Module 5 – Strength-Following and Contrarian Markets

Introduction

‘I wish I was the fish, he thought, with everything he has against only my will and my intelligence.’

The Old Man and the Sea

My training as a trader began more than thirty years ago. I was lucky enough then to learn from experienced and successful traders who had a deep understanding of the moment to moment struggle waged between buyers and sellers.

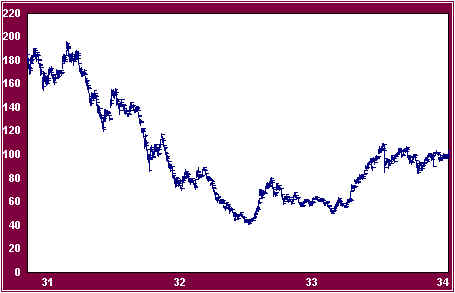

The approach of those teachers was shaped by their experience of the ’29 crash and by the post-crash market of the thirties. The market of the early ’30s was lively in both directions, and anyone who survived and succeeded during this turbulent period necessarily developed a keen appreciation of risk. For that reason, perhaps, the methods stressed by those early trader-teachers was both defensive and contrarian.

Dow Jones Industrials 1931-1933

Contrarian traders focus on detection of change in the trend of stocks and of the overall market, that is, on detection of accumulation and distribution. Contrarian techniques prompt traders to buy sold-out issues very near solid support, usually before upward trends are broadly recognized.

On the other hand, contrarians are ever-alert for signs that a stock or the market has entered a period of distribution. Early detection of strong-handed selling allows them to protect long profits and to prepare for important declines by putting out shorts in advance of markdown.

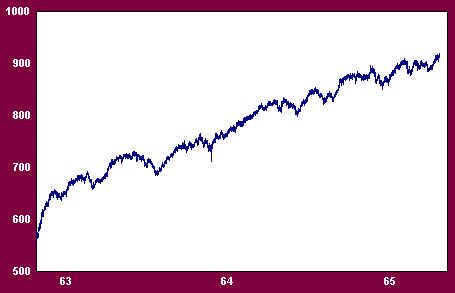

Early in my own career I studied the contrarian methods of my teachers diligently. However, my introduction to trading began during the go-go years of the ’60s. The market at the time was trending upward strongly, and the market’s leading issues were, nearly without exception, well above primary accumulation and showed no signs of distribution.

Dow Jones Industrials 1962 – 1965

The dominant feature of the market then was its continuing trend. But whatever edge I had depended on my ability to spot changes in the trend. I was soon completely befuddled. Stocks which lagged, and which appeared to be under accumulation, continued to languish, while strongly trending stocks rolled right on through preliminary indications of distribution.

A contrarian in a trending market, I was like an electrician who had been called out to fix the plumbing. The skills I had worked so hard to develop seemed irrelevant. I still had much to learn, and the market itself became my teacher.

What I will teach you in this series of lessons is, so far as I know, taught nowhere else. The main ideas are simple but of the highest strategic importance to anyone who wishes to trade successfully in all market environments.

Join the discussion