The Dangers of Shorting Stocks

We have already covered some of the dangers and pitfalls in a previous article so I’m going to keep this brief. For these reasons my shorts tend to be fewer and even more tentative than my longs. For one thing when you go long the worst you can do is to lose all your starting capital. However, there is no cap on your potential gains as there is no limit on how much a company’s share price can rise. Thereby if you take care to invest in undervalued companies not only is there upside but the downside is also limited as the share price is already discounted. If you pick the same company to go short you can face the opposite situation where you are limiting the upside to 100% (a share price can’t go below zero) but opening your downside to potentially unlimited liability.

A thing to note is that its rare for large companies to collapse in an instant or even in a predictable and straight line (unless, of course they are involved in a mass scandal like Enron!!). Smaller companies are much more likely to sink to much lower valuations fairly rapidly. Of course, by not going short you could miss opportunities especially in a bear market where you can pretty much short anything and make money, so spread betting and cfds provide a happy medium with which you could go long but also short from time to time when the opportunity strikes.

A simple way to short is to look for underperforming shares in underperforming sectors and then it’s just a question of waiting to pounce at the right time. Perhaps finding weak companies is a smarter way to do it. Shop around for shares with high debt and not so fabulous statements… (shorted ABU recently which had similar credentials and made a nice sum though did not put it on the site).

One of the troubles with shorting is this: any fundamentally (and I mean fundamentally) good company that has been marked down ‘with the rest’ simply becomes a bid target. So one day you wake up and find that your lovely short is up by 20% and you have lost a shed load of money. This week I didn’t make 20% on a stock that was bid for as I wasn’t in it. Had I been in it I would have been short (the chart, the chart). It’s just something to think about.

Jesse Livermore made huge fortunes shorting. He also went broke three times (twice because the particular exchange closed down rather than pay him) and had to be surrounded by armed guards as those who lost everything blamed him.

Why Did The Stock Market Slump?

Blame the NINJAs – US mortgage brokers were just too liberal with other people’s money. They were handing out loans to people with No Income, No Job and No Assets, NINJAs. This is the so-called sub-prime mortgage market, where those with poor credit histories get their loans.

Fine and dandy when interest rates are low and a housing market is buoyant – the bank can always foreclose, take a profit on the property and move on. Unfortunately the US housing market has collapsed and these loans have gone bad. The tenth largest mortgage lender in the US, American Home Mortgage has gone bust.

So far, so what – bad enough perhaps but not cataclysmic – it would be like one our bigger name remaining building societies going bust. What’s exacerbated and spread the problem is a fancy piece of financial engineering and the globalisation of the financial markets. Take all these, shall we say mildly dodgy, loans, packaged them together into a bond you can sell on; call it a collateralised debt obligation, CDO for short, and sell it as an investment to a hedge fund or financial institution of your choice anywhere in the world.

CDOs were supposed to be great investments, after all they offered strong interest income stream, they were backed by mortgages that were backed by property. Until it all went pear-shaped because the loans should never have been lent in the first place.

We’ve seen a couple of US hedge funds go bust and a German bank, the banks here have taken a bath as well and one French bank, BNP has blithely refused to even value some of the funds it was running that are supposed to be backed by these debt instruments.

Many of the underlying sub-prime loans were effectively fraudulent – wave the money goodbye in other words. When they were repackaged as bonds they were given ratings that were far too flattering, meaning investors were buying the equivalent of a clocked motor, mutton dressed as lamb, all fur coat and no knickers at all!

Then there were the really clever financial engineers who made CDOs out of CDOs – calling them CDOs squared – and they were marketed as high quality investments. To anyone who remembers the split capital investment trust debacle, this magic circle of investment trickery may sound painfully familiar, proving as it does that if there isn’t one born every minute, then there’ll be one along shortly. And I have a nice bridge in Brooklyn I’d like to sell you!

|

What’s truly astonishing is the size of this market: The market for these securities is enormous. Since 2000, it has ballooned from $900 billion to more than $45.5 trillion – bigger than the US equity markets, US Treasuries, and Mortgage Securities — COMBINED.

|

CDS are thinly traded, have huge counter-party risk, are difficult to analyze, and are unregulated insurance products.

“As with other securities that trade privately and by appointment, assigning values to credit default swaps is highly subjective. So some on Wall Street wonder how much of the paper gains generated in these instruments by firms and hedge funds last year will turn out to be illusory when they try to cash them in.”

Sell is the Call, not Buy

Sell is the call not buy.

|

Kennedy got out of the market in 1928, the year before the Crash, locking in multi-million dollar profits. Indeed when the 1929 crash did come, he made money due to his short positions. He famously remarked about getting out of the stock market in 1928, ‘You know it is time to sell when the shoe-shine boy tries to give you stock tips.’

In 1928 Joe Kennedy had the Dow Jones research and shoe-shine boys to point out that economic fundamentals beneath share prices were starting to fall apart. Today we have much better means, i.e. the tracking of selling off their own company stock shares by corporate ‘insiders’, Fed regional business activity surveys, nationwide bankruptcy filings, and a host of other information sources, to show that economic fundamentals re stock valuations are on ‘shaky ground’.

A global financial shock is just one “Bear-like” event away, economist Mark Zandi warned Thursday, giving it a one-in-five chance. In the current “high level of angst” following the collapse of two Bear Stearns funds, the uncertainty caused by another hedge-fund failure could cause investors to freeze, he said.

However, I don’t believe in scare-mongering so I’m simply expressing some of my own concerns.

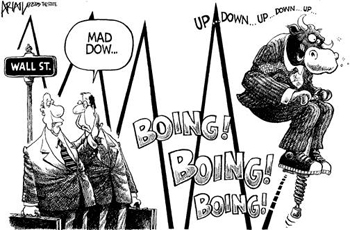

My own interpretation of the situation is influenced by personal memories of the Wall St Crash, when, after a succession of very poor sessions, the market lost 20% on the Monday. Institutional clients in the City were in a state of total shock (they are professionals, they have larger resources available to them than individual private clients, but they are also human). So apologies if I seem to have become a bit gloomy. There is an old adage: the worst doesn’t necessarily happen! One thing is for sure; we live in interesting times, volatility is back with us.

In a bear market you just need to slowly ditch longs and gradually increase shorts. I usually do it gradually – slowly building up shorts at the moment. It’s really crazy you can’t short in an ISA but can in a SIPP. I suspect if the bear market gets going I’ll just stick to the oils which I reckon may carry on rising.

There are still quite a few over-hyped Aim stocks waiting to get their comeuppance. If you want to find them, you could do worse than look for those with a low sales to market capitalisation ratio and a weak cash position – this market will give them increasingly little leeway.

One further point: not sure that the very poor recent performance of certain stocks, including PRTY, won’t soon be seen to have been a kind of advance warning of an oncoming bear market. The trouble with a liquidity squeeze is that it can feed on itself: losses are made on geared or time-limited positions, so stocks have to be sold, so prices go down, so stocks have to be sold.

My advice is to not try to buck the trend. There is lots of money to be made in shorting overvalued stocks at the moment.

Join the discussion