Candlestick Patterns and Signals

Over the next few pages I aim to cover the key candlesticks that I use to spot price movements. Candlesticks are great for spotting contrary movements within markets that may on the longer term be trending in any given direction, or indeed not trending at all (consolidation). Candlesticks can also give you an indication of when momentum is starting to diminish and can be very useful for identifying reversal points. It is this power, coupled with our moving averages, which give you the ability to trade – whatever the markets are doing!

Doji

The Doji candle, pronounced doh-gee, is a very powerful single candlestick that usually appears at the end of a trend. This trend can be a main trend, or even a swing within a trend, where the price trends in mini intraday, or daily smaller trends, within the greater trend. It is these end of trend signals that are incredibly powerful.

A Doji candle is relatively flexible, but does have one key point that is easily spotted in candlestick charts. The real body, which can be positive or negative depending on the direction of the trend in which it is breaking out of, is relatively small or non-existent. The shadow can be large or small in range but usually will stay within the limits of the previous trading high and low. As a note this previous high or low can be used as a guide to a stop. Essentially what the candle is saying is that technically that the chart closed at, or near its open price.

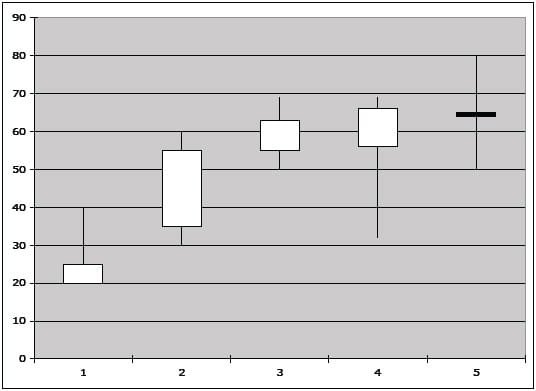

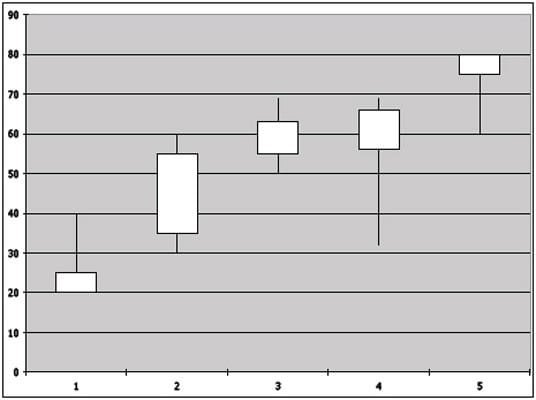

A Doji example can be seen on number 5 in the chart.

This indicates total indecision within the stock’s current value. If at the end of a bearish run, the traders have come to a point, usually at a point of support on the chart, where there are no sellers in the market, but equally no buyers to push the stock back up. Causing indecision as to the market’s value – the traders are waiting.

Likewise if the Doji appears at the end of a bullish run, usually at a point of resistance, the buyers have lost interest but those that can sell are unwilling. Again causing indecision.

It is this indecision in any market that is dangerous to the stock’s value. The markets thrive on knowing to a greater, or lesser degree on what is happening. When there is indecision, it causes a state of flux in the stock’s price which can result in a ‘bounce,’ which I talk about later.

On either run, if the Doji is near either resistance or support, depending on the direction of the trend, this will add a great deal of weight in favour of the contrary direction, this is emphasised further if we see a Doji candle before a bullish or bearish engulfing signal – see example number 5 below.

Bearish Engulfing Signal

An engulfing signal is identical to the pattern we discussed when there is no shadow, all there is, is the actual real full body (coloured black or red) of the candle that is either positive or negative in nature.

A bearish engulfing signal will usually shadow that of the previous candle – engulfing it. A bearish engulfing signal will appear either during a trend, which can mean further falls within the current trend. Or, at the end of a trend after a Doji candle above, adding weight to the sudden change in direction from resistance. These combined will create a bounce on the downside.

Bullish engulfing signal

Not so surprisingly, the opposite of the bearish engulfing signal.

Again, the candle’s clear real body will not have any shadow above or below it. The open and close prices are the trading high and low of that day.

Bullish engulfing signals will be covering the trading of the previous day and are either indicating that the current trend is gaining more speed, especially if there is no resistance nearby, or that the chart has signalled a prior Doji near support and we see a bullish engulfing signal, suggesting that the market for this stock is bouncing on the upside.

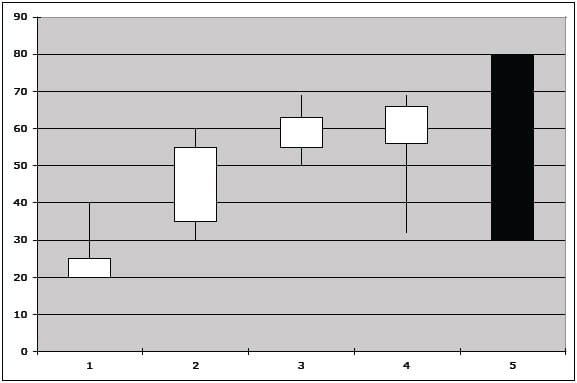

See candle number 5 in chart below:

Shooting Star (Strong Bearish Reversal)

The Shooting Star is a very strong bearish sentiment indicator, which usually appears at the top of an upwardly trending chart.

As the name suggests, the candle looks like a shooting star. The real body is full (either black or red) and is small. The difference between the open price and the close is also small, with the closing price acting as the low of the day. Furthermore, the shadow protrudes from the top of the full real body, giving the impression of a trail, the real body being the star.

Basically this candle is saying that the current chart is overbought and a correction is due soon. If this candle is followed by a bearish engulfing signal then look out for some sharp falls.

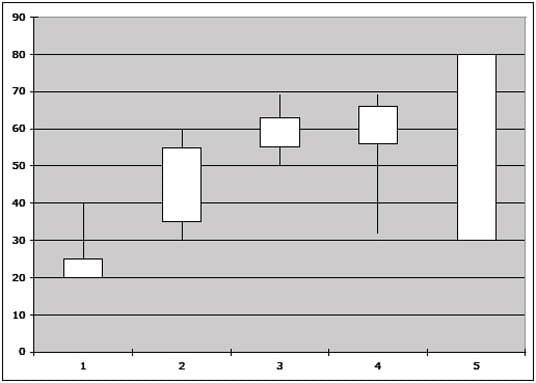

See example number 5 in the chart below:

Hanging Man & Hammer

These two identical candles show reversals – the Hammer showing a reversal on the upside from a downward trend, the Hanging Man showing a possible reversal on the downward side from an upward trend.

They are both clear, real bodied candles with a small, real body that has closed at the high of that trading day. The shadow is usually long. Looking similar to a Shooting Star but clear in nature, with the candle part at the top of the shadow.

Personally, I find that these are slightly weaker signals and require further confirmation the following day. They can usually lead to good clues that the market may be making an about turn, especially if these are near support or resistance.

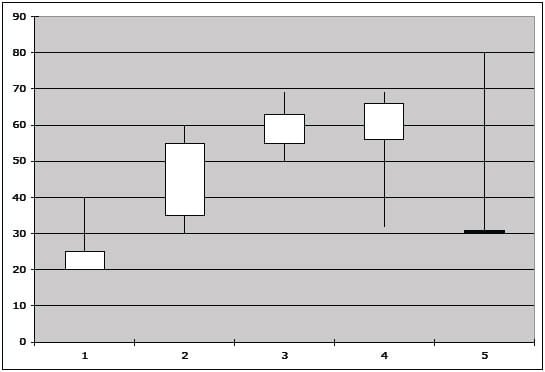

See example number 5 for a Hanging man at the top of trend. The reverse of this is a Hammer that looks identical but appears at the bottom of a Short trend.

Is that a candle in your pocket or…?

Candles are becoming more and more popular. I hope that my brief introduction into the main candles that I personally look for prove to be useful.

I tend to use the above candles when scalping the markets – where I am taking a contrary view to the current trend, to benefit from relatively strong moves over a very short period. Under Technical Analysis you will find my ‘Bounce’ trading style. It is this method, where I use candles the most.

Join the discussion