The Benchmark Equivalence Line

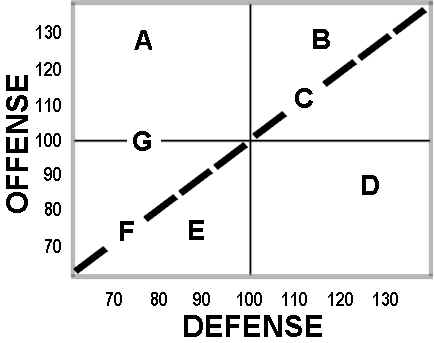

If the benchmark is considered as a target which is measured against itself, then the benchmark’s defensive and offensive scores are always equal to 100. For that reason, the benchmark is always located at the center of the matrix, at the intersection of the offensive and defensive benchmark indications.

Location Of The Benchmark

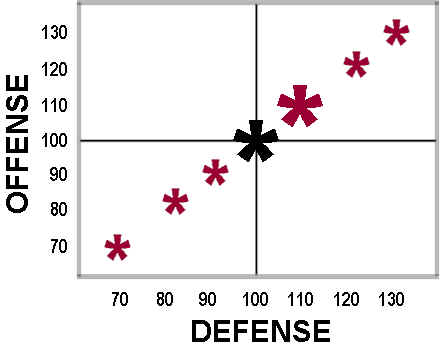

Now suppose we alter the volatility of the benchmark-as-target. If volatility is increased by, say, ten percent, then offensive and defensive scores will each increase by ten percent to 110 and 110, respectively. That new target will be located to the northeast of the original benchmark. If this computation is carried out repeatedly, randomly increasing or decreasing the volatility of the benchmark-as-target, these targets will all fall on a diagonal line extending southwest and northeast from the center of the matrix.

Benchmark At Different Volatilities

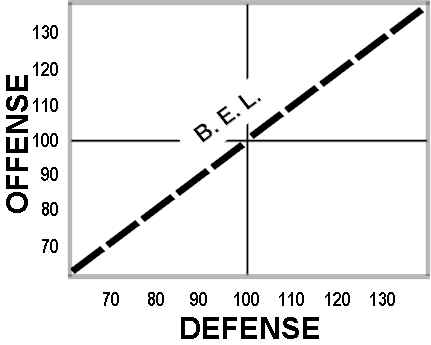

Theoretically at least, an infinite number of such targets could be calculated, forming a solid diagonal line. This line is The Benchmark Equivalence Line, or BEL.

Benchmark Equivalence Line (BEL)

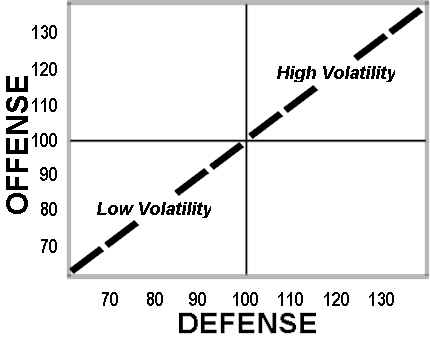

Along the BEL, offensive and defensive performance offset each other. Targets on the BEL to the northeast of the benchmark (matrix center) are stronger offensively but weaker defensively than the benchmark. As a result, the relative performance of those targets is quantitatively equivalent to the benchmark’s. There is a behavioral difference, however, which is qualitative; targets to the northeast of the benchmark which lie on the BEL are more volatile than the benchmark. These targets rise more than the benchmark as the benchmark rises, but fall more than the benchmark during those periods when the benchmark falls.

Similarly, targets which lie on the BEL to the southwest of the benchmark are less volatile than the benchmark. These targets drop less than the benchmark as the benchmark falls and move up less than the benchmark during periods when the benchmark rises.

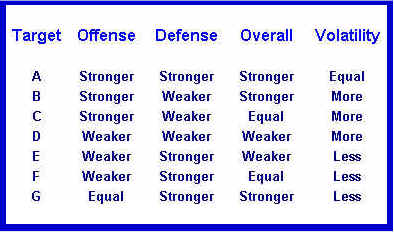

In the matrix below, identify each target as 1) offensively stronger or weaker than, or equal to, the benchmark, 2) defensively stronger or weaker than, or equal to, the benchmark, 3) overall stronger or weaker than, or equal to, the benchmark, and 4) more or less volatile than, or equally volatile to, the benchmark. The correct answers are given below the next graphic.

Answers

Join the discussion