In today’s fast-paced financial markets, where milliseconds can make or break a trade, automated trading has emerged as a game-changer. Using complex algorithms, automated systems can buy, sell, and manage positions with lightning speed, offering traders the chance to capitalize on opportunities that might be missed in manual trading. But, as with any powerful tool, the promise of easy profits comes with its own set of challenges and risks. Let’s explore the exciting world of automated trading and weigh its pros and cons.

Anyway, my purpose in this article is not to review the plethora of automated trading systems but to look to consider in more general terms whether a trading system can be fully automated. The question that I ask myself in these cases is not “Will it work?” but “Can it fail?”

An Automated Trading Test

As a former computer programmer, it should not be beyond my wit to devise a computer program that back-tests some automated trading rules over historic data in order to demonstrate that a computer program can trade successfully… until it doesn’t. So that’s what I did.

I won’t bore you with the technical details, but I devised a computer program that traded into and out of the FTSE 100 index — historically, not in real time — using the following rules.

- Trail the market down until it reverses (turns up) as far as a predefined trailing stop buy trigger distance.

- Buy into the market at that price using all available funds.

- Trail the market up until it reverses (turns down) as far as a predefined trailing stop sell trigger distance.

- Sell out entirely at that price, and bank the proceeds.

- Repeat from step 1.

This program allowed for only one position to be held at a time, utilising all available funds. A profit at step 4 would result in more available funds to be utilised next time around, and a loss at step 4 would result in less available funds to be utilised next time around. The trailing stop order trigger distances were fixed for each trading run but could be varied between trading runs.

It was a simple automated trading system, but a realistic one.

The Results

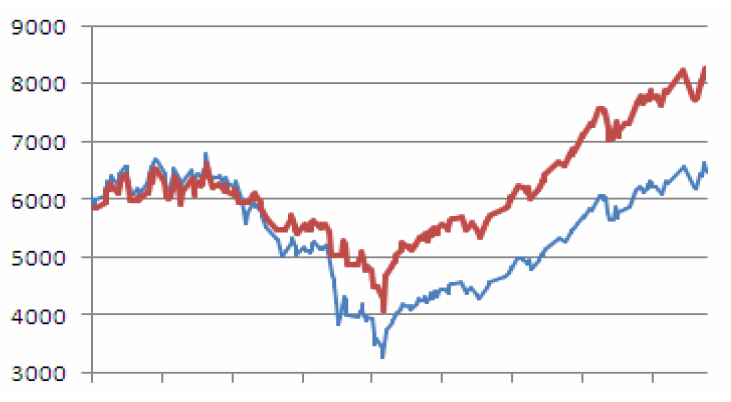

I back-tested the virtual trading system on the FTSE 100 index using a trailing stop buy distance of 1% (the program would buy on a 1% upturn) and a trailing stop sell distance of 10% (the program would sell on a 10% downturn) over the period 4 January 1999 to 28 October 2007. The result was as follows.

The thinner blue line represents the fluctuating index price during the period under test, and the thicker red line represents the trading account fund value. This demonstrates that a fully automated trading system can make money.

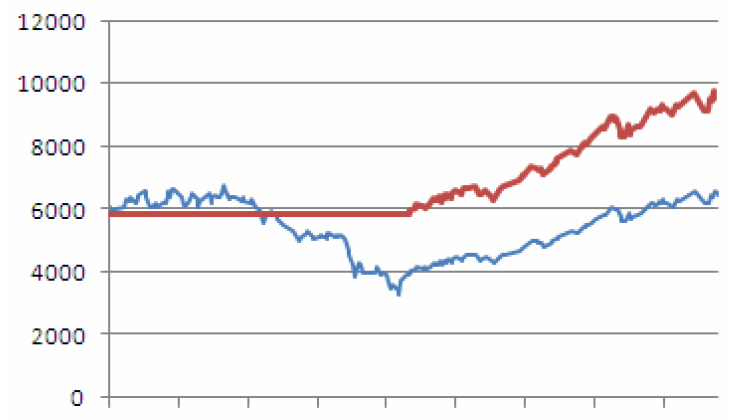

I then set about “optimizing” the system by altering the trailing stop buy distance to 20% while keeping the trailing stop sell distance at 10%, which yielded the following result. Not only is the final fund value notably higher in this case, but the trading account never fell in value because the system did not trade at all until such time as the underlying index rose by 20%.

Not only does this show that a full automated trading system can make money, but also that we can optimise such a system so as to increase profits and reduce volatility. Or can we?

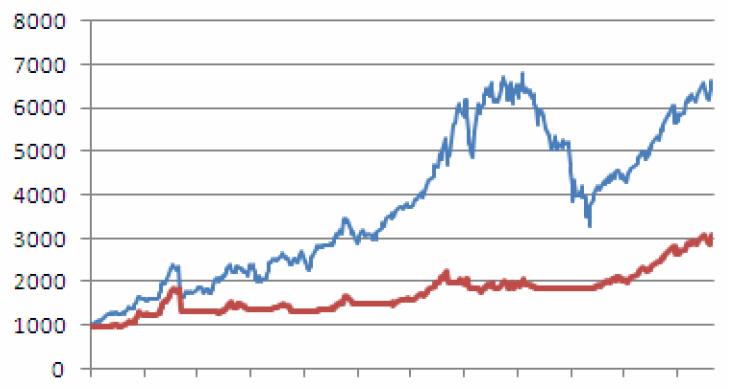

See below what happened when I back-tested exactly the same system with exactly the same parameters over the period from 2 April 1984 to 28 October 2007. In this case my trading system (red line) consistently and significantly under-performed the base index (blue line).

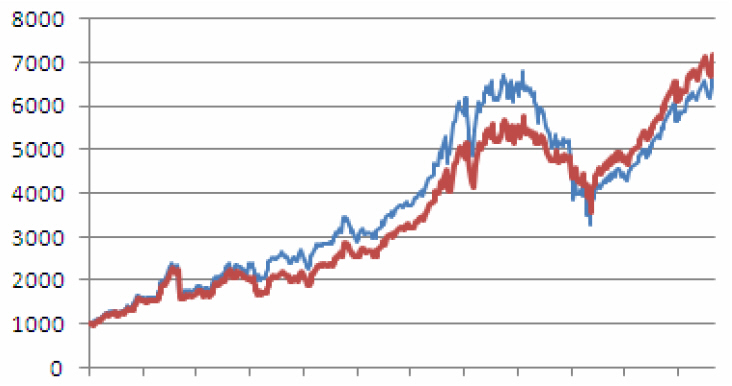

Okay, so the system was not suited to this longer time period, but how could we know this kind of thing in advance when trading real markets in real time? Furthermore, look at what happened when I ran the system over the longer time period but with the original trailing stop buy distance of 1%.

While in this case my full automated trading system under-performed the base index most of the time, it came out on top in the end.

Conclusion

I have shown that a fully automated trading system can sometimes work, and sometimes not. Success or failure can depend crucially on the correct tuning of specific parameters to match the specific market conditions, and this is difficult in retrospect never mind in advance. Rather than proving that a fully automated trading system does work, proving that it can fail is really all I need to do.

Too many traders get excited about the sometimes legitimate and verifiable positive results published by trading systems developers; yet they fail to realise that it takes only one or two adverse examples (usually not published) to disprove the system.

The Upside of Automated Trading

- Speed That Humans Can’t Match

Imagine you’re trading stocks and a market-moving news event hits. In the blink of an eye, the price starts to shift. A human might struggle to respond quickly enough, but an automated trading system can execute trades in milliseconds, taking advantage of those price swings before anyone else. In high-frequency trading (HFT), this kind of speed is essential, and machines are the only ones who can handle the volume and speed of the market. - No More Emotional Rollercoasters

Human traders are prone to emotions—fear during market dips and greed when the market rallies. These emotions can lead to poor decision-making, like selling too soon in a panic or holding on to a losing position for too long in the hope it will bounce back. Automated trading systems, however, operate on logic and rules, completely removing the emotional component. This consistency can help traders stick to their strategies, regardless of market conditions. - Always-On Trading

With automated trading, the market never sleeps. These systems work 24/7, meaning they can capture opportunities even when you’re not watching the markets. Whether it’s trading in the U.S. or capitalizing on opportunities in Asian markets, automated systems can ensure you’re always in the action. Plus, they don’t need sleep, coffee breaks, or vacations. - Backtesting: Learn from the Past to Trade Smarter

One of the most powerful features of automated trading is the ability to backtest strategies. Traders can simulate how their algorithms would have performed in different market conditions using historical data. This helps refine trading strategies, ensuring they work in various market scenarios. It’s like having a virtual trading lab where you can test your ideas without risking real money. - Consistent Execution

Ever made a mistake by entering the wrong trade or missed an opportunity because you were distracted? Automated systems execute trades with precision, following predefined rules to the letter. There’s no room for error, which means you’re more likely to stick to your strategy and achieve your trading goals.

The Dark Side of Automated Trading

- The Pitfalls of Over-Reliance

Algorithms work wonders, but they’re not infallible. If the underlying strategy is flawed or not adjusted to changing market conditions, automated systems can amplify mistakes. For example, a system designed to profit from a certain trend may fail when market dynamics shift unexpectedly. Relying too much on the machine can leave you exposed to significant risks if you’re not paying attention. - Tech Glitches and Outages

Imagine spending hours perfecting your trading strategy only to have your system crash in the middle of an important trade. Technical failures—whether they be software bugs, connectivity issues, or data feed problems—can result in missed trades or incorrect executions. The consequences can be costly, especially in volatile markets where seconds matter. - Lack of Flexibility in Uncertain Times

Algorithms work on predefined rules, which means they can struggle when unexpected events happen. For instance, a geopolitical crisis or an economic shock might cause market swings that an automated system simply isn’t equipped to handle. While humans can quickly adapt to new information and adjust their strategies, automated systems might get stuck in “autopilot” mode, unable to respond effectively. - Whipsawing and Market Volatility

The rapid trading cycles of automated systems can sometimes lead to whipsawing, where prices move in one direction, then quickly reverse. This can trigger a series of automated trades, resulting in cumulative losses. This phenomenon is particularly common in high-frequency trading environments and can add unnecessary volatility to already uncertain markets. - Costs of Development and Maintenance

Building a successful automated trading system isn’t cheap. Whether you’re hiring a developer or purchasing a pre-built solution, the costs can add up quickly. Additionally, ongoing maintenance is required to ensure the system stays up-to-date and functions properly. For traders without deep pockets or technical expertise, the financial and time investments might outweigh the benefits.

The Verdict: Is Automated Trading Right for You?

Automated trading holds immense potential for savvy traders looking to capitalize on speed, consistency, and market opportunities without emotional interference. However, it’s not a “set it and forget it” solution. The key to success lies in understanding the complexities of algorithmic trading, minimizing risks from technical glitches, and constantly fine-tuning strategies to adapt to the market’s ever-changing landscape.

For those who are willing to put in the work, automated trading can be a valuable tool in the trading arsenal. But just like any other investment approach, it requires careful planning, ongoing monitoring, and an understanding of both the rewards and the risks involved. If you’re ready to embrace the future of trading, the machines are waiting—but be sure to stay in control of the wheel.