Level II Trading: Tactics and Techniques

As an equities trader, you can make money on intermediate-term and swing trades by using an online broker. But, if you’re an active trader, and you trade more than two or three times a day, or you’re a scalper, and jump in and out of stock positions in seconds to minutes, you know the importance of using a trading platform with a Nasdaq Level II order entry system.

Level II screens show traders what specialists and market makers have always had access to–every player who wants to participate in a particular stock at a particular moment. That’s quite an advantage!

If you’re new at this trading game and haven’t executed trades on a level II order entry system yet, you’ll want to learn the tricks of the trade.

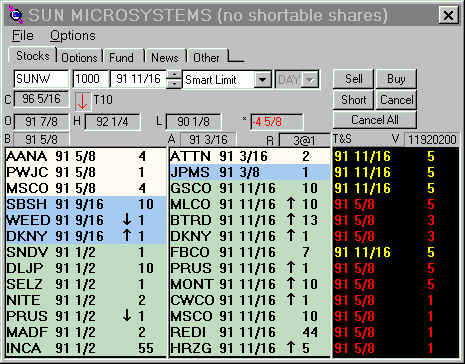

Across the top of the screen, you’ll find the level I quotes, or the inside bid and ask (the best prices offered at that moment by those who want to buy or sell the stock). Other useful information may include the stock’s high and low for the day, the opening price, current spread (difference in price between the inside bid and ask),and the volume traded for that day.

Below that, the screen is divided into two wide columns. The left shows “the bid,” or all those who want to buy the stock. Bidders are lined up from top to bottom, with those willing to pay the highest price at the top. “The ask,” or “the offer,” is on the right. All those wishing to sell the stock line up with the lowest offer at the top.

To the right of the ask, or offer, a Time and Sales screen forms a final column. This screen posts the current time and “prints,” showing every trade that takes place by price and lot size. The Time and Sales screen is the trader’s friend. Believe me, when specialists and market makers start playing head games with you—and they will—Time and Sales shows the facts as they are.

Trading NYSE Stocks on Level II

The bid and ask on a level II screen displaying a New York Stock Exchange, or listed, stock is different than a level II screen displaying a Nasdaq stock. On a NYSE stock, regional exchanges are listed under the bid and ask columns, with the lot sizes they’re bidding for, and offering out for sale. Some regional exchanges you’ll see on the screen are BSE (Boston Stock Exchange), NAS (Nasdaq Stock Exchange), CSE (Chicago Stock Exchange), PHS (Philadelphia Stock Exchange), PSE (Pacific Stock Exchange), CIN(Cincinnati Stock Exchange), and NYE(New York Stock Exchange).

If you’re familiar with the stock market, you know that each NYSE stock has one specialist (think auctioneer) who orchestrates the trading in that stock. Since specialists are responsible for maintaining a fair and orderly market in their stock, the spread between the inside bid and ask on listed stocks usually stays narrower (less of a point spread) and more consistent than the spreads of some wilder Nasdaq stocks. That’s an important point to remember, especially when you’re scalping.

Scalpers typically look to gain from three “teenies” (a teeny is trader jargon for 1/16th of a point) to ½ point on a trade. So, the best scalpers look for stocks with the narrowest spread. Day traders want the same advantage. Why? To lower risk.

Stocks with a narrow spread between the inside bid and ask, such as a teeny or 1/8th of a point, are usually very liquid. When we say a stock is “liquid,” we mean it is blessed with a lot of trading volume. Examples of liquid stocks on the NYSE would be General Electric (GE), or AT&T (T), or AmericaOnline (AOL). The benefit of buying a liquid stock is that you always know where to find the door! If you buy it and it immediately starts to crumble, there’s always someone you can sell it to—fast. That keeps your losses small. When a stock is illiquid, meaning it trades few shares and has a wide spread, say ¼ point or more, if it suddenly starts to fall, you may have to chase a seller to get out of it. That can cause you hefty losses.

After you confirm your stock’s spread of no more than 1/8 to 3/16, watch the Time and Sales screen for “size.” Say your stock is trading 50 ¼ (bid) x 50 ½ (ask). Is the stock being bought (green prints) at the asking price? Or is the specialist filling buy orders a 1/16 or 1/8 below the ask? What are the lot sizes being bought? Are they big such as 10,000 shares, or 25,000 shares? (We call this “size.) Large size on the offer indicates an institution may be buying up the stock.

Now, check out the red prints, which denotes sales. Are the lot sizes small, perhaps 100 to 500 shares per print? That suggests individual traders, not institutions or heavyweights, are selling the stock.

Therefore, if you see print after print going off at the asking price with size, that means buyers are willing to pay the going price for this stock, and they’re buying a lot of it! As long as other market internals are positive, you can assume this stock will probably rise in price.

If the scene above is reversed, with small size printing on the offer or below, and large size printing at the bid price, you can assume the stock will fall. Please remember, though, level II activity on any stock, whether NYSE or Nasdaq, only foretells a stock’s probable direction for the next few seconds or minutes. Buyer and seller sentiment can change in a heartbeat, causing stock movement to reverse just as quickly.

If the stock looks positive and you decide to buy, the prints will tell you whether you have to “pay retail,” by buying at the offer price, or whether you can “split the bid and ask” by slipping a limit order between the two prices. Say the stock is trading at 50 ¼ x 50 3/8. To get a bargain price, you place a limit order for the number of shares you want at 50 5/16. If the stock is moving slowly, the specialist may fill you at that price. But if buy orders are slicing through the offer like warm butter and the stock is skyrocketing, splitting the bid and ask can cause you to lose out on the trade completely. When I want a stock badly, I pay the retail price!

Conversely, if I want to sell quickly, I hit the bid price. I don’t try to split the bid and ask in a falling stock. If it’s falling really fast, I place my limit order to sell two or three levels lower than the highest bid price. When I’m ultra-desperate, I’ll get out with a market order. After all, getting filled at the next available price beats chasing the stock down to lose one, maybe two points, or more!

Points to remember when using level II to trade NYSE stocks:

Look for a narrow spread, 3/16 point or less.

Trade toward size. Old trader saying: “The Trend Is Your Friend.”

If you want to own this stock and it’s rising fast, buy on the offer.

If you want to sell fast, sell on the bid, put in an order below the bid price, or use a market order

Trading Nasdaq Stocks on Level II

Level II screens for Nasdaq stocks differ in that the bid and ask columns consist of market makers waiting in line, instead of regional exchanges. Many of these market makers represent large broker/dealers such as Goldman, Sachs (GSCO), Merrill Lynch (MLCO), Morgan Stanley (MSCO), and Prudential Securities (PRUS). Smaller, independent market makers also jump in and out of the lines. Alternative market makers are ECNs (electronic communications networks). Think of them as electronic order takers, or electronic co-operatives, for individual traders like you and me. Some ECNs you see most frequently are Island (ISLD), Instinet (INCA), Archipelago (ARCA).

No one person, be it market maker, institutional investor, or day trader, knows everything that’s going on with a particular stock at a given moment. Though a NYSE specialist knows of every buyer and seller who comes in and out of his or her stock, no one player in a Nasdaq stock knows everybody else’s business.That’s why the level II screens of actively traded (liquid) Nasdaq stocks resemble high-stakes poker games. The players attempt to shield their cards (orders) and true intentions from our eyes, and winning means outwitting your opponents by any means possible!

Market Maker Games

For instance, pretend you’re the 800-pound gorilla broker/dealer known as Goldman, Sachs. One of your institutional customers, a mutual fund, places an order with you to buy 500,000 shares of Microsoft (MSFT). You aren’t going to alert the other market makers that you have a juicy order by posting a single buy order for 500,000 shares on the level II bid. If you did, everyone would raise his or her prices. Instead, you slip in and out of the market, accumulating MSFT as quickly and quietly as you can, until you fill the order. That way you keep your client happy by getting a good price, and when MSFT rises, as it will from all the shares you absorbed, you can sell some shares from your own account and pocket a tidy profit.

If you (still Goldman, Sachs) feel like the order is important enough to camouflage, you’ll sit on the offer, selling off small lots. Traders will see you there, and say, “Goldie’s selling Microsoft. We’d better sell, too.”

What those traders don’t know, is that you gave your big institutional order to the ECN, Instinet (INCA), to buy for you. Your presence on the offer keeps the price low, while INCA nonchalantly sits on the bid, filling your order at a low price.

Now, how do you, as the trader, know that Goldman, Sachs is really buying when he sits on the bid, and not selling through another source? You don’t. That’s why you should have every other factor possible in your favor when you’re scalping or day trading.

When you start to trade Nasdaq stocks using level II, look for a narrow spread, 1/8 to 3/16 point or less, just as you did when trading a NYSE stock. Again, you want to narrow your risk and be able to sell your stock immediately, should the trade go against you.

Caution: with some volatile stocks (at the moment, Internet stocks are a prime example), the spread between the bid and ask fluctuates wildly. One moment it’s 1/8 point, the next it widens to 5/8, or even a point. Please avoid these stocks unless you’re well aware of the acute risks involved. Remember, buying a stock can be a lot easier than selling it!

The next factor you look for is “depth.” If you’re targeting a stock to buy, look for at least three to five market makers and ECNs lined up at the inside bid price. Why?

Say you buy the stock at the offer price. When only one market maker, or ECN sits on the inside bid, if the stock price drops, you and every other trader are hitting that market maker with sell orders to get out. Chances are you won’t get filled. The next price level down is your next selling target. What if that price level suddenly disappears? And the one below that? Uh, oh. . . . Agony City.

If your target stock is safe to enter, and you’re trading on the long side, next, look to see who’s buying. Are major broker/dealers lined up on the bid side? Despite the Goldman, Sachs and INCA story I told you earlier, that’s still what you want to see. So, check the bid for significant market makers who may be buying the stock for an institutional client and will hold up the bid. Below is a sampling of market makers with their representative symbols:

- Bear Sterns BEST

- Cantor Fitzgerald CANT

- Donaldson, Lufkin & Jenrette DLJP

- Gruntal & Co. GRUN

- Goldman Sachs GSCO (lead gorilla)

- Hembrect & Quist HMQT

- Herzog, Heine, Geduld HRZG

- J.P. Morgan Securities JPMS

- Knight/Trimark NITE

- Mayer Schweitzer MASH

- Merrill Lynch MLCO

- Montgomery Securities MONT

- Morgan Stanley MSCO

- Paine Webber PWJC

- Prudential Securities PRUS

- Solomon Smith-Barney SBSH

- Spear, Leeds & Kellogg SLKC

- Lehman Brothers LEHM

Let’s say all systems are go. Market internals are positive. Your target stock shows a small spread and five market makers on the inside bid. At least one of these is a major broker/dealer who has shown interest by remaining on the bid for some time. Your next choice is what vehicle to use to buy the stock. Generally, your choices will be SOES, Selectnet, the ECN assigned to you by he broker/dealer with whom you opened your account, and other ECNs you can access, like ISLD and INCA.

Trading Level II with SOES

The Nasdaq’s proprietary execution system developed for individual traders and investors is called SOES. SOES is the acronym for Small Order Entry System. The Nasdaq implemented SOES after the 1987 stock market crash. During the crash, many market makers avoided their phones. Brokers calling with customer orders (computerized trading wasn’t as widespread then as it is now) couldn’t get through, and the orders went unexecuted.

SOES provides liquidity by allowing the public direct access to the Nasdaq and its market makers. After it’s inception, it mushroomed into a popular vehicle for day traders.

If a market maker places himself on the level II list (your market maker screen), he automatically becomes eligible for executions sent to him on the SOES system from traders like you and I. The automatic executions force him to accept orders at the price he posts. He can refresh the bid/ask and restate his intentions to buy/sell the stock. He may also adjust his quote. At that point, he again becomes eligible for SOES orders.

SOES rules:

- You cannot split the bid and ask with SOES. You must place your orders at the posted inside bid and ask. You can issue them as limit orders, but to be filled, they must be posted at current prices.

- Market makers fill SOES orders. ECNs do not. Therefore, if you want to buy on the offer, and the only takers listed consist of ECNs such as INCA, ARCA, and ISLD, the SOES order you place will automatically cancel.

- Market makers who post at the bid or ask are required by law to buy or sell 100 shares if they list themselves on a level II screen. That doesn’t mean they’ll fill your order. It’s first-come-first-serve. Know this, they usually have more to buy or sell, but usually won’t show their hands. Instead, they stay put and keep “refreshing,” their bid or offer.

Trading with SelectNet SelectNet is also a Nasdaq electronic order taker. Some quick facts about SelectNet:

This system is not required to fill orders. You can issue two types of SelectNet orders, broadcast and preference. Broadcast means all market makers can see your order. Preference means just that–you preference the exact market maker (not ECN) you want to accept your order. Disadvantage: if you cancel an order sent to SelectNet, it takes 10 seconds before it is cancelled. In a fast moving stock, this feels like a lifetime!

Trading with ECNs

The final, and possibly best, way to execute orders on your level II system is by using ECNs. This gives you, the trader, an opportunity to “play” market maker. Some of the major ECNs are:

- Archipelago ARCA

- Bloomberg BTRD

- Instinet Corp. INCA

- Spear, Leeds & Kellogg REDI

- Attain ATTN

- Brass Utility BRUT

- Island ISLD

Say the perfect setup for your target stock presents itself. If the stock moves slowly enough, you can buy on the bid: post a limit buy order with your ECN (or ISLD or INCA if available) for the inside bid price.

Maybe your stock is climbing too fast to get filled on the bid. If there’s enough room in the spread, you can “go high bid.” That means you split the bid and ask by entering a limit buy order 1/16 or 1/8 higher than the current inside bid.

Now you’re the high bidder. Your goal: to entice sellers. If nobody bites after a few seconds, believe it or not, that’s good! It means that the stock is in such high demand, no one’s selling.

(The times you do manage to get filled at high bid, the spread gained translates into more profit to you. Make an extra teeny four times a day, and it equals a quarter of a point. When you’re trading 500-share lots, that equals $125 extra profit.)

If the price starts to skyrocket, you may not get hit as high bidder. To own the stock, you’ll have to cancel your order as high bidder and buy on the posted offer.

Points to remember when using level II to trade Nasdaq stocks:

- Look for liquid stocks with a narrow spread.

- Make sure there are from three to five market makers on the bid if you are going long. (Short sellers want depth on the offer.)

- For optimum safety, you want the market makers on the bid to be “800-pound gorillas,” like GSCO, MLCO, or MASH. (If all the heavyweights are on the offer, you may want to target a different stock to buy.)

- Learn the advantages of each execution vehicle, be it SOES, SelectNet, or an ECN, and develop your skills in placing orders quickly and decisively.

Access to level II screens has leveled the playing field for active traders like you and I. As day traders and scalpers we can compete on a one-to-one basis with major market players and emerge victorious. Good luck and good trading!

Editor’s Note: For more, see Toni’s book, Day Trading Online

Join the discussion