Module 2 – Accumulation

The Art of Buying

These days, investors rarely form together into groups for the purpose of manipulating stock prices. Nevertheless, the aggregate operations of independent buyers and sellers are in many ways indistinguishable from the outright manipulations so common in the past.

Suppose the stock of XYZ has fallen to a level low enough to encourage a number of strong-handed traders to accumulate large lines of stock. Suppose further that these buyers take all stock offered in a range from, say, 9 to 12.

As these traders continue to accumulate shares, the number of shares readily available to new buyers between 9 and 12 shrinks. Once ready supply has been reduced, only small buying pressure is necessary to raise the price to the upper end of the range, around twelve.

Systematic accumulation by strong hands retires stock from the market for a time, thus reducing the number of shares readily available for trading. Therefore, one tell-tale result of accumulation is declining trading volume.

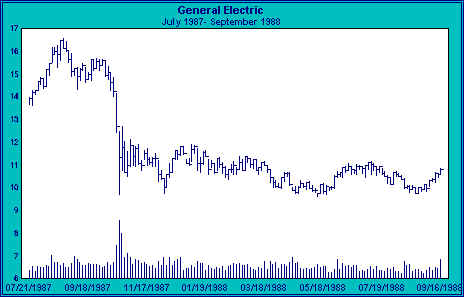

The two-day basis chart of GE, below, is a good example of accumulation. Initially, volume increased sharply as sellers panicked during the sell-off in late September of 1987. Selling climaxed with a nearly vertical drop on huge volume and a very wide spread from daily high to daily low. The selling climax is the most dramatic part of the liquidation process, but not the end of it.

Shareholders unable or unwilling to get out of their positions during the sharpest part of the decline continue to exit over the following months as the stock trades within a relatively narrow range. Those hoping that a quick rebound will allow them to get out even are eventually discouraged by the stock’s dull action and sooner or later throw in the towel.

As depressed longs sell at a loss, other traders accumulate their shares. Note that GE encounters support from buyers between 9 and 10 (the historical price has been adjusted for splits). Note, too, that volume picks up as the stock dips toward this support. The increase in volume toward the bottom of the trading range indicates that buyers are stepping up to hold the bag for all the cheap stock being dumped on dips by exhausted longs.

As the process of accumulation by strong hands proceeds, trading narrows and overall volume shrinks. Stock in weak hands is, by definition, readily available. It follows that as the amount of readily available stock declines, as indicated by declining overall volume, the amount of stock in weak hands is also declining.

As a consequence of the reduced ready supply of shares, trading becomes relatively thin. Thin stocks trade on reduced volume and require only moderate buying to advance the price.

Once the bulk of shares are back in strong hands, new buyers will have to bid up for scarce ready supply. As the price is marked up, new buyers seeking action are attracted to the issue, adding fuel to the advance. This bidding process is likely to build momentum until strong hands who hold sizeable lines release shares back into the market. Typically, strong-handed traders are not willing to sell until they have booked substantial profits.

Join the discussion