The Parts of a Trend

Now you may remember that Dow Theory talks about the three parts of a trend, the primary, secondary, and minor. The primary or major trend may last for years, and Dow classified it as something lasting more than a year, although depending on the market you trade in, such as futures, it arguably may be as little as six months. The secondary or intermediate trend is a short term retracement within that primary trend which Dow figured would take from three weeks to three months for the stock market. Minor or near-term trend covers anything else of shorter duration, basically less than two or three weeks, and in real life there are many small fluctuations up and down even during one day.

Acceleration and Deceleration of a Trend

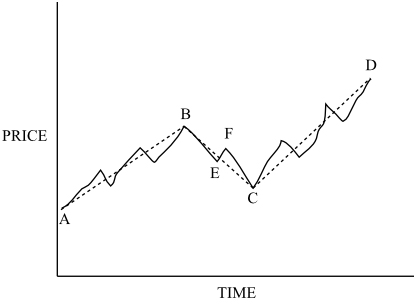

Each trend becomes part of the next bigger trend, so the minor trends make up the secondary trend, and the secondary trend is part of the primary trend, and is sometimes called a ‘correction’ to that trend. Commonly a major trend may see the market stop to correct itself with an intermediate trend for a couple of months from time to time. This means that in practice charts are not quite as neat as already illustrated. Here’s a more complex illustration of how prices move.

The solid line represents the price chart, and the dotted line is included to show the main uptrend more clearly. You can see that B and D are successively higher peaks, and that A and C are successively higher troughs, and they define the movement as an uptrend on the overall time scale. The retracement or correction is from B to C, which represents the secondary or intermediate downward trend, with lower lows at E and C, and lower highs at B and F. But B to C is broken up by another retracement, this time an uptrend from E to F.

It is easy to see how there can be a confusion over what trend is in force at any particular time. To a position trader, the trend is clearly an uptrend from A to D. A short term trader may want to trade on the downtrend from B to C, whereas a day trader might see an uptrend for a couple of days from E to F, and be happy to trade on that. So if you are talking to other traders, you need to know what sort of trading they are doing to see the trend from their point of view. In fact, if a fellow trader asks you what the trend is in a particular market, you should always clarify what viewpoint they are taking.

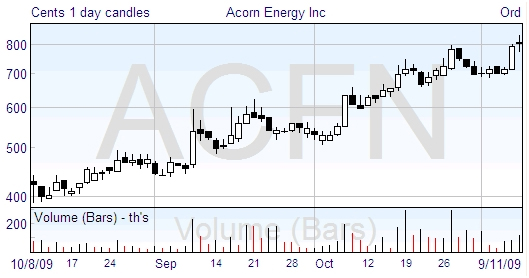

Here’s an actual example of a daily stock chart, in which you can see the different types of trend.

While the overall primary or major trend is upwards, and you can clearly identify the successively higher peaks and higher troughs, the secondary retracements clearly form downtrends on a smaller timescale. If you were to look at the daily price charts associated with the one above, you would undoubtedly be able to find many more minor up and downtrends on that scale.

So how you view chart trends depends on what sort of trading you’re doing. Many experienced traders who use a trend following system find that it is possible to trade secondary trends as well as the primary moves, with the shorter term price movements being watched for entry and exit timing.

In general, it is good practise to follow the trend. If you don’t, then you’re betting against the market. If you are still learning to trade, it is a good idea to ignore trading the secondary trends and concentrate on the main trends, simply trying to identify as early as possible when the secondary trend is finishing so that you can buy (or sell) when the primary trend resumes. This is much more straightforward than trying to guess when to switch between the short and long positions, as you would have to if you were trying to trade both types of trend.

Join the discussion