The Trendline Fan

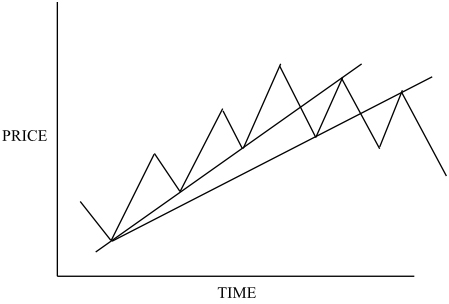

To elaborate further on the use of the trendline, sometimes it is possible to draw several trend lines creating the appearance of a fan. When the first trendline has been violated, and in an uptrend has become a resistance, you can draw a second line going from the start of the trend through the new low point, and at a lower angle. When the second line is violated, it too may become a resistance—here’s a diagram to show what I mean–

You can carry on and draw a third trend line from the start to next low point, but generally if that too is violated, as it would be in the diagram above, you can reckon that the prices are going lower and that this uptrend is history.

Trendline Steepness

Now you may have noticed that many of the diagrams above show trend lines at about 45°. You will find that most important trend lines are about this angle, so much so that some people just draw a line at 45° from a major high or low and work from there. The noted analyst W.D. Gann favored this angle as it seemed to represent a balance between price increasing and time.

If your trend line is much steeper than this, it usually indicates that prices are going up too quickly for the trend to be sustained, and the trendline may well be broken back to a lower angle of increase. If you have a much shallower trendline, it suggests that the trend isn’t very strong, and maybe you should not trust it.

Even though many traders count on 45°, if you know anything about charts and graphing you will realize that the angle depends on the scales that you set for the price and time. What we’re really saying is that analysts have noticed that with the customary scales for the charts it turns out to be this angle. As always with technical analysis, you need to observe what the markets do, more than trying to rationalize the science.

Adjusting the Lines

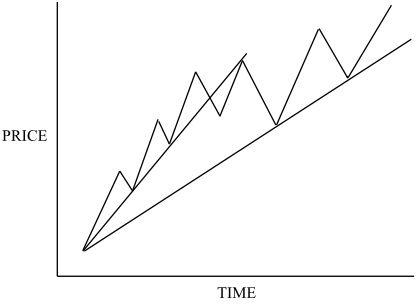

Apart from trying to get a good fit for a straight line when you draw the trendline, there are times when you need to make a bigger adjustment to the angle of the line, for example if the trendline is really steep and then broken, you may need a trend line at a lower angle. Here’s a diagram of how that looks –

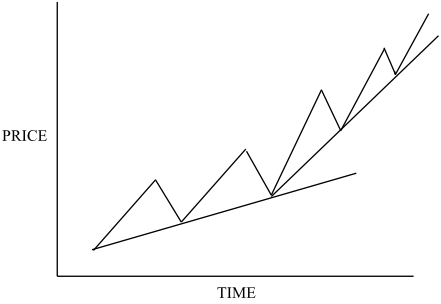

The original trendline proved to be so steep that the trend could not be maintained by the market. After a break, and a rise to the line as resistance, the price settled down to a lower angle, confirmed by two touches. In a similar way, if the trend starts out too slow it may increase and necessitate drawing a second line at a greater angle –

Sometimes a trend accelerates, which would make you draw several trend lines at increasing angles to try to encompass the price action. In the end, you might be better off using another tool, the moving average, which would give you a curving boundary trend line.

Moving averages will be discussed in module 6, and this is just one of the uses for them. It is always useful to have a repertoire of tools available to fit the situation as you find it.

Finally, for this discussion of multiple trend line angles, it is quite possible to have a trendline over a long period showing the underlying uptrend, and to have other shorter trend lines tracking secondary swings. Just look at the demonstration chart again –

Clearly there are steeper trends going on, and depending on your needs you can draw additional trend lines on shorter time periods. There is no one correct answer to drawing these lines, and you should experiment to find out what works best for any particular chart and your trading requirements.

Join the discussion