Saucers and Spikes

These are patterns or shapes that you will see at a chart reversal, and fortunately they don’t occur very often as they are difficult to reliably identify. A saucer shape, sometimes called a rounding bottom, is just a gentle curving transition from a downtrend to an uptrend which may take months or years to form. They are major reversals, but on such a long time span they do not offer much trading opportunity. You also can’t easily determine any price targets from them.

Spikes are the opposite. There is a sudden switch in direction with hardly any time for the transition. They can be caused by a major piece of adverse or favorable news. Alternatively, sometimes the markets can get very over extended, while still trading in the original direction, and this pent up pressure is suddenly released by a spike reversal. This is usually accompanied by very heavy volume. When we look at indicators in module seven, you’ll see some ways to judge whether the market is becoming overextended in either direction.

Saucer Bottom

A Saucer Bottom is a semi circular rounding bottom that looks like a bowl on a price chart. The volume dries up during the formation of the saucer and increases as prices approach the resistance. Saucers occur somewhat infrequently but when they do they are among the most reliable patterns to trade.

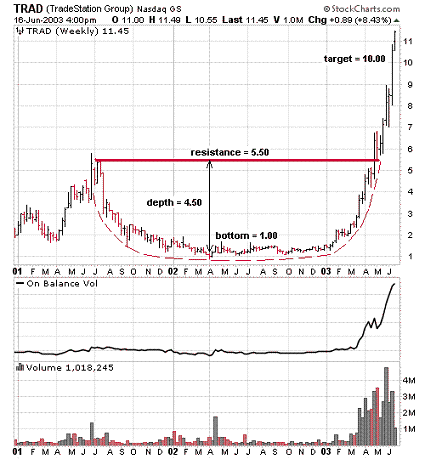

Profit Target – can be measured by adding the depth of the saucer to the previous price high that forms the resistance of the formation.

Example – This weekly chart of TRAD shows a typical saucer bottom having formed over many months.

Trading Tip – Look for a significant volume increase as the prices approach the resistance. When accompanied by rising on-balance volume, this will usually precede a good breakout.

Cup & Handle

A Cup and Handle is a close relative to the saucer bottom. It starts as a saucer bottom that instead of breaking out, retraces to form a shallower and smaller curved consolidation near the top of the pattern. A Cup and Handle is a very reliable bullish pattern that is known for producing large and rapid price advances.

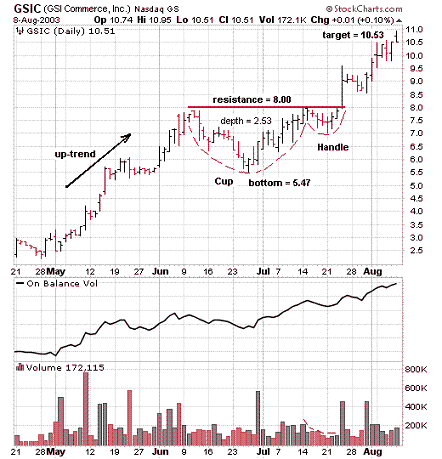

Profit Target – can be measured by adding the depth of the cup to the previous price high that forms the resistance of the formation.

Example – This daily chart of GSIC shows a Cup and Handle continuation pattern in an uptrend.

Trading Tip – Keep an eye out for significant volume change as the prices approach the resistance. Strong, rising on-balance volume usually precedes a good breakout.

That concludes our look at the principal reversal patterns, and of these you will come across the head and shoulders and double patterns most frequently. As you can see, they build on our previous discussions of market behavior, using trendlines and support and resistance, and making decisions based on the violations of those lines. Identifying and using reversal patterns allows you to get in at the start of a trend to capture most of the move with your trading.

Contributed by Kamil Schumann

Join the discussion