Corrections: Zigzags and Flats

While the principles are clear and simple, the difficulties with the Elliott Wave Theory are in correctly identifying the various phases. The five wave move is not so difficult, but the correction is often hard to trace, as it tends to be less clearly defined. Three basic patterns of correction have been identified — zigzags, flats, and triangles.

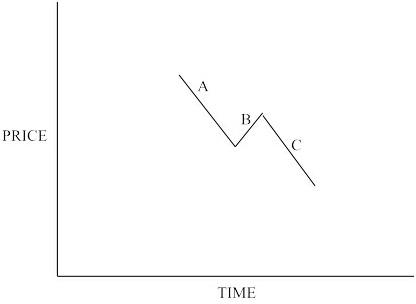

Zigzags

This is a three wave ABC declining pattern, which on a smaller scale breaks down to a 5 wave — 3 wave – 5 wave sequence, just as in the correction above.

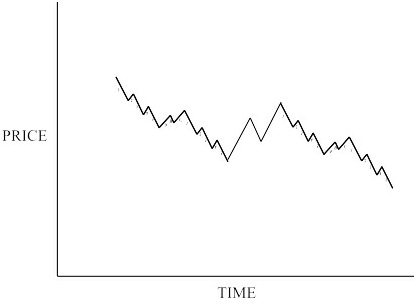

Sometimes you’ll see the zigzag repeat, with a three wave pattern in-between –

This is actually just two 5-3-5 zigzags with a three wave ABC pattern connecting them. You can also get zigzags as corrections in a downtrend, for which the diagrams would be inverted.

Flats

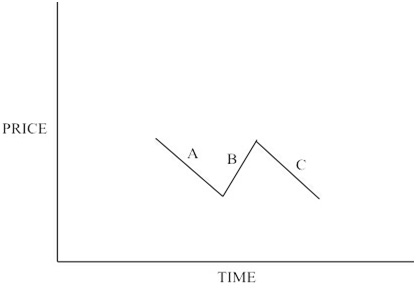

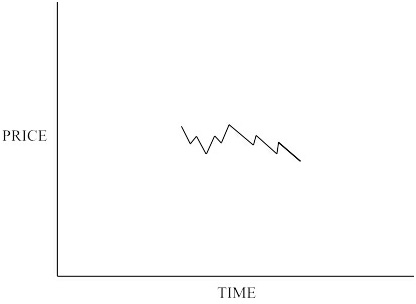

‘Flat’ corrections look at first sight very similar to zigzags, with a fundamental ABC pattern that is not as sloped as the zigzag.

When you look at the subdivision of the level below, however, there is a discernible difference – the Flat has a 3-3-5 wave pattern.

The flat correction retraces less than the zigzag, but you should normally expect to see the bottom of wave C slightly lower than the bottom of wave A. You will also find that flat corrections are not as long as zigzags. You can find a couple of variations, one where wave B rises higher than the start of wave A, or another where wave C fails to go lower than A. Again, flats are seen in both uptrends and downtrends, the examples given here show the correction to a bullish trend.

Join the discussion