Oil Price Analysis: The Impact Of Supply and Demand

Apr 14, 2015 at 9:18 am in General Trading by Gaurav Sharma

Global oil markets are witnessing a profound change in the shape of a correction that happens once in 20 years if not more. The oil price slide, which began in July 2014 and has seen major benchmarks shed over 50% of their value, is quite unlike any other slump in recent memory.

2015 Crude Oil Forecast – Will the Price Plunge Continue?

The decline of 2008-09 was caused by a drop in economic confidence as the global financial crisis hit home. What we have at the moment is purely a supply-driven correction as there’s just too much oil on the market. Aggregation of available data from various sources suggests there is around 1.1 million to 1.3 million barrels per day (bpd) of surplus oil coming on to the market.

In tandem with flat, if not negative, demand from emerging economies, these surplus barrels are more than meeting demand and neutralising the geopolitical risk premium that oil markets are historically famous, or rather infamous, for.

Unless the surplus production level falls to around 500,000 bpd, price supporting factors such as geopolitical risk, natural disruptions, industrial hiccups and situational demand spikes would struggle to come into play.

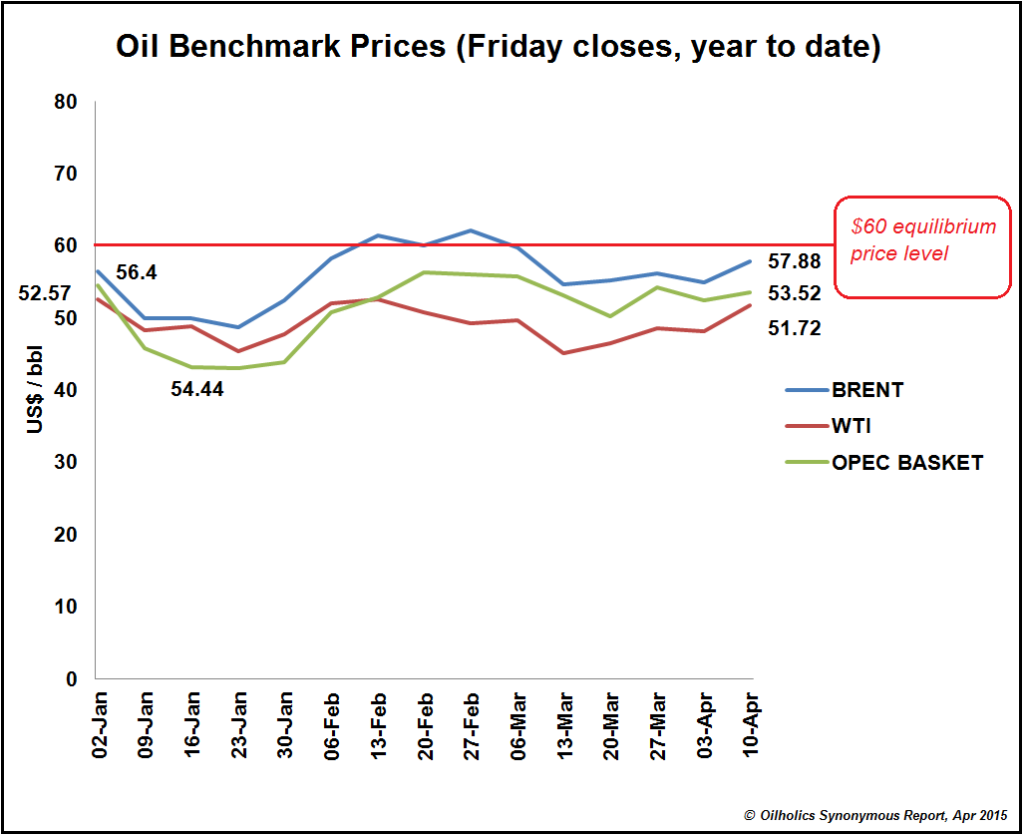

What we have seen so far this year is that each time the Brent front month futures contract looks like its approaching the $60 per barrel level, it flatters to deceive. The first quarter of 2015 typifies this. There have been situational dips below $40 and a few momentary spikes above $60, with the Brent contract ultimately returning to the $50-59 range.

Meanwhile, conspiracy theories are available in abundance. Are the Saudis and Americans punishing the Russians by keeping production high to support lower oil prices? Are the Russians and Saudis keeping production high to dent the US shale revolution? Are the Saudis and other OPEC heavyweights demonstrating their clout within the cartel? We could go on forever.

Meanwhile, conspiracy theories are available in abundance. Are the Saudis and Americans punishing the Russians by keeping production high to support lower oil prices? Are the Russians and Saudis keeping production high to dent the US shale revolution? Are the Saudis and other OPEC heavyweights demonstrating their clout within the cartel? We could go on forever.

Quite frankly, in the oil business there’s always politics but all of this should be taken with a pinch of salt if you are to trade on market sentiment. Broadly speaking, that sentiment is bearish, and much of it could be blamed on the aforementioned trio.

Saudi Arabia, Russia and the USA are currently pumping over 10 million bpd each for their own reasons. The US simply wants to cut overseas imports, the Saudis do not want a loss of market share by cutting production [something which they were on the wrong side of in the 1980s] and with Russia overwhelmingly reliant on oil revenue there’s little option for the Kremlin but to play along.

However, the current situation cannot last as the lower oil price would dent investment. As a domino effect, production would decline lessening the glut and supporting prices. While that is sound logic, it will not happen with the speed some are hoping it would. The industry’s survival instinct has kicked in prompting producers to do more with less.

For instance, there would be fewer operational rigs in Canada this year, but Canadian production would be higher than 2014. US shale producers are using technological advancements and economies of scale to make production profitable even at $35.

African producers are busy diverting oil destined for US markets to Asia on better terms, while the Saudis have used various enticements to smartly manage both their market in Asia and the respectable 19% share they still have in North America.

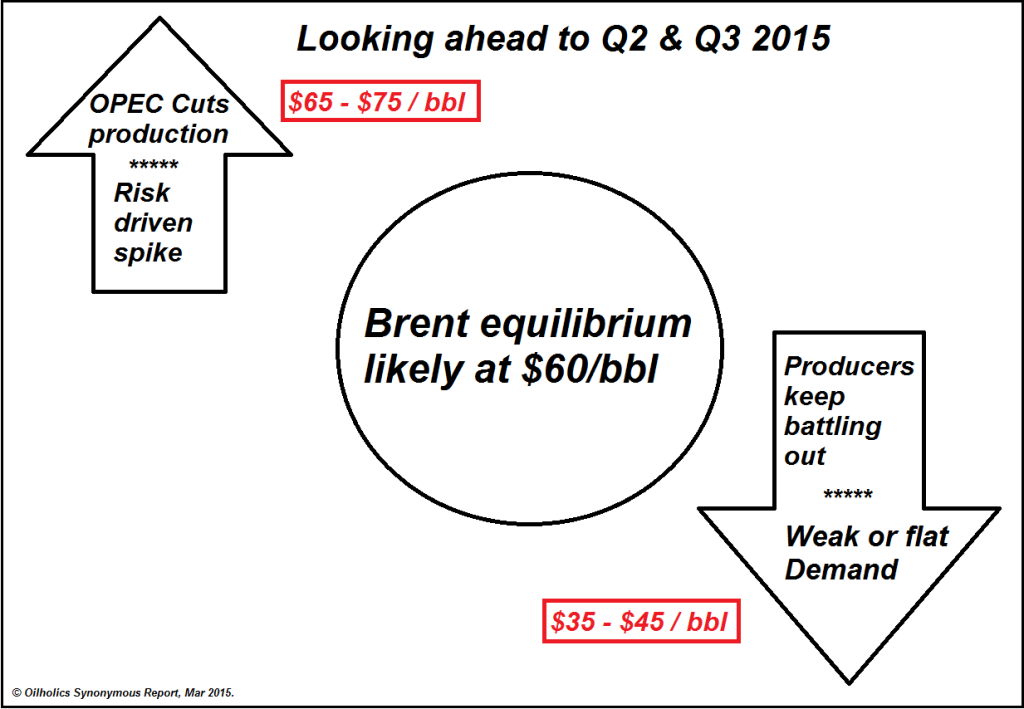

Inevitably, some production prospects would run into trouble and that is what you need to gauge in your attempt to predict the direction of oil using Brent as a global proxy benchmark. The 2015 target price should be $60 between now and June. However, from June onwards, barring a global financial tsunami, we should see the price rise gradually to stay first in the lower $60-range and then perhaps as high as $65-75, but no higher come Christmas. You can forget a $100 oil price for 2015-16 at the very least, perhaps even as far forward as 2017-18.

Unconventional, especially Arctic exploration, won’t be feasible at current prices. Weaker US Bakken shale plays will suffer, even though Eagle Ford shale would continue to prosper. Russia is bound to see a supply correction too. All of this will lend support to the price.

The big riddle here is – will it be enough to convince OPEC to lower its production quota from 30 million bpd, either in June or later this year, without risking a decline in its market share as many cartel members fear?

If it does react, then Brent will find support over $60, but not the kind of spike that we’ve come to customarily associate with historic OPEC quota cuts. Finally, there are two more factors that you need to watch out for, and temper your thinking accordingly.

First of all, do not be overly influenced by chatter about a rise in Chinese demand. Chinese economic data continues to remain mixed. As such, hoping the world’s largest oil importer would suddenly find an appetite to import at historic highs over the remainder of this year would be foolish, rather than bullish.

Secondly, perceived bearishness from the so-called imminent arrival of additional Iranian barrels to the global supply pool is also exaggerated. If, and it is by no means certain, Iran sees international sanctions lifted, and the country manages to add 400,000 bpd by mid-2016 then it would have done well. Iran won’t flood the market; rather I see a gradual, incremental rise in exports which would take time to gain traction.

Sum it all up, and it’s why I think $60 should be a short-term target between now and June. Post-OPEC, we could be looking at something higher between $65-75. Even then, a likelihood of the upper end of the range being achieved would be contingent upon a “major” geopolitical event. Going the other way, a severe slump below $40 is looking just as unlikely in the absence of a prolonged economic downturn which no one is currently predicting.

Sum it all up, and it’s why I think $60 should be a short-term target between now and June. Post-OPEC, we could be looking at something higher between $65-75. Even then, a likelihood of the upper end of the range being achieved would be contingent upon a “major” geopolitical event. Going the other way, a severe slump below $40 is looking just as unlikely in the absence of a prolonged economic downturn which no one is currently predicting.

Gaurav Sharma is an oil markets analyst and author of the Oilholics Synonymous blog. He regularly comments on the direction of the industry on broadcast media, and writes for various publications including Forbes, Digital Look and ShareCast.

Follow the author on Twitter @The_Oilholic

Disclaimer: The above commentary is meant to stimulate discussion based on the author’s opinion and analysis. It is not solicitation, recommendation or advice to trade oil and gas futures or place bets on the direction of the market. Oil and gas markets can be highly volatile and opinions may change without notice.