the abundance of buyers which is driving the market up, and this most frequently occurs on low volume. If you don’t believe me take a closer look at any price chart which also plots volume and see for yourself.

Of course once the move is underway the volume of housing completions will increase as everybody and their uncle scrabbles to get a toe into the hot real-estate market. Now lets suppose that there has been a change of government or that the new Governor of the Bank of England has let it be known that he does not care too much for the over valuation of housing, and that it is felt that a way of cooling the market would be to increase interest rates dramatically. What is going to happen now? Prices are going to fall I hear you say. By how much though? A little or free fall? It could be argued that this would depend on the size of the proposed interest rate hike, but this would be wrong. It depends on peoples perception of what is going to happen to their most valuable asset. Remember that it is fear and greed that drives all markets and logic does not enter into it. If there is fear this will quickly turn into panic. There will be a flood of houses on the market. There will be many sellers and very few buyers. Over supply and weak demand. Prices will fall way below their real value and it is only when the professionals start to buy in quantity, as they recognise a bargain when they see one, that the market will start to recover. On the other hand in a stable economy it could be argued that it is peoples ability to afford big mortgages that may allow a more relaxed attitude to an interest rate hike. If there is no fear there will be stability and price congestion. I hope you can see now that markets have more to do with how people feel about their assets or ability to meet their liabilities than actual worth.

So what has all this to do with trading Futures contracts? Well a great deal really as contracts are no different to houses when it comes to valuation. The same mind set drives their worth, which has everything to do with the fear and greed of the participants and very little to do with weather or not they have real value. This is why when trading stocks I have little time for the value investors. As a technical trader I believe that many company reports will be full of half truths or lies as has been made patently clear by the recent accounting scandals. It was peoples perception which drove share value and of course it is the same with the Futures markets. This acceleration of prices when there is a restriction of supply has become known as the Venturi Effect. If you are watering the lawn and you restrict the end of the hose you will notice that by restricting the supply the water comes out faster. If the supply of markets becomes restricted prices move faster, but not always on higher volume as the experts would have you believe.

Examples from the FTSE June 2005 Futures

At this stage you should already know more about how markets really work than when you started. So lets take a look at the 60 minute chart for the current FTSE June contracts using this new knowledge. At first glance we can see that the trading is very ordered and that there is a clear pattern reflecting the zones of support and resistance.

|

Market Myth No 5 Drawing a line between three lows or highs shows the support or resistance

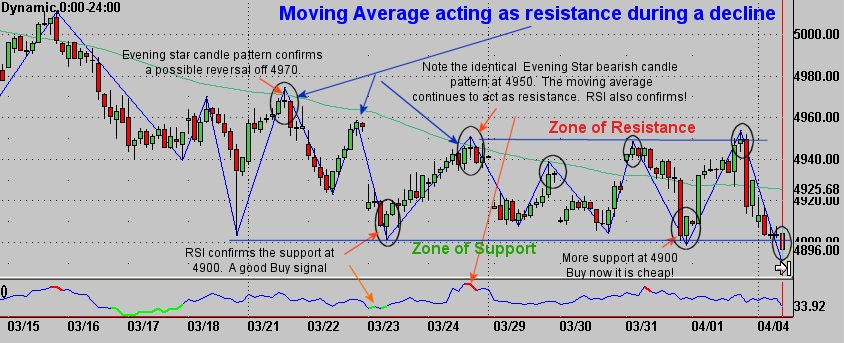

Many experts think of support and resistance in the wrong way. If they have read Joe Murphy’s excellent book ‘Technical Analysis of the Financial Markets’ they will want to draw a neat line between three points where the highs or lows touch and say that this is the floor or ceiling of the current trend. However this is one area where I find myself disagreeing with Murphy, as most traders are just too bone headed to think that deeply about what they are doing. They are continually asking themselves only one question, ‘does the price at the current level seem cheap or expensive’? If it appears cheap then they will start to buy and if it looks dear they will start to sell. So the question may be ‘what do they use to reference their idea of current value’? Well one commonly used indicator is the long term Moving Average or (MA). A good example of how this is working comes from our 60 minute chart. We can see that the market has been in gradual decline since the start of the contracts in March. How do we know this? Simply by looking at the MA which is consistently sloping downwards. Notice also that the price is mainly trading below the MA.

Now I hope that you are going to look at the chart again with new vision and experience a change in thinking. Notice what happens when the price is trading well below the MA and then moves up towards it. It should be clear that the market reverses and retraces back. This is a pattern of behaviour which happens time after time. Why is this? Remember that on the whole traders are a pretty blinkered lot, and like sheep they have to get their idea of fair value from somewhere. If there is a down trend and the market is rising to trade close to the MA, traders are going to ask themselves the magic question ‘is the market cheap or expensive at this point’? They then consult the chart and notice the MA and all chorus together expeeeeeeeeeensive!!!!!!!. They will be flocking together to sell. Now it will not just be the MA that is telling them to sell. Their spread betting company news letter will be telling them that most of their clients are currently selling short and the news will be full of information about how the inflation figures mean that interest rates are going to increase. I could go on but I think you get the idea. Everyone thinks that the market is overvalued at this point, and all of it is founded on hot air, with little to do with actual value and everything to do with perceived value.

As short term traders how are we going to use this knowledge of herd behaviour to our advantage? Some would just sell at any point along the down trending MA line, and tough it out during the adverse retracement swings, but this would not be a particularly sensible strategy. Why? Because the swings are within a 60 point range, and in my book that is a lot of money!

Round numbers are significant for protective stops as well as resistance and support zones

Lets take a closer look at the numbers through the eyes of the trading herd. We know there is a down trend and we know that the odds will therefore favour selling, after all “the trend is our friend”. We wait for the market to move back up and as trade starts to take place close to the moving average we look for opportunities to sell short. Traders don’t think in terms of thin lines on a chart. They think in terms of numbers and the rounder the better. For example currently a round number such as 5000 represent significant psychological area of support or resistance simply because traders are thinking that over 5000 it is expensive and below 5000 it is cheap. This is the mind set of the trading herd. It is not complicated as they are simply thinking in the same way as they talk. This is incidentally the reason why you should never place a stop on a round number. It should always be just below or above, as the market will nearly always reach the round number such as 4500 and then bounce off. The round number is acting as support or resistance in the minds of the traders. Your stop would be better placed at 4998.5. You would know then that if your stop was taken out it was because there was no further support for the market at prices above 4500.

Back to our chart 60 minute chart.

On 24th of March 2005 the FTSE June contracts move up to trade close to the downward sloping moving average. Interestingly the MA is plotting around 4950. That is a pretty round number in the mind set of the herd. They get nervous and start selling. “Oh dear 4950 sounds a bit expeeeeeeeeeensive”! “Better sell”! The market trades around 4950 for a while in what is a clear distribution phase. Yep go back to earlier lesson to learn about distribution. The selling now starts. Of course being super traders and having graduated from the Trade School we are already in possession of our short selling contracts.

- We noticed that as the price moved up to the significant moving average that the RSI also became over bought.

- We noticed the bearish candle pattern at the top of the rally. (Evening Star)

- We noticed that the volume of trades increased at the expected resistance.

All of these important confirmation indicators will be dealt with more fully in later lessons. However we mainly noticed that we were at a zone of resistance. We would have been surprised if the market had moved higher. The other indicators were merely the icing on the cake inviting us to sell.

Lets say that we have now sold short. How do we know when to close out our trade. After all you have not made a profit until you have made an exit. The smart trader is looking to where the next zone of support is going to be. There is no moving average to help us this time. However we can see that with financial markets history as in life nearly always repeats itself. Every time the market traded close to 4900 is rallied back up. It would make sense to place and exit order a few points above 4900. Now if you had done this you would have traded better than the herd and netted a good 40 to 50 points. Was this a unique event plucked out of the ether to make a point? Certainly not as we can see that the same thing happened 5 other times at least since the start of the contracts in May.

Market Myth No 6 Share value will increase if a company’s results are good

“Buy the rumour sell the news”. Have you ever wondered why is it that when companies release good results their share price often falls? You may have heard the saying “buy the rumour sell the news” and this harps back to what was being discussed in lesson 1 regarding ‘insider trading’. Everyone has already taken their position long before the news is released. The news may be basically good but there are no new buyers left to take up the march forward, so sellers start to off load their shares in disappointment and then fuel a downward move, often to analysts surprise. Remember that others have to buy after you buy to make a profit, but by the time the good news has been released all the buyers have been exhausted.

Conclusion

If you have really understood everything in this lesson you are a number of steps closer to becoming a great trader. You will start to look at financial markets in a different way and I hope that next time your spread betting company tells you that most of their clients are short or selling the markets you will question their motivation for telling you this. To quote Nasser (talking about experts) “The only difference between them and you is that they get paid to be wrong”.

Over at Capital Spreads, Simon Denham had these thoughts; “UK Markets looking marginally buoyant this morning but clients are selling into the strength. “Capital Spreads is calling the Dow unchanged on the open.”

Meanwhile, Stephen Bower from CMC Markets gave us this; Clients remain bearish and we have seen some short selling. Our opening forecast at 10am is for the Dow to open 30 points higher at 10,516.”

Finally, Tom Hougaard from City Index gave us his thoughts on the US; I suspect we are in the final stages of this bull-rally after which we will see the market trade lower for quite some time.”

As a memorandum Tom Hougaard is one the few experts I really like! When I met him he told me his methods included analysis of lunar cycles for determining market direction. Beats the pants off following the spread better’s clients.

Join the discussion