A Rising Market

Next, we take up the action of an industrial index as it rises out of a period of reaccumulation. Prior to the action shown on the chart, the index rose within a well-established uptrend.

The index has shown evidence of accumulation since April. At A the price shakes out below minor support. The shakeout triggered sell stops and encouraged short selling. The trap closes quickly on sellers during the next session as price recovers to close high in the range and above support. The shakeout has created potential future demand, for once sellers realize they’ve been trapped, they will scramble to buy back at higher prices.

We take a long position at the opening of the next day. An immediate rally carries the index over near-term supply around 130. A reaction over the next seven sessions shows little selling enthusiasm. Spread narrows. The sharp but regular decline in volume as the price settles back to minor support (B) indicates that sellers are unwilling to pursue the price down. There is a clear bias of power to the upside. We add to our long position.

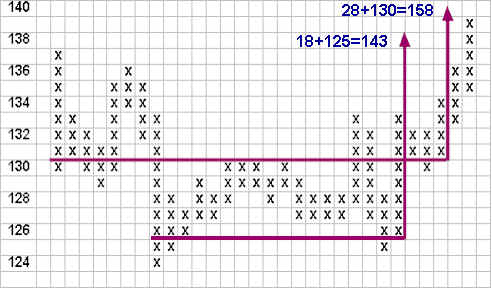

The point & figure chart below uses one-point reversals. Two objectives are taken. The count at 126 spans 18 x’s, from the vertical descent on the left to the vertical ascent on the right, to yield a target of 143. A second, more ambitious count at 131 yields a target of 158.

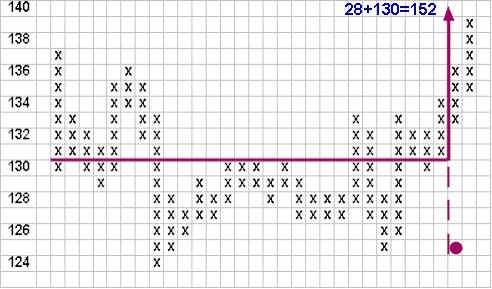

Point & figure counts can be taken either from the row across which the count is made or from some other support level. In this case, the count of 28 across 131 may be added to support at 124 to yield a more conservative target of 152.

Point & figure analysis provides three possible objectives: 143, 152 and 158. We will remain watchful for signs of possible distribution should the price approach these levels.

Join the discussion