When you sell shares, the proceeds from the sale are known as your disposal proceeds. Subtracting the original purchase cost of the shares and certain allowable expenses gives you what is generally considered your profit. However, this profit is not the amount that gets taxed directly.

Although once you sell shares you have what are called ‘disposal proceeds’. Subtracting the purchase cost of the shares you end up with what most investors would describe as their profit.

Although many accountants would have you believe otherwise, the basic capital gains tax calculation is pretty straightforward.

Although however, this is not the amount that gets taxed. From your profit you can deduct certain expenses, such as stamp duty and stockbroker’s fees

What is the difference between the Capital Gains Tax (CGT) exemption and the Personal Allowance?

The Capital Gains Tax (CGT) exemption and the Personal Allowance serve different purposes and apply to different types of income or gains:

Capital Gains Tax Exemption

- Purpose: Applies to profits (gains) made from the disposal of assets such as shares, property (other than your primary residence), and other taxable investments.

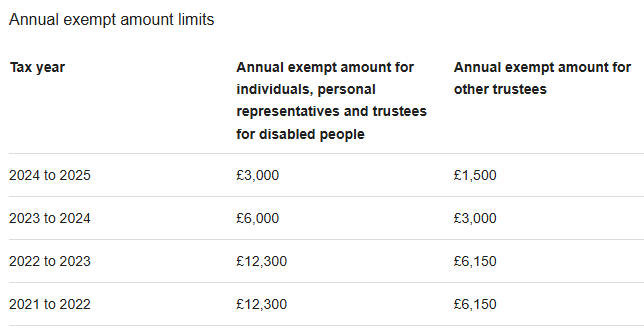

- Annual Limit: For the 2024/25 tax year, the CGT exemption is £3,000. This means you can make up to £3,000 in gains from disposals without paying CGT.

- Specific to Gains: Only reduces your taxable gains and is separate from income tax.

Personal Allowance

- Purpose: Applies to your income from earnings, pensions, rental income, or other taxable sources.

- Annual Limit: For the 2024/25 tax year, the Personal Allowance is £12,570. This is the amount of income you can earn before you start paying income tax.

- Applies to Income: It reduces the taxable portion of your income and does not apply to capital gains.

Basic Capital Gains Tax (CGT) Calculation

While some may find tax calculations daunting, the basic computation for capital gains tax is relatively straightforward:

- Calculate your disposal proceeds from selling the shares.

- Subtract the acquisition cost and allowable expenses (such as stamp duty and brokerage fees).

- Deduct any applicable reliefs or allowances.

- Apply the relevant tax rate to the resulting chargeable gain.

Allowable Deductions

From your profit, you can deduct specific expenses, including:

- Stamp duty

- Stockbroker’s fees

- Other associated transaction costs

Since indexation relief and taper relief were abolished after April 2008, they no longer apply to any shares sold today, regardless of when they were purchased. The resulting figure after these deductions is referred to as the chargeable gain.

Tax-Free Allowance and Rates

As of the 2024/2025 tax year:

- The annual CGT exemption (also known as the annual exempt amount) is £6,000 for individuals.

- Any chargeable gain above this threshold is taxed at:

- 10% for basic rate taxpayers (where total taxable income and gains fall within the basic rate band).

- 20% for higher and additional rate taxpayers.

Example CGT Calculation (2024 Update)

Aaron sells shares for £50,000 in January 2024. He bought them for £23,000 in January 2022. His calculations would be as follows:

| Typical CGT Calculation | ||||

| Proceeds | 50,000 | |||

| Less | ||||

| Acquisition cost | (23,000) | |||

| Deductible expenses | (75) | |||

| Chargeable gain | 26,925 | |||

| Less: | ||||

| Annual exemption | (6,000) | |||

| Taxable gain | 20,925 | |||

What Assets are Subject to CGT?

Although it’s also important to point out that not all assets fall into the capital gains tax net.

Of course, matters aren’t always this simple. Every step of the typical CGT calculation outlined above has a variety of ‘ifs’, ‘buts’ and ‘maybes’…

Avoiding capital gains tax is possible but not for the uninitiated. Venture capital trust profits and spread betting profits are completely tax free, as are capital gains from gilts and most corporate bonds. Hedge fund profits are usually subject to income tax.

The table below lists some of the more popular types of investment, along with their capital gains tax treatment.

| Subject to CGT? | ||||

| UK shares | Yes | |||

| Overseas shares | Yes | |||

| Unit trusts | Yes | |||

| Venture capital trusts | No | |||

| Hedge funds | No (income tax applies) | |||

| Gilts | No | |||

| Corporate bonds | Usually No | |||

| Warrants/options | Yes | |||

| Futures | Yes | |||

| Gold Coins | Yes | |||

| Spread betting | No | |||

Some assets, such as profits from spread betting, venture capital trusts, and gilts, remain tax-free. However, hedge fund profits are typically subject to income tax, not CGT.

Who Pays Capital Gains Tax?

Most UK residents pay CGT when selling shares or other taxable assets. However:

- If HMRC classifies you as a trader, your profits may be subject to income tax rather than CGT.

- To pay UK CGT, you must be a UK resident for tax purposes. Non-residents are typically exempt unless they meet certain conditions (e.g., selling UK property or returning to the UK shortly after disposing of assets).

Share trader status is not easy to acquire (and often not very desirable!) and becoming non resident does not appeal to the vast majority of investors (especially if it’s done for tax reasons only!) so the vast majority of those buying and selling shares will pay capital gains tax on their investment profits.

Acquiring share trader status in the UK is often not desirable for several reasons:

1. Tax Treatment of Profits

- If you are classified as a share trader by HMRC, your profits from share trading are treated as income rather than capital gains.

- This means you will pay Income Tax rates (20%, 40%, or 45% depending on your income band) rather than the lower Capital Gains Tax (CGT) rates (10% or 20%, depending on your income level).

Example:

- A basic rate taxpayer pays 10% CGT on capital gains but would pay 20% Income Tax on trading profits if classified as a trader.

2. Loss of CGT Exemption

- As a trader, you cannot use the CGT annual exemption (currently £3,000 for the 2024/25 tax year) to reduce your taxable profits.

- This means you lose a valuable allowance that would otherwise help lower your tax liability.

3. More Stringent Record-Keeping

- Share traders are required to maintain detailed business accounts and may need to file self-employment or business income forms in addition to standard tax returns.

- This creates more administrative work and additional complexity.

4. National Insurance Contributions (NICs)

- As a share trader, your profits may be subject to Class 2 and Class 4 NICs, further increasing your tax burden.

- Capital gains, by contrast, are not subject to National Insurance.

Final Thoughts

Avoiding CGT is possible within legal allowances, such as utilizing the annual exemption or investing in tax-efficient vehicles like venture capital trusts or ISAs. For most UK investors, careful planning and understanding of allowable deductions can help minimize tax liability, but professional advice may be necessary for complex cases.

[Note: Paper is dated 2007] (430 Kb)

[Note: Paper is dated 2007] (430 Kb)