Another shock for Gulf Keystone shareholders as funding short fall becomes apparent

Mar 21, 2014 at 7:45 am in AIM by contrarianuk

It has been quite a week or two for shareholders in Gulf Keystone Petroleum. After a disappointing reserves report last week which saw the company’s share plummet there were more shocks in store yesterday as the company prepares for its main LSE listing on March 25th.

Todd Kozel, GKP’s Chief Executive has always been infamous but the lack of forward thinking illustrated by recent events has almost been laughable as the company leaves AIM behind for good.

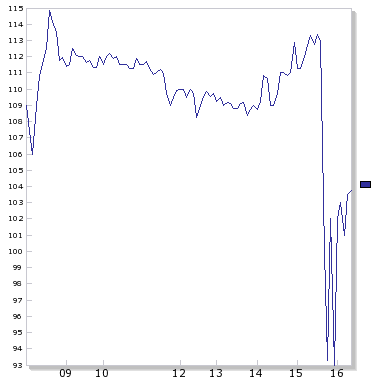

After announcing a $250 million bond issue on Wednesday, an RNS at 3.40pm yesterday caused a 22% drop to 86p, before the shares quickly recovered and finished at 104p, down 5%.

As part of a prospectus accompanying the planned debt sale, the company said it would burn $102 million of cash between February and May, which would leave it with a $20 million funding shortfall. “The Company is of the opinion that the Group does not have sufficient working capital for its present requirements, that is, for at least the next 12 months from the date of the Prospectus.” For shareholders to find out about this working capital deficit just before a move to the FTSE smacks of incompetence or wishful thinking. Why didn’t the company plug this hole in its finances some time ago?

The Company also announced that Lord Guthrie was stepping down as Deputy Chairman to be replaced by Jeremy Asher with immediate effect, very much an M&G man and perhaps an indication that the institutions are trying to get a grip on Kozel. However, Guthrie will continue in the role of Non-Executive Director.

The big priority for the company is now to close $250 million bond sale by the end of April and bring it back to being a going concern.

It was interesting to note in the bond prospectus that “In addition, certain members of the Group’s executive management (in particular, Todd Kozel) are considered to be key to the Group’s relations with the KRG and the MNR. The loss of any of such executive management with its concomitant loss of institutional and operational knowledge, experience, expertise and possible effect on governmental relations, and its ability to deliver the strategy of the Group could have a disproportionate and material adverse effect on the Group.”

Clearly Kozel is trying to protecting his back side from a board room coup instigated by less enthusiastic institutional shareholders. If Kozel does depart it won’t be cheap for GKP shareholders!

Now as well as the FTSE listing next week, corporate results will be released on 27th March.

An article in the Deccan Herald caught my eye, “IOC-OIL JV eyes Gulf Keystone acquisition”

http://www.deccanherald.com/content/16641/ioc-oil-jv-eyes-gulf.html

In a first overseas acquisition, Indian Oil Corp (IOC) and Oil India Ltd are jointly eying acquisition of London Stock Exchange-listed Gulf Keystone Petroleum Ltd for about US$2.23 billion.

The 50:50 joint venture of IOC and OIL, are in talks to acquire Gulf Keystone Petroleum that has operations in Kurdistan, Iraq and Algeria, investment banking sources said here. “They are talking to a set of promoters of Gulf Keystone and have valued the entire buyout at US$2.23 billion,” a source said. Another investment banker said IOC-OIL joint venture was in talks with the two promoters groups based out of Kuwait.

“The promoters are keen to sell but are asking for more,” the banker said without putting a value to what the promoters were demanding. Gulf Keystone is a Bermudian incorporated company that has six exploration blocks and two producing fields in Algeria. In November 2007, the company acquired interests in two production sharing contracts in the Kurdish region of Northern Iraq.

There was also news from Iraq that “As a goodwill gesture the Kurdistan Regional Government (KRG) has offered to make a contribution to Iraqi oil pipeline exports to give the negotiations the maximum chance of success,” read the statement by Prime Minister Nechirvan Barzani. Kurdistan has agreed to export 100,000 barrels of oil per day under Iraqi auspices from April 1 as a “gesture of goodwill” while negotiations with Baghdad continue, a statement from the region’s prime minister said on Thursday.

Private shareholders need to have nerves of steel right now in GKP and plenty of margin if they’re spread betting with the extreme volatility. The shock RNS releases seem to be coming thick and fast right now! If you want an adrenaline rush, then GKP is for you!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.