You may remember that an ascending triangle is a bullish continuation pattern. Continuation patterns are an ideal second entry point if you missed the original signal. They also bring peace of mind if you're already involved in a trade. It can be very comforting to see an ascending triangle form when you are already in a long trade.

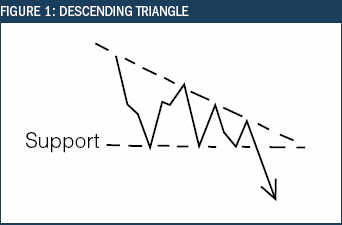

Ascending triangles, like many chart patterns, have an opposite counterpart. We will continue to focus on a family of macro continuation patterns called descending triangles.

|

This pattern shows a downward sloping trendline that creates the upper boundary of the triangle. A level of support that is approximately horizontal forms the lower boundary of the triangle. A breakout will often occur before these two lines intersect. It is especially common for the share to break out during the final third of the triangle formation. Breakouts are usually downward, in the same direction as the slope of the trendline. For this pattern to be valid, the trendline must be touched at least twice by the share price action.

These patterns are usually formed during an existing downtrend and act as downtrend continuation patterns. They can be seen on either a weekly or a daily chart. If a breakout occurs in an upward direction, the signal has failed. An upward breakout is a bullish sign.

Every time the share price drops to a certain level, people start to buy shares because they are perceived as 'cheap'. This is the equivalent of the doors opening at the Myer Grace Bros stocktaking sale as buyers scramble over each other to pick up a bargain. Once the price drops through this psychological level, the buyers realise their error and then push each other out of the way to sell.

This is one of my favourite patterns to trigger a short sale, or a bought put. You can write calls with this as well, but as the move is often quite significant, you may as well use an approach to capitalise on this.

To estimate the expected fall in price action, measure the height of the pattern at the beginning of its formation. Take this result and subtract it from the horizontal line to give you a potential short-term price target. Of course, if the share is in downtrend already, this point will just provide you with a likely consolidation point before further falls. Short sellers could close their positions once the share comes close to this price target, and await a re-entry signal to attack again if the trend continues.

While reviewing my analysis of ascending and descending triangles, I found myself thinking about these patterns metaphorically. There are some people who are on the ascent in life, and whose careers and academic qualifications reinforce their sense of superiority. Yet, others experience the exact opposite.

I have trained many traders to improve their skills in the share market. This has led me to try to work out why some people succeed, and why others become net losers. I've seen people with superior intellect decimate their superannuation funds. On the other hand, some people who have not been as gifted intellectually achieve remarkable profits. So, just how clever do you have to be in order to trade effectively?

I'll always remember being approached by an extremely well groomed gentleman after an Expo seminar that I'd run. He was wearing an impeccably pressed suit, and he had just the right amount of credibility. When he spoke to me, it was clear that he had received a private education, and the benefits of a good upbringing. However, the first words he said were: "For the life of me, I cannot work out how to trade effectively. I've read over 100 books on trading, and for some reason, I'm still making losses." We chatted for a while and I eventually asked what he did with his life other than trading. It turns out he was one of Australia's top neurosurgeons.

He described his trading system to me. When it became clear that I was going to require a degree in advanced mathematics to understand how he traded, I stopped him mid-sentence and said, "Trading is meant to be quite simple. Maybe you'd better 'dumb it down a little'." He looked at me in utter disbelief, shook his head and walked away.

Many professionals have established an enviable level of success in their corporate or academic roles. Often they feel that the share market should recognise that they are about to trade and roll out the red carpet of profits. Some seem to have an unfailing belief that they are bulletproof.

There is a psychological phenomenon called the 'halo effect'. This effect is responsible for an oversimplification of events in the world, so that your psyche can have an easier time getting through life. The halo effect suggests that if someone has developed knowledge and skill in one area of life, then this should radiate to a totally unrelated area. It is why Kieran Perkins advertises milk. "Well, if he can swim like a champion, then he must know the best type of milk for me to drink!" It also explains why Buzz Aldrin recommends fitness products, and bikini-clad beauties sell spanners. ("Well, if those girls recommend that I should buy that brand of spanner, maybe I will find that beautiful women will throw themselves at me as soon as I leave the hardware store.") It is a simple leap of logic designed to line the pockets of clever marketers.

It is tempting to feel that if you have been successful in one area of your life, it should spell automatic success in the share market. This simply does not happen. There are few similarities between the backgrounds of great traders. Some terrific traders used to be garbage collectors, others doctors. Your past profession has very little to do with your future as a trader.

In some ways, the highly paid corporate professionals who begin trading are at a psychological disadvantage. Due to their above-average incomes, the losses they make can often be mitigated if they take on one extra patient or see one extra client. Trading from this perspective negates the importance of discipline. It's far better to trade as if your very life depended on it, even if it doesn't.

Trading is one area where IQ does not guarantee your success. Some of the dumbest people make great traders because they follow their trading rules without question.

There are some people who are secretly concerned that they lack the intellectual ability to become effective traders. They wonder whether they'll be able to understand the imagined complexity of trading. They harbour an inferiority complex because they don't have a fancy degree, or they have been told in the past that they are 'dumb'. This translates directly to lack of confidence.

Female traders are often plagued by this sense of inferiority. Research suggests that when feedback is unequivocal and immediately available, women are just as confident in their own abilities as men. It was found, however, that "when such feedback is absent or ambiguous, women seem to have lower opinions of their abilities and often underestimate [their share market performance] relative to men." Feedback in the stock market is ambiguous.

Many people become worried that they may not have what it takes to be a good trader. Sometimes they have struggled with the maths involved in position sizing, or in understanding a concept such as options. This leads to their confidence levels plummeting.

Let me assure you that having the right level of motivation is much more important than having a superior IQ. You may need to flip your perceptions about this. There are distinct advantages in feeling a lack of confidence about your own abilities. First, it is unlikely you will create a plan that is complex and difficult to follow. It is more probable that you'll write a plan that is simple to follow, and more robust. Secondly, it is unlikely that you'll suffer the perils of over-inflated ego.

Effective trading relies on two central activities. First, you need to generate a trading plan that covers all your entry, exit and position sizing requirements. Secondly, you need to follow that plan. The paradox is that you need quite a high level of intellect to create an appropriate trading plan. However, to follow a plan to the letter, it is far better to turn off the 'thinking' part of your brain, and just trade according to the rules. Having a high level of intellect is an advantage in writing a plan, but it may not assist you to cope with the day-to-day monotony of following the plan. Often, more intelligent people struggle as they question, over-measure, and generally are caught up in their own trading results. Some are so carried away with the application of indicators that they keep adding to their charts until they almost buckle under the pressure. It seems that the more intelligent traders feel compelled to tinker with their plan, which is of no advantage to anyone.

People with a perceived lower level of intellect may struggle initially to write their plans, but when it comes time to trade, they are content to follow their plans to the letter. They do not over-analyse, and they remain loyal to their trading system. The ideal trader is clever enough to formulate a trading plan, but dumb enough to follow it without question. So if you're not a budding Einstein, you can still be an incredibly profitable trader.

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.