A: Spread betting is just that - betting! It was invented by Charles McNeil, a Connecticut math teacher who became a bookmaker in Chicago in the 1940s. Sports gambling is one segment that has experienced increased popularity in recent years in parallel to the rapid growth of online betting. Many punters now like to have a flutter on their favourite sports online with increased regularity, and with a wide array of sports on offer to bet on, your gambling opportunities are almost unlimited. In practice, spread betting was initially used exclusively for sporting events but spread betting has now broadened out into the investment world, allowing 'bets' to be taken on movements in share or commodity prices, the 'investor' winning or losing according to the success or otherwise of predicting the ultimate direction.

You see, traditionally a bet is placed using the fixed odds model e.g. 1/3 or 2 to 1. You place this on a win or lose scenario meaning that you can either win or lose your bet. Your potential winnings are calculated at the outset from the odds and amount staked. So if you place a £20 bet on Liverpool to win at 1.6 and they win (!), you stand to make 1.6 x £20. Should Liverpool lose or draw, you will lose your £20 stake. One of the problems with this fixed odds model is that it tends to create a market where the majority of punters bet for the better team and spread betting helps to balance this by creating an active market for both sides of a wager.

So what is sports spread betting? Sports spread betting is a form of gambling on the outcome of a sporting event where the more right you are, the more you win and conversely the less accurate your prediction the more you lose. A bet is made against a 'spread' (or index), on whether the outcome will be above or below the spread. The amount you win or lose depends on the level of the index at the end of the event. The spread represents the index firms margin.

The concept has a long history in American sports betting and was imported to the United Kingdom in the 1980s. For instance in many informal office football pools in the United States, where one team is touted over another, they make use of the spread which indicates that the favorite team has to win by a certain number of points and serves to even the odds of placing a bet on either team. In North America the bettor usually bets that the difference in the scores of two teams will be less than or greater than a value specified by the bookmaker. For example, if a bettor places a bet on an underdog in an American football game when the spread is 3.5 points, he is said to take the points; he will win his bet if the underdog's score plus 3.5 points is greater than the favourite's score. If he had taken the favourite, he would have been giving the points and would win if the favourite's score less 3.5 points was greater than the underdog's score.

Spreads may be specified in half-point fractions to avoid ties, or pushes. The loser of a North American spread bet loses only the amount that he has bet, while a winning bettor collects the amount wagered minus the bookmaker's commission (in addition to receiving his original bet back). The bookmaker's commission is commonly known as vigorish or vig, and is usually 10 per cent of the original wager; in the United Kingdom both sides are held at odds of 9-10. In North American betting a push is treated as if no bet at all had been made, while in the United Kingdom 'dead heat' rules apply, resulting in a net loss of £5 on a £100 wager due to the 9-10 odds of the proposition.

If a key player on a side is marginally injured and may or may not play, the 'sports book' - or establishment that handles the bets - may declare the game off-limits to bettors (by not quoting any spread at all on it), or may "circle" the game; in the latter scenario, lower maximum amounts for each bet are enforced (typically $5,000 instead of the $25,000 limit observed at most Las Vegas sports books) and certain specialty wagers, such as "teasers," are banned on either side in the game. (A "teaser" is a bet that alters the spread in the bettor's favour by a predetermined margin, often six points - for example, if the line is 3.5 points and the bettor wants to place a "teaser" bet on the underdog, he takes 9.5 points instead; a teaser bet on the favourite would mean that the bettor takes 2.5 points instead of having to give the 3.5. In return for the additional points, the payout if the bettor wins is less than even money. At some establishments, the "reverse teaser" also exists, which alters the spread against the bettor, who gets paid off at more than even money if the bet wins).

In the United Kingdom spread betting has come to resemble the futures market. The bets are usually on the outcome of sporting events or indeed on financial instruments, but the firms often offer bets on more arbitrary events - such as the number of corners during a football match or the total shirt numbers of the goal scorers.

Unlike fixed odds betting the amount won or lost can be very large, as there is no single stake to limit the maximum losses. However, it is usually possible to place a "stop loss" with the bookmaker, automatically closing your bet if the value of the spread moves against you by a specified amount. "Stop wins" are the opposite - closing your bet when the spread moves in your favour by a specified amount.

Example: In a football match between Liverpool and Everton the spread for corners is 12-13, the index firm believes there will be 12 or 13 corners in total during the match. A bettor approaches the firm with the belief that there will be more than 13 corners during the game, the bettor 'buys' at £25 a point at 13. If the final total of corners is 16 the bettor has won, receiving 3 x £25. If the final total of corners is 10, the bettor loses 3 x £25. A 'sell' transaction is similar except made against the bottom value of the spread. Often there is live pricing, which changes the spread during the course of an event allowing a profit to be increased or a loss minimized.

In North American sports betting many of these wagers would be classified as over-under (or, more commonly today, total) bets rather than spread bets. The mathematical analysis of spreads and spread betting is a large and growing subject. For example, sports which have simple 1 point scoring systems (e.g. baseball, hockey, and soccer) may be analysed using Poisson and Skellam statistics.

According to the FT before the betting exchanges were established sports spread betting represented the only way you could bet against a horse, as well as backing it. If you just want to back a horse to win, fixed odds is probably still your preferred method. But if you want a market on the extent of that victory, spreads offer a lot more choice. In fixed odds you stand to win if your horse places first, and it doesn't make any difference whether it does so by a neck or by 25 lengths. Spreads offer markets in which that makes a difference.

A: Spread betting might seem daunting at first, but the principle is fairly straightforward. Sports spread betting provides you with the ultimate betting thrill and challenges your skill, judgment and knowledge of sport. It is also a great way to bet in that you are able to bet in-running meaning that you have the opportunity to place a bet from the very first minute of a game right through the finish. However, the real beauty of spread betting is that the odds are constantly changing and you can close a bet at any time to materialise your profits or cut your losses or you can sit back and watch your profits grow (or losses accrue) until the very end!

With sports spread betting you are betting on a range of outcomes referred to as the spread, and you bet whether you believe the outcome will fall above or below the spread. To explain how it works it is best to describe with an example involving whole numbers as many beginners have difficulties understanding how there can be 2.4 goals in a game.

Let's take cricket. The spread betting company may be of the opinion that a batsman should make around 35 runs so it would quote a spread of say 34 - 36 (this covers the range of outcomes that the spread company predicts are most likely to occur for an event). If you think that the batsman will score more than this, than you would BUY and if you thought the batsman was weak you would SELL.

IN THIS EXAMPLE THE BATSMAN SCORES 45.

If you BUY for $1 - you will win $9 (you bought at 36, result was 45 - the batsman scored 9 more runs than the buy offer).

if you SELL for $1 - you will lose $11 (you sold at 34, result was 45 - the batsman scored 11 runs more than the sell offer).

Let's now consider an example with fractions which tends to be baffling to many newbies, let's take a football match on TOTAL GOALS (total number of goals scored in a match) -:

The spread betting company may quote a spread of 2.5 - 2.8 goals. Naturally you can't have 2.4 goals in a football match. The odds simply suggest that the estimate is between 2 and 3 goals with a bias for the 3 goals (as the spread quote is closer to 3 than 2). Here, you can play with bigger stakes as there tends to be less volatility (there is a limit on to how many goals there can be in a match).

LET'S SAY THAT THE FINAL SCORE IS 1 - 0 IN THIS GAME, TOTAL GOA LS = 1.

If you buy for $150 you will lose $270 (you bought at 2.8, result was 1 - the total goals were 1.8 less than the buy offer -> $150 x 1.8 = $270).

If you sell for $150 at 2.5 you will win $225 (you sold at 2.5, result was 1 - the total goals were 1.5 less than the sell offer - $150 times 1.5 = $225.

The providers make their cut from the gap between the buy and sell figures - if they are able to correctly predict the outcome they will end with a small profit from BOTH the buyers and the sellers.

If you take a darts match for instance, you can spread bet on the highest checkout. The spread could between 107 and 110. So, if you believe that the maximum checkout of 170 will be realised you can buy at 110. If one of the dart players did indeed achieve a 170 checkout and you bought at £1, you would win £60 - the difference between the final result and the price you bought at, multiplied by your stake.

Note that by human nature most punters tend to have a bias to BUY; they do this because there is no ceiling for profits, as opposed to selling when you know your maximum possible gains (like shorting shares!). Of course the bookies know this and will thereby pitch their spreads that little higher than they want them to be (although they cannot quote them too high or they will get hit by big punters selling aggressively), so it is best to approach the market with a view to SELL, and only consider buying after careful thought.

A warning before starting out is to be careful as spread betting can very volatile - you should take into account your liabilities at all times; play one market at a time and close your bet before opening another.

A: Not surprisingly the most common bets in sports tend to be on the most volatile and popular markets. Football definitely dominates the sports spread betting business, but golf, tennis and cricket betting are also hugely popular. Tennis spread betting usually focuses on the men's game which can account for up to 95% of the action.

Some of the most popular bets in football include supremacy as well as the total number of goals scored in a match. In golf the Catastrophe Specials and bets based on the day's pairings and on players' overall finishing position attract the most action. On the other hand in tennis the so-called 'crosscourts' which multiplies the winner's and loser's score in each set to reach a final number and which can be very volatile are very popular.

Rugby is also very much popular with spread betting providers with Spreadex stating that it accounts for 10% to 15% of their business, according spokesman Andy MacKenzie. This is due to the fact that Rugby's relatively high scoring games lend themselves well to spread betting (unlike football where the margin of victory is usually one or two goals).

For almost all of the sports betting industry in the past it has been exclusively fixed odds based on the simple premise of backing a winner. Fixed odds betting still dominates and some sports spread betting companies like Spreadex have started offering fixed odds to compliment their spread markets. This leaves Sporting Index, the largest sports spread betting provider as the only company concentrating on spreads.

A: It would be quite difficult to deny that, here in the United Kingdom, we enjoy a flutter. Betting on horses, greyhounds, football, tennis, golf and other sporting events has been a long-standing hobby for generations.

In 1985, Jonathon Spark and Michael Spencer went to Paris to watch the Prix de l'Arc de Triomphe at Longchamp, which is one of the premier horse races in France. Until that time, the only way that you could bet on the result of a horse race in the UK was to try to forecast and nominate a specific horse that would either win, or finish among the first three (occasionally four) horses past the post. Sometimes it was possible under certain circumstances to bet on the outcome of a stewards' enquiry (e.g. whether an objection would be upheld or dismissed), or the distance by which the winner beat the second (e.g. a short head, a head, a neck or half a length) in the days before cameras were installed at every racecourse. Messrs. Spark and Spencer had an argument, not about whether either of their selection would win the race, but about which of either horse that they fancied would beat the other, and by how many lengths. The concept of spread betting can best be illustrated by this different approach to backing your conviction. It works like this -:

If you think that horse A will beat horse B at the end of the race, you ask the bookmaker (or the person who fancies horse B with equal conviction) for a price. Suppose he makes 'a price of 2 lengths at 3 lengths'. Let us assume that you have great faith in your opinion that horse A is far superior and altogether a better horse and will finish the race considerably ahead of horse B, you would 'buy' lengths. You would place a 'buy' bet at a stake of - say - £100 per length. That means that for every whole length greater than 3 lengths that horse A beats horse B, you will receive £100 from whomsoever you placed the bet. Conversely, for every whole length greater than 2 lengths that horse B finishes in front of horse A, you will pay £100.

You think that Horse A will beat Horse B. The odds that are quoted for this are - 2 lengths, at 3 lengths. You place a 'buy' bet at £100 per length.

The race result- Horse A sixth, Horse B eleventh i.e. 7 lengths between A and B.

YOU WIN 7 less 3 = 4 x £100 = £400.

But if the race result had been- Horse A eighth, Horse B third i.e. 5 lengths between Horse B and Horse A, then

YOU LOSE 5 less 2 = 3 x £100 = £300.

Thus it doesn't matter what horse wins the race, there is still a way for you to make winning bets on the outcome.

This concept opened up a whole new vista of betting opportunities and the dealers in the City of London as well as the sporting bookmaking fraternity recognised and welcomed the birth of a great big new market for punters to bet, and money to be made.

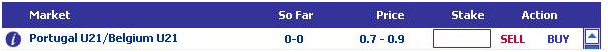

A: Price is 0.7-0.9 for Portugal so if they win 2-0 you win 1.1 of your stake if you back them to win, if you sell them i.e. think Belgium will win and they win 2-0 you lose 1.3 of your stake...

|

A: The line was probably 24-28 so if you thought that he would not score you would sell at 24. If he doesn't score you would win 24 x your stake but he did in the 55 min so you would have 55-24=31 so the loss would amount to 31 x your stake. Now, if you had bought his goal minutes at 28 and he had not scored you would lose 28 x your stake. So in this way you lose your stake per point.

It is a good way of betting but also dangerous as it can cost you a fortune as I can vouch foe as I used to bet on the shirt numbers. When it's good it's very, very good, but when it's bad...

A: Spread betting on football is without doubt one of the most exciting ways to have a bet on a match! When spread betting on football (as with all spreadbets) it is not just a matter of getting the result right or wrong, since the amount you stand to win or lose depends upon how right or wrong you are. Sounds confusing? Well it's not! Let's have a look at one of the most popular football spread betting markets for instance -:

The timing of the first match goal is a market played frequently by football punters. In this market a trader at a betting company sets a spread on at what time during the match he believes the first goal will be scored. The punter betting on the market has to decide if he believes the first match goal will be scored earlier or later than the quoted spread.

So for example the spread on the time of first match goal market might be 39-42. The selections for the spread better are thus:

-> 'Buy' or 'go high' the quote at 42 if he thinks the time of the first match goal will happen after the 42nd minute (or indeed he believes there won't be a goal in the match in which case the market will make-up at 90). Don't forget the 42nd minute starts when 41:01 is on the match clock.

-> 'Sell' or 'go low' the quote at 39 if he believes the time of the first match goal will be earlier than the 39th minute (remember that the 39th minute starts with 38:01 on the match clock).

-> * No trade, if he believes the market is spot-on and the first match goal will indeed fall between the 39th and the 42nd minute.

And what are the results?

-> A 'buyer' will win money if the first goal is scored after the 42nd minutes, making one unit for every minute after this time it is scored. Therefore if the first match goal is scored in the 51st minute a 'buyer' will make nine units or nine times his stake. A goal in the 81st minute will net a 'buyer' 39 units or 39 times his stake.

-> A 'buyer' will lose money if the first goal is scored before the 42nd minute, losing one unit for every minute before this time it is scored. Therefore if the first match goal is scored in the 38th minute he will lose four units or four times his stake. A goal scored in the 11th minute will cost a 'buyer' 31 units or 31 times his stake.

-> A 'seller' will make money if a goal is scored before the 39th minute, making one unit for every minute before this time it is scored. Therefore if the first match goal is scored in the 31st minute a seller will make eight units or eight times his stake. A goal in the 14th minute will net a 'seller' 25 units or 25 times his stake.

-> A 'seller' will lose money if a goal is scored after the 39th minute, losing one unit for every minute after this time it is scored. Therefore if the first match goal is in the 50th minute a 'seller' will lose 11 units (or 11 times his stake). A goal scored in the 61st minute will cost a 'seller' 22 units or 22 times his stake.

The time of first match goal market is one of literally dozens of football spread betting markets traded in-running throughout a live football match.

A: Spread betting is considered higher risk than fixed odds betting since your potential losses or gains are potentially uncapped and can be greater than the amount staked. Big wins are possible from small stakes which makes it attractive but this cuts both ways and you can also lose substantial amounts. Having said that, if you know what you're doing and bet sensibly, then you shouldn't have any problems.

If you'd like try giving sports spread betting a try, but are worried about the risks, then you can always use the 'Stop Loss' feature on your account which limits the amount you can win and lose. So suppose that you were betting on a footbal match with a spread of 8-10 corners and you traded at 8, you could set a stop loss on 15 corners, so that you do not lose anymore monies after that point. Although this would also stop you from winning more if there were actually only 1 or 2 corners in the game...

The first thing that attracts punters to spread betting is the fact that you can win a lot of money, but the other side of the coin is that you can lose a lot as well.

A: Well, you can lose in excess of your stake due to the mechanics of how spread betting works. In this form of gambling, the bookmaker makes a prediction on a particular aspect of a sporting event. The prediction takes the form of a spread, so say, in the England v Pakistan cricket test match series there is a spread of 22 to 24 on the number of sixes there will be.

If you decide to place a bet on this market you would need to first decide if there are going to be more or less boundary sixes. If you believe there'll be less, then you would sell at 22, and if you think there will be more sixes, then you would buy at 24. If you sold at 22, betting £10, and there were actually only nine sixes, then you would win £130. This is because your winnings or losses amount to the difference between your bet and the actual outcome, which is then multiplied by your stake. This is the reason you can lose more than your initial stake, as the more you're wrong the more money you'll lose. This shouldn't put you off as it also works in reverse; the more you're right, the more money you'll win... Just remember to bet responsibly.

A: It is a fact that with spread betting, unlike fixed-odds betting, you can lose more than your stake. However, some sports spread betting websites offer a stop-loss account where you can cap your winnings and losses, which is a good idea to take out if you want to control your balance.

A: Well, going long will always be more popular in football spread betting (and really, not only football but also in most other forms of sports and financial spread betting).

The reasons are -:

-> Buying is safer. You always know how much you stand to lose when buying. In fact, when you buy you know how much you stand to lose from the outset, i.e. you know how much you are risking should the spread bet go against you. Let's take an example. If you buy on a total goals scoring market of 4 - 5, the most you stand to lose is 5 times your stake (since the minimum number of goals possible in a football game is 0). Working out your profit or loss is a simple calculation:

Check the difference between the spread and the outcome and then multiply this by your stake, in our example the outcome is 0 goals; hence 0 goals minus 5 goals = -5. This follows logic since the minimum possible goals in a match is 0 so the outcome-the result...If you had placed a bet of £25 per goal, your loss would have amounted to £125. Thus, as you see your maximum risk amount is known from the start. This is not so if you sell the market at 4 goals since you don't know the number of goals that could be scored in the game. In theory there could be an infinite number, although very unlikely since in practice there are very few games in a season where more than 10 total goals are scored.

-> Buying is more exciting. The second reason is due to the 'thrill factor'; when you buy, your bet is winning once a certain number of goals are scored and although realistically there is a limited number of goals which can be scored in one game, we don't know what this will be. On the other hand if you sell, you start the game with the potential maximum profit since your goal total is already as far away from the spread on the short side as it can be (each additional goal reduces your profit). i.e. if you sell and total goals stays at 0 then you make the most profit. This is perceived as less exciting because you hope that no goals will be scored. Whereas if you buy, you are hoping that the goals scored will keep increasing to first reach the buy spread number so your trade is on the winning side of the bet. Then you hope it keeps increasing so you win more money! Moreover the goal margin can also move over to the buying side at which point you actually start making a loss. Thus if you're starting you should always lay small bets on sports (especially rugby) as the bets can quickly go against you.

Obviously your spread betting provider knows this and they make the selling side of a game more enticing to the spread better i.e. the spreads are often set to favour selling more.

Most spreadbetters love the feeling of a spreadbet and like to play it to the very end. This is actually good and we can take advantage of it because if more punters are buying the spread rather than selling it the spread betting provider would raise the spread; and this could be raised to an artificial level due to the thrill-seeking punters (as opposed to real sporting probabilities) It is similar to what goes on with favourites; when people go in bookies and bet on the favourite they lose long term. This is because the bookies odds for the favourite are lower than the expected probability of that event occuring (remember odds are probabilities). Exchanges offer close to a perfect reflection of a true price in the same way as a share price (all things being equal and information being available to the public) should represent a perfect market. Fortunately greed, inside information and weight of money through psychological betting means I can still make a living as it is not a perfect market.

A: There is more likely to be value on the sell side of an open ended possible result (i.e. a market without a ceiling).

But there isn't necessarily going to be value. just that if there is it will be on that side...

And this is not just because the firm expects more punters to buy, but also you have to factor in the possibility that "the worst that can happen is the worst that can happen"

So if you sold Lara's runs at whatever price the day he hit 400, then you have suffered from that 'worst that can happen' scenario, or goals in last season's portsmouth game at home where it finished 7-4, or tennis games that go to the 5th set and finish 19-17...etc So the extreme possibility of a monster MU has to be accounted for.

A: If I had to make a guess...

SportingIndex quotes get moved by weight of money to balance their positions.

Spreadex probably match their initial quotes to what the other two put up. They also likely have the fewest punters and even then they're not particularly big spenders.

ExtraBet have what appears to be the most 'cutting edge' trading screens of the big three. The constant adjustments made to their quotes could be that they're more tightly tied in to movements in the Betfair markets.

Betfair and similar exchanges are now a solid foundation from which the main betting markets take their lead, and spread firms can build their quotes.

A: Before the Monaco grand prix, ExtraBet was offering a binary price on Juan Pablo to win the race at 17.2-18.5. That means you can buy him at 18.5 or sell him at 17.2. In this case, let us say you decided to buy £1 per point. Had Montoya won, the bet would score 100 points, so you would make a profit of (100 - 18.5) x £1 = £81.50. But if he lost, the bet would score 0 and you would lose £18.50. In the event Montoya was fifth, 1.21 seconds behind Williams team mate Kimi Raikkonen.

A: Ok, the outright index is the principle 'to win tournament' market and works by assigning points to players depending on how far they progress.

For instance players get 60 pts for winning the tournament, 40 for the runner-up, 20 for losing in the semi-finals, 10 for losing in the quarter-finals and 6 for losing in the last 16.

Here's typical odds for the frontrunners -:

Men

Federer 42 - 44

Murray 31 - 34

Djokovic 9 - 12

Roddick 8 - 9

Del Potro 9 - 11

Tsonga 7 - 11

Verdasco 5 - 7

Haas 5 - 7

Soderling 3.5 - 5.5

Safin: 2.5 - 4.5

As usual you buy at the highest price which is 34 for Andy Murray for instance. Andy can get a maximum of 60 points for winning so the most points you can make is 26 points. If you buy at £5 a point you would win £130.

No points are awarded if Murray gets knocked out in Round 1 so if you SOLD Murray at 31 for £5 a point, you would win £155.

A: Yes, of course spread betting in horse racing is possible and indeed has increased in popularity in recent years. In fact one of Sporting Index's racing specialists commented that he has been around since the company was just starting up 'When I arrived 12 years ago I was one of six employees, doing all the racing by myself. Now there are 190 of us, with a racing staff of 12.'

Here, you can either bet on the jockey index, winning distance or bet on the distance of places between individual horses so as such it involves a fair amount of guessing on the spread between them. Distances are one of the most popular area here and are offered on both individual races and across entire cards of seven or eight events across a day at a meeting. A further spread speciality is the 'match', which is a bet based on the distance between two finishers in a horses' race. These markets have a cap to serve as a protection for both punters and providers alike (in that it caps losses), with a limit of 15 lengths in National Hunt races and 12 on the flat. As the capping measure might indicate these markets are very volatile - especially the National Hunt where Fences can make a lot of difference.

Match bets are also another way to bet. The challenge here is to decide which of two horses - both of which are close to the top end of the betting and are reasonably closely matched - will run better. Here it doesn't matter whether your horse wins the race; what matters is that it does better than the other one in the match.

You can bet on the favourite's index where each favourite gets a certain amount of points. A popular favourite (traditional odds of 6/5) is likely to be given the maximum amount of points which is 25 while a 9/1 favourite in the Grand National might only be awarded 8 points for the index. This allocation of points creates a spread and horse spread betting punters will buy if they think the horse will win or sell if they think that it won't. You can also bet on the jockeys index which is very similar to the favourite's index except that here you are betting against a quote of how great a race a jockey will have.

Warning: Being quite a technical form of betting spread betting on horses is definitely is not suitable for beginners as you are never entirely sure how much you stand to lose; hence it is risky especially in the wrong hands. Some of these markets are difficult for punters and dealers alike which adds to the excitement of the game; and one sports trader highlights one example 'A six-horse race with three novices and two more that haven't run over fences before. How do you predict that? Thatís the challenge.'

A: Here are a few thoughts in no particular order.

Choose something you have some basic knowledge of and/or interest in. You are going to be spending a lot of time on it so if you enjoy it it helps. If you have some basic knowledge that helps but be prepared to search out more.

Choose something that is available with all three spread firms. That way there is a market so you should get better prices.

Choose something that is NOT hyped by the spread firms that way the market may be more in your favour.

Choose something that is an aggregate like total lengths or total goals avoid bets that require you to work out two values that are then multiplied together like multi mules or total goal minutes. (There are reasons for this).

Choose a market that gives you plenty of opportunities to bet.

Choose a market and/or firm that supports small stakes and stop loss accounts particularly to start with.

Avoid bets where the spread firms simply use Betfair and a set of tables to work out the spreads. This includes all Index bets and especially binary spreads.

Avoid any bets where the outcomes have arbitrary points alloted to them and you buy or sell the result or aggregate. This is things like Jockeys, Top weights and performance indexes.

Choose low quality sport as well as high quality. Firms are so busy pricing up Man U v Chelsea they have less time with Partick v Morton.

As with a lot of betting and trading, it is a matter of heart versus head. The advice given to punters in any field is to bet on your fears as opposed to your hopes. The propensity of the football punter to do the exact opposite may explain the feelings of spread traders. As Chris Shillington, a spokesman for a sports spread betting company says "When you get into the office, you tend to start thinking in terms of what will be best for business. Our traders are football fans, and many of them are English, but it will still be pretty gloomy in here if England do win the World Cup, because it will mean we end up paying out on a large scale."

A: This was answered by member Spreadz from the uk-spreadbetting.info spread betting forum.

Most of the time when a punter's thoughts drift towards this subject it is because they're looking to improve their returns. Can't fault that for an ambition! Because of the hype surrounding many money management 'plans' the unwary can start to believe that improved returns can be gained merely by manipulating stakes. Whereas in reality, the only way to really get more bang for your buck is to improve your selection methods.

The majority of staking plans, Kelly et al, require the player to know the precise chances of success. Unless you're tossing a coin, cutting cards or playing roulette, etc. (given it's a straight game) you can never know your precise winning chance (at least not that would stand up to scientific scrutiny). Even if I know my results over a lengthy period, there is no guarantee that future results will mirror what happened in the past.

IMO, staking plans are excellent at jacking up returns when applied to past results. As for increasing profits on future results... don't trust staking, concentrate on improving your winner finding skills.

Spread betting is unlike traditional odds betting inasmuch all too often your risk is unknown beforehand. My own approach is to examine your likely worst loss on the event you're playing - even then add in an additional 50% (we all tend to the optimistic when judging such things).

How much of an impact would this maximum single trade loss make on my betting bank? Then attempt to approximate what the ratio is between your losing & winning plays. Playing the spreads is much like fixed-odds even money betting, going higher or lower "should" give you an even chance. If your returns show more losers than winners, even though you might be showing a profit, I would re-examine your strategy. Making money from spreads when you have fewer winners than losers suggest you're relying on big hits, which IMO is dangerous ground. The higher your percentage of losers, the more likely that successive maximum losses will be encountered. Make sure you are prepared for the worst cumulative cases eating into your reserves. (Like hard disk crashes, it is not a case of "if" it will happen, but "when"). IT WILL happen at some stage, so be prepared.

Overall juggle your potential winners to losers strike rate with the worst loss that can be inflicted from each of your trades to estimate the bank size you'll need to cope. I don't know of a formula to help, and only you can know what your figures are.

FWIW, my advice would be, do all you can to increase your winner to loser percentage so as to minimise consecutive losers. Be ultra cautious with your estimations of worst-cases, and make it a bit worse than you first thought for luck. Accept losing days, weeks or even months with good grace (they're all part of the picture). Look for steady growth over the long term. Forget any get-rich-quick ideas, they're for story books and all too often the "buy my tips" websites.

Comfort yourself with the knowledge that almost all hobbies cost money, some a great deal more than others. This is one hobby with the potential to pay you to do it, and the better you get, the more you can make. But as with most hobbies it might cost you a bit to do it too, especially so in the early stages. Nothing teachers you better than experience, especially when it hits you in the wallet!

A: This was answered by member selphie from the uk-spreadbetting.info spread betting forum.

Having just dropped back a few points today. I'm fairly in the mood for this.

Long losing runs are easier to deal with if you have a steady flow of bets. It is psychologically more difficult to have a large loss then no opportunities at all or only ones with relatively small upsides for the next week or so. This is when you go down the slippery slope of trying to "squeeze in" bets that normally you wouldn't take. A good idea is to write your method down on a piece of paper and look at it every so often to make sure you're still doing it.

You need to have faith in what you are doing. In my case that is pretty straightforward because my method is mechanistic both in terms of selection and staking. This stops me from wandering off track and also gives me a degree of faith in what I'm doing because I know the same thing has worked over a long period beforehand. However if you are using your judgement then it is much more difficult. Ironically the closer you get to being right without actually being right the more distressing it is. For example the 33/1 shot winning by a short head I find far more annoying than the one that wins by four lengths going away. This is because in the latter case I can feel that clearly the horse was much better than everyone thought whereas in the former I was soooo close!

You need to have an idea of how variable your results are likely to be. What is your worst case scenario? I already have mine, it is a 75 point loss in one trade. That is my worst possible result. So today's effort was as nothing. My bank has enough to cover 10 of these losses.

In practical terms I have a 75 point loss happening about 1 in 5000 bets. The problem is that once you get above a certain level badness you can't really work out the probabilities. For example 6 100 /1 winners could occur but would need such a freakpot of results (Not all races have 100/1+ shots) that getting anything meaningful in terms of probability would be difficult. So I have my "worst possible" at 75 then allow for 10 of them. This is the first one in a year and a half I have hit. Which is about 1 in 1200 bets so I'm a tad early I guess.

I would suggest you have at least 30 and preferably 50 bets before you start reassessing things.

Try and make a list of things that could cause your method to fail. In my case for example it might be a new course opening or a new distance of race or race conditions. For golf it might be rule changes new courses etc. If you have these listed in the first place at least you'll be aware before they arrive and they will give you a list of ready-made suspects if things go wrong.

One of the worst errors I make and I'm sure everyone else does is take a single bad outcome and extrapolate it over everything. For example today I had a bad result. "God it's a Monday. I bet more bad horses run on a Monday. I'll bet less on Monday's ". Totally incorrect as it happens but it sounds logical.

I'm at a disadvantage as I am a one trick pony but if you have several strings to your bow then often one will do badly and others well. This does help.

Look very very carefully at your staking. I do far better with my geared staking than pure levels. Perhaps bet more on bets with limited downsides and less on the almost bottomless ones? Try and evaluate your advantage on every bet. What would you set the quotes at? Record this with your bets and see how it correlates with the results.

Finally watch out for the correlated bets. These are bets that are connected. For example SP's at Hamilton and SP's at Kempton are independent, one does not affect the other. However if you have multiple bets. on say the Ryder Cup. then common factors such as weather or team psychology may cause several bets all to fail together so you end up with longer winning and losing sequences than if the bets were independent.

A: Well, to gain an insight on this one has to watch some of SportingIndex's spread compilers in action which is exactly what two reporters from Inside Edge did.

The company's dealers have immediate access to their order book on each market and can see the book's overall exposure as well as information as to how each punter is performing. The dealers are experts in the art of odds compiling for certain sports so this section focuses on just a few of the more popular markets - the favourites index, match bets and distances.

The dealers typically start the day by going through the Racing Post and getting a first feel for the likelihood of the 3 or 4 horses forecast to be at the head of the market for the different races. Since each winning choice is valued at 25 pts on the index, the dealer will make provision for this by estimating how many pts the favorites are likely worth.

For weaker-looking, seven-runner maiden races where the jolly is likely to be 6/4, a dealer might be inclined to mark it down for all 25 pts. On the other hand, a runner quoted at 6/1 in a 15-race handicap might only be marked down for 8 pts. Dealers will then usually cross-check against the Betfair prices (this is a free substitute of the tissue prices of old which bookies used to pay for) to get an idea of where the money is going. At this stage a dealer will compile his spread prices for the favourites index before putting it on the line. Once the bets start coming in, the line will be adjusted accordingly.

What about the other markets? A dealer's work on the distances is less of a chore. It still involves an odds compiler working out the spread based on the racing form, but he will also compare his findings with that of other dealers to come up with a more general view. This group effort is Sporting Index's response to counter individual preferences which makes it far less likely that a dealer will overestimate winning distances, especially on the National Hunt race. An interesting trait of this market is that taking the contrarian view can pay nicely since punters typically over-react on the spreads. For instance, taking the distances market, should it starts raining lightly the compilers will adjust the distances spread up to allow, should the weather turn nasty, for the possibility that the winning margins may end up extended further.

If the course becomes softer for instance, the margins will normally push the spread distances up in the expectation that most punters will try monetising with a buy. Obviously, this means that they will have to keep a watchful eye on the weather and the new spread as well as where the spread action is going in case they need to revise the lines down again. This is where most spread betters are caught out since the real total of the winning distances mostly fails to equal the spread where it was pushed out to. One might think that this would mean some good profits for a punter prepared to sell at this new spread but the number of sellers will always be lower compared to the buyer irrespective of the market. This is because of the punters' natural tendency against shorting. Which comes with a hidden message for punters: if circumstances change and the spread on winning distances shoots up, don't be shy of selling; sure there won't be many others like you but you will be improving your chances of making money simply by taking the contrarian view. A final note about playing distances is about the final totals. Dealers will want the final total figure to be inside their spread so for instance if they have quoted 7-9, they will hope that the make-up will be 7.5 or so as in such scenarios they win the most cash. Races which have close finishes generally favour dealers the most so will commonly hear they shouting 'Not too far!' or 'Photo! Photo!' as the race horses come close to the end of each race.

As for the match-bets market, spread compilers are trying to filter out two horses which they think have a good change of finishing close to each other; with usually the smaller the distance, the greater SportingIndex's profit margins. Dealers are usually wary of racing horses that have visors, sporting blinkers or tongue straps for the first time as the animal might react negatively to the extra gear and make a poor race finishing well away from their matched-up counterpart.

Not only that but SportingIndex software is designed in such a way as to follow and flag spread traders who are on a persistent winning streak or are simply well-known in the industry as canny forecasters. This is the reason that spread bets are at time referred to manual authorisation from a dealer before acceptance or rejection. In fact, when it comes to skilled punters, dealers will in some cases even allow themselves to be directed on a spread if a 'hot punter' puts in some large action on a particular bet.

Most punters already browse through the Racing Post to evaluate the market leaders' chances and check out Betfair to see where the action is going. They also respond to any tweaks the dealers might do to their odds once the action starts hotting up yet they still end up losing. This is because most punters are not sufficiently disciplined to compile the odds in the same way dealers do; for instance it take a dealer about 2 hrs just to work out a favourites index.

What all this means in practice is that to improve one's chances of beating Sporting Index, traders need to specialise in one or two markets and use the same disciplined approach to establish their own prices. Which means you have to work out your own spread using roughly the same techniques that dealers do, and if it's higher or lower, betting accordingly.

A: The spread betting bookmakers make money from the gap in the spread, example 54 - 58 which represents a 'margin of error'. Should the outcome fall between this spread, then the bookie stands to win. Naturally, different sports and events can have vastly different size margins of error with some ranging up to 10%. In general, the smaller the margin, the better it is for the punter since the result is then more likely to fall either side of the spread.

A: I think the short answer is probably 'no'!

I'm sure that the spread-betting and general bookmaker firms may well have their own estimates and calculations on what each team will score in the upcoming matches, but this will not be published publicly anywhere.

As you have noticed, they wait until the toss has been made before putting in their opening quote on total runs. Issues like the state of the pitch, the weather, and the make-up of the team will all have a factor in helping to formulate this quote (as well as a bit of guess work from the 'cricket experts' at each firm).

A: This was responded by an experienced trader -:

With regard to arbitrage betting, there's nothing "wrong" as such, but from the bookies perspective it disturbs the standard risk-risk balance of the "game". Such players add nothing to the system, they are takers, pure and simple, extracting money from the spread betting pool with little or no risk. Not illegal, but if you were the head of a spread firm, would you want an arbitrageur on your books...what do they bring to the party? If you want to play the arbitrage game then take your business to Betfair. On the exchanges you're robbing Peter to pay Paul and taking your arbitrage percentage of the trade, no loss to Betfair, and Peter is even unlikely to know what's going on. On the spreads you may be robbing Sporting Index to pay IG Index, as soon as they latch on to what you're about, you're likely to be considered not worth keeping on as a client. Can you blame 'em?

One bookie dealer commented 'Bookmaking is the art of making a book, not as some people believe simply laying a bet. Thus like all firms we have risk guidelines and will when necessary limit clients or change prices as we see fit. Sports betting is a leisure service, a battle of minds between market maker and punter but a handful of clients will only play our markets when there is an arbitrage opportunity with another firm, this is not good business and these clients will be restricted in the size of bets they are able to have.'

A: Tagging this on here as it relates to palpable errors -:

This morning looked at Sporting index

Their quotes for SP markets were

Warwick 49-52 Lingfield 45-48 Kelso 50-53

Tucked away was an aggregate quote of 132-138

This meant you could buy aggregate for 138 and sell the individual markets for 144 in total.

Ok so I put my bets on the individuals, no problem, then came the buy on aggregate.

A nice message came up saying you bet has been "referred to a trader". After about 30 seconds a message came back saying my bet had been accepted.

It was at that stage I got a bit of cold feet about this. What if they voided the aggregate buy as a palpable error?

I rang them up.

"I've just put four bets on are they Ok?"

"Yes they've been accepted" then a pause. "Ah why have you rung?"

Honesty mode cut in or maybe stupidity. "Because you've given me an arb in your market and I want to make sure your not going to call it a palpable error".

"Oh yes we have haven't we. Your the first to spot it. Want do you want to do?"

"Er let my bets run as offered?"

"That's not an option. The aggregate price is a palpable error and we won't settle at that price".

"Hang on your software has accepted it and it's been referred to a trader and I've rung you to point it out surely that deserves something."

"If you hadn't rung we still would not have paid on the aggregate bet what would you like me to do?".

I had the feeling that I was getting nowhere fast.

"Ok cancel all the bets but as I've been sensible and rung you what about some hospitality at one of the events you sponsor?"

A short pause.

"I'll send your details to our marketing department".

"With an appropriate message?" .

"With an appropriate message, I've cancelled the bets".

A: I don't think they hedge at all. Of course they can move the spread to balance the positions to a greater degree with sports betting than financial betting. But inherently there does seem to a higher degree of risk exposure in sports betting for the spread betting company...(as opposed to financial markets where the spread betting firm can hedge in the underlying markets).

Also, on a single bet there is more risk and occasionally they do get it wrong - like the number of bowling wides bowled with a white cricket ball in the last world cup. However, over the long run, they set the spread in such a way that they will consistently win more than they lose - just like straight forward bookmaking where they set the odds so that statistically they will win more than they lose. That's why gambling is a mugs game - you will occasionally win big and it feels great but you will also consistently lose more than you win with very few exceptions!

A: I don't think you'll find anything perfect, but then I don't think using "yield" as a statistic for fixed-odds betting is perfect without also having information about the odds (a yield of +10% from bets around evens is outstanding, but a yield of +10% from bets around 100/1 ... I wouldn't bother).

One thing you could do is express the total profit from winning bets as a percentage of the total loss from losing bets. E.g., if you make a profit of 1123 units on winning bets, but lose 1050 units on losing bets, then 1123/1050 = 1.0695 = 106.95%, so you could express that as +6.95%.

It's a simple statistic that gives some idea of the profitability or otherwise, and has the advantage that it makes sense for either spread betting or fixed odds betting.

It's not the same as yield for fixed odds betting, though if your fixed odds bets are all at about the same odds then you can convert between the two:

Example: a +10% yield at odds of evens means you have a 55% strike rate, so your winning bets make you 55 units for every 45 units your losing bets lose, and 55/45 = 122.22%, so this statistic would be +22.22%.

A 10% yield at odds of 4/1 means you have a 22% strike rate, so your winning bets make you 88=4x22 units for every 78 units your losing bets lose, and 88/78=112.82%, so this statistic would be +12.82%.

A: In actual fact sports results are not as unpredictable as one might first think. Taking the United Kingdom Premiership as an example, over the passage of the season, you will typically find that the number of goals scored is about two or 2.1 on an average basis and this has now been repeating for 10 or 15 years, but the actual stock market I would say, had been far more predictable than it has been over the past couple of years. Whether we're going to see more volatility over the next couple of years, who knows really?

A: The few people that can do this profitably in the long run work very hard all week. They analyze every aspect of the game including conditions, players, stats, and many other things. After all this analysis, they pick just a few games that they think they can profit from. They don't bet any more than 2% of their bankroll EVER. (probably less than that). Very important - they know that there is NO SUCH THING as a 'lock'. If you ever hear someone say they've got a 'sure thing' or a 'lock' on a game, be very leary to ever trust that person. The profitable sports bettor WILL lose games. They know how to do what they do so well that they make a profit in the long run.

A: This was responded by an experienced trader -:

I'm not a high roller, but neither am I a minimum stakes player. My maximum per-bet exposure regarding risk and reward is several hundred and only occasionally (depending upon number of trades) do I gain or lose in excess of £1k per day. I've been spreading since the mid 90's and am in lifetime profit with most firms, including those who have disappeared over the past decade.

As for keeping your betting accounts open...Betting is a risk business for both sides of a bet, your risk is matched by the bookies risk (well not quite, they have overround or spread width, but they're running a business). Both sides in such an arrangement need a degree of trust in each other that they will be playing with a straight bat. The punter requires that the bookie plays by the rules, both written and unwritten/moral (fairness). Equally the bookie needs to ensure his risk is always slightly less than yours. So, he figured, you play right by them, and they'll play right by you.

-> Always settle your accounts promptly and expect the same of them. Have a "steady" profile, i.e. allow them to become accustomed to your stake sizes, your bet types, the frequency of your betting, etc.

-> Put yourself in their shoes. If you were running a book, and although there may be nothing intrinsically "wrong" in flitting like a butterfly, the punter who varies stakes, bet types, frequency without apparent rhyme or reason can be a financial risk too far, a nuisance to the business and too uncomfortable to accommodate without marking their card for at worst an account closure, or at best to keep a close eye on.

Winning accounts have benefits for the firms that administer them, so long as the client profile is stable. Winning clients can be a source of good market information for the spread boys. If they examine data to both pre-judge a market for setting the initial spread, and then keep abreast of breaking news, part of the data picture they have access to includes their customer's trades. Some of these must help give a clearer picture of what the outcome might be. I know I would relish the thought of having access to the trades of every player in real time, as they happen. Wouldn't anybody? What a rich source of information that would be!

Although it would be bad for trade to have ALL winning clients plundering your early quotes, having a fair few does open up the chance for them to become ambassadors of your business. Word of mouth is probably the best form of advertising there is.

For myself, despite being a long-term spread winner I have never had a spread account closed, or knowingly marked and/or had bets referred on a regular basis. Whether that has anything to do with my having an "easy" profile to monitor and giving no surprises, settling promptly, playing regularly with regular stakes, never arbing or jumping on obvious pricing errors, I'll probably never know.

A: Sports spread betting currently comes under the control and regulation of the FSA. A historical quirk due to spread bettings roots in stock market transactions. The FSA have long been reluctant regulators in this area and feel they have been saddled with a role in sports betting they didn't ask for or want. But the spread firms have been keen to keep the relationship strong, probably because they see its removal as a threat to their own market domination, restricting the competition to FSA approved companies only.

Hope that answers some of your sports spread questions but feel free to contact me at traderATfinancial-spread-betting.com with any questions you may have.

Please do not copy/paste this content without permission. If you want to use any of it on your website contact us via email at ![]() traderATfinancial-spread-betting.com (remove the AT and substitute by @).

traderATfinancial-spread-betting.com (remove the AT and substitute by @).