Section 4.1 – Market Myths – The Moving Average, Lesson 4

In lesson 3 we discussed the importance of trends and how to recognise them. We also looked at pivot points or turning points in trends. If you are unfamiliar with these concepts check out lesson 3.

|

Lets start by taking a closer look at a commonly used indicator and the myths that have grown up around it. We have been taught that “the trend is your friend”, and that we are ‘better off trading in the direction of the trend’, and for the most part this is true. We have learned how to recognise a trend by identifying the type of highs and lows in lesson two, but why do we need to know this when the MA (Moving Average) tells us the same thing? After all if the price is trading above or below the MA, surely the slope of the MA should indicate the direction of trend.

Market Myth No 1 – The Moving Average (MA) tells you the direction of a trend

A huge number of traders use moving averages as the basis of their trading decisions because of their graphic simplicity. However few take the time to understand what information they are really being presented with. In lesson 1 we talked about how MA’s can give you the news too late. They can tell you if a trend is underway but by the time it is clear you may have already missed the move.

Furthermore in range bound conditions (the most common personality of the market) they can be nothing more than a confusing line on a price chart.

The reason is simple. We already know from lesson 2 that markets respond the most to events in the most recent past. However MA’s calculate the average closing value of each bar for a given period, with the most commonly used simple MA giving equal weight to each bar. In my own view a 200 period MA is telling you about something that happened in another life time where Futures are concerned.

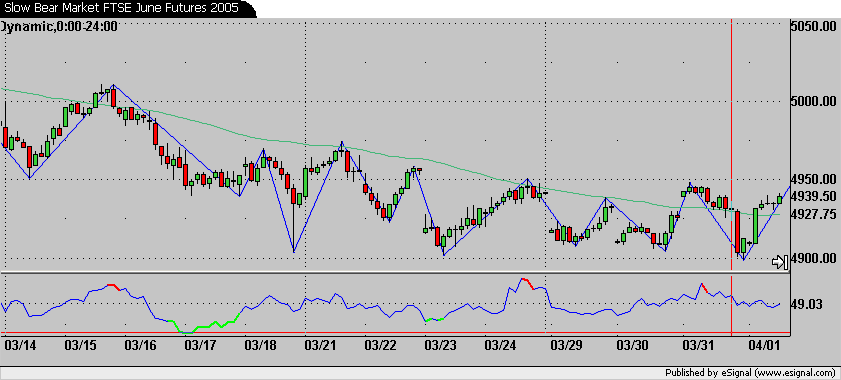

Market Myth No 2 – Two moving averages crossing can give a good Buy or Sell signal

Some trading systems use two MA’s crossing in order to generate their buy and sell signals. I have tested this frequently and the results continue to support a view that this method has little merit. If you think about what is really going on when two moving averages cross, it should be obvious why. What would a 10 period and a 20 period crossing, for example, be telling us about the state of the market at that point? Simply that both moving averages at the crossing point are in equilibrium. Hardly the conditions you would associate with a positive move. So why have them on the chart? The answer lies in how you use them and like all tools they are only of value if used in the right way. There are two main uses the anticipatory trader has for MA’s. Firstly MA’s can help identify which phase the market is currently trading in. For example if it is in decline or mark-up. If these terms are unfamiliar to you go back and take a look at lesson 2. The second is that the trading herd follow them like sheep and react in the same way that they react to the news. This is why MA’s can often act as zones of support and resistance as traders see them as significant and react to them. Take a look at the above 60 minute chart at the top of the page entitled ‘Slow Bear’ and see for yourself. In the slow sell off the moving average is acting as a ceiling of resistance to any attempts the bulls make to drive the price higher. Finally there is a breakout which fails but after a few attempts we see a reversal of conditions. This chart is still ongoing at the time of writing but I would not be surprised to see the long term moving average start to act as a floor of support to the newly formed rally.

The elasticity of markets

The picture can often be confusing with subjective indicators such as moving averages on the chart, but if we remain objective in our thinking and focus on what the price is actually telling us, we will already be trading better than 90% of traders. It is in the nature of markets to move from one extreme to another and like an elastic band being stretched, there will come a point where it can be stretched no further and will snap back. The reversal point is often referred to as the pivot, but it will nearly always occur where the ceiling of resistance or the floor of support has been reached. These are areas of special interest to the professional trader and yet we find that most traders enter and exit their trades away from these key zones. When the FTSE trades within a tight range I find it helpful to ask myself ‘where would be the very worst place to put a trade on?’ The answer is hopefully obvious as it would be in the centre of the range, and yet this is where you will find the majority of the trading pack jostling to enter the market. However the lowest risk opportunities for short term traders are not to be found in the centre ground but at the outer extremes of the range and most often when the market has traded furthest away from the moving averages.

Market Myth No 3 – Trading breakouts is a safe & profitable strategy

One reason perhaps people shy away from putting on trades at the extremes of the range, (selling at resistance or buying at support), is that they often feel that the market is about to break out into a new range. This belief results in many acting in the opposite way to the professional, causing them to take on higher risk positions to trade the possible break-out. Of course break-outs do happen, but not as often as you would imagine and rarely without other lead indicators. The first couple of times resistance or support is encountered the odds nearly always favour the contrarians who are looking to take reverse positions. Even if these barriers are broken around 75% of breakouts go on to fail. Furthermore it is unlikely that a professional would ever place a trade without first having placed a protective stop in the market at the technical point where they would know that they had got it wrong, further limiting their risk. In the next lesson we go on to look at zones of support and resistance in detail and learn how to use our understanding of them to trade profitably.

Join the discussion