Billions of shares created in Range Resources mean uncertain prospects despite Trinidad opportunities

Mar 18, 2014 at 10:43 am in AIM by contrarianuk

Its been quite a while since I wrote about AIM oil and gas company Range Resources. In a piece in 2011 entitled “Range Resources look to have good prospects but not for the faint hearted”, I summarised the company in the following terms, “Every one seems to be tipping it. The current market capitalisation is £220 million. Undoubtedly there is serious upside in Range if either Georgia, Puntland or Texas have exploration success (estimated to be 75p if everything went to plan). Range is therefore a high risk, high reward play and at 16p it is not one for “widows and orphans”. One to keep an eye on and will be very volatile no doubt but Contrarian Investor UK hasn’t quite got the guts to invest in this one at 16p. Good luck to holders though, it looks an exciting ride!”.

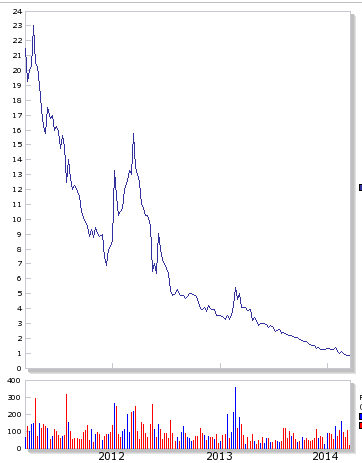

With the benefit of hindsight, I’m mighty relieved I didn’t jump in and buy into the company in 2011. At the time in February 2011 there were 1,327,461,176 shares in issue at a share price of 16p (they were up 85% in the last month and 400% in the last year at the time). Over the the last 3 years, the number of shares in issue have ballooned to around 4 billion (3,608,773,943 ordinary, 80.5 million quoted options, 400 million unquoted options). The shares now sit at a lowly 0.82p, that’s a drop of 95%!

Range has a broad range of assets in Puntland (Somalia), Georgia, Guatemala, Texas, Colombia and Trinidad. Some would argue too broad!

Yesterday the company issued its half year report for the period ending December 31st 2013. It wasn’t good news for long suffering shareholders. The real sting the tail was the issue of yet more shares with another 126,346,484 new shares to be admitted to trading on ASX and AIM on 21 March 2014. The majority of the shares and options being issued relate to the loan facility arrangement with YA Global Master SPV Ltd, Empery Asset Master Limited, and the Cranshire Capital Master Fund in 2013 to keep the company afloat due to issues with divesting assets.

The company lost just over $19 million in the second half of 2013, compared with $8.5 million in the year before period. Financing costs of $10 million and Technical, consultancy and administration costs of $7 million stand out, given revenus of just $12 million. The company’s cost of sales of $12 million, meant that gross profit was only $42,000. The company appears to be bloated with consultancy and head office costs as well as very high operating costs.

Rory Scott Russell, an ex Shell man, became the Company’s new Chief Executive Officer on February 3rd and they have brought on board Dr. Douglas Field and Mr. William Duncan as Vice President of Production and Vice President of Exploration, respectively. Scott Russell replaced Peter Landau, who remains on the board as a Non-Executive Director. Landau seems to have got carried away finding that monster field in far flung regions of the world, overly relying on equity raising rather than building a sustainable financial platform where revenues could eventually fund wild cat wells.

Peter Landau

In early 2014, Range announced that the previously proposed merger with International Petroleum Ltd will not be proceeding, with constructive negotiations continuing with regards to Range’s $8m loan to International Petroleum. Frustrating for shareholders given the loan, which begs questions of why it was given to IP in the first place?

The company’s efforts to rationalise its portfolio of assets seems to have had some hurdles with the company entering into a sale agreement and concluded all key completion requirements for the sale of its Texas assets for a total pretax cash consideration of US$30m (US$25m initial payment plus US$5m in royalty production payments to be received from future production). However, the purchaser failed to meet the originally agreed timetable for payment of the sale consideration. The Company understands that this failure is due to internal structuring and related issues of the purchaser.

The focus for the company is now firmly in Trinidad with the farm-in agreement with Niko Resources Ltd, regarding the Guayaguayare Block in Trinidad formally approved by Trinidadian authorities in December 2013, adding 280,000 acres to Range’s net Trinidad acreage position. The company was also successful with its bid for the St. Mary’s block in Trinidad in early February 2014 following the submission in the Trinidad Onshore Bid Round 2013 with 44,731 acres onshore. The company received a Certificate of Environmental Clearance (“CEC”) approvals received for the drilling of a total of 40 wells, 8 well deepenings and commencement of the enhanced recovery waterflood programme (“EOR”) on the Beach Marcelle license.

Range’s focus now is firmly on raising production in Trinidad to 4,000 bopd by the end of 2014 and to 9,000 bopd by the end of the 2015 and also to divest some of its non-core assets, notably Texas. Peter Landau appears to have over stretched the company and the problems selling the Texan assets meant that the company was forced to use equity based lending schemes to fill funding gaps in 2013/2014 which have seriously hampered the share price.

New Chief Executive, Rory Scott Russell , has much to do to boost the company’s financial strength with the market cap only £28 million. With net assets of $169 million, his focus must be divest, contain costs and ensure that Trinidad delivers. There have been so many false dawns with Range, there is certainly a crisis of confidence. No more expensive wild cat drilling in the likes of Puntland (which they undertook in 2012 with Red Emperor Resources) which proved ultimately expensive and a failure with successive dusters.

As in 2011, I’m not buying into the Range story with $4 million of cash as of the end of 2013, the problems with the Texan divestment, limited short term revenues and 4 billion shares in issue. The company rolled the dice with Somalia and ultimately the bad bet has left the company in a precarious position relying on endless equity placings. If you feel inclined to have exposure to Trinidad and love the sub 1p micro caps, my money is personally on Leni Oil and Gas rather than Range Resources.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.