Trading Volume

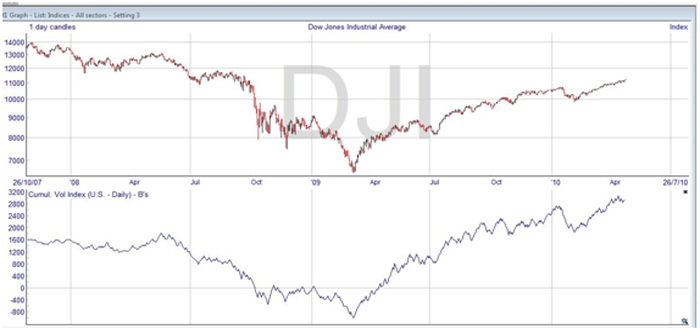

A third measure of the strength of the market is to look at the trading volume, and a common way to do this is by looking at the volume in advancing issues and the volume in declining stocks. This is called the upside volume and the downside volume. These can be shown as two separate lines, but in the case of ShareScope which illustrates the principle below the indicator is a cumulative one, taking the difference between upside and downside each day and adding it to the previous day’s value. Once more, the absolute value depends where you start, and so is not relevant, but you are comparing the ups and downs of the indicator to the market index.

When the upside volume is strong, and the index is rising, this indicates that the market is strong. If the index is falling, then the market is weak. Usually when the volume is reduced then the stock price will be lower, because it indicates that fewer people are seeking to buy into the market. But high volume is useful from a trading perspective, as it shows good liquidity which means it is easy to trade, and orders will be fulfilled quickly.

Sometimes you may see a sudden jump or fall in volume. If so, you should look to the reason before taking any further steps. Usually you will find that there has been some change in circumstances, or news released which you will need to take into consideration before taking a position on the security.

Working with Volume and Open Interest

Join the discussion