Introduction to Technical Analysis

MODULE 4: What you will learn!

- You will learn a technique in reading charts that has been around for coming on 100 years, yet is still as valid today as it ever was.

- Learn how to apply this technique to your own trading and your own analysis.

The theory of what you’re about to learn maybe over 100 years old. But in practice you will realise the significance of the findings of just one man, who is forever immortalised in one of the largest Indices in the world.

Dear Trader,

Many moons ago it was only the Japanese that really used technical analysis (candles sticks – more on that in another module), the majority of the west relied mostly on fundamental data; the companies net worth, profit share and so on.

However in the early part of the 1900’s one man discovered that charts do in fact relate to psychology of greed and fear. Many of his writings only appeared in the Wall Street Journal and although praised, not really taken on board until another trader and writer took these articles and formed a theory based up the findings of the man that lent his name to the DJIA – his name was Charles Dow.

In this module you are going to learn what the Dow theory is and how you can apply this relatively painlessly to your own trading. Are you ready, I certainly hope so.

Right then, let’s get things moving and start your training

Technical Analysis is a technique used to spot price movements in charts. What you are going to learn within this module is a combination of Technical Analysis and my own techniques for spotting price movements and managing to trade successfully, regardless of what the market is doing. I would suggest that you do NOT buy any books on Technical Analysis as these will only confuse and bemuse you. I do not exclusively use Technical Analysis and rely heavily on my own techniques that I will detail to you through this section.

Some of you will be familiar some aspects that we cover within the early stages, which is great, as this will further instill your understanding. I will be covering various techniques, which will allow you to trade in short time frames during a day (intraday) to a more conservative trading strategy lasting days and weeks.

We will be covering; charts, trends, bounces, scalping, candlestick trading and much more.

When I first started writing this course, I covered the techniques that I was using at the time; this was quite a few years back. Since then I have developed additional techniques that have enabled me to trade with a good degree of accuracy and dare I say, relatively stress free. However, you will need to get a good grip of the main aspect of your training that covers the main technique I use for spotting potentially profitable trades. From covering this first area, and making sure you have a clear understanding of how to apply this initial technique – we will then move onto the more advanced techniques.

I think it’s foolish to believe that there is a single system or technique that can be applied and be expected to make consistent profits. The reason being is that the markets are not consistent in their nature. If they were then trading would be very easy indeed and there would be a million traders talking of double bottoms in the nearest pub. It is therefore prudent for any trader, new and old alike to have an armory of techniques that can be used, regardless of what the market is doing. This training course provides you with just that and more; first the knowledge of the markets and specifically the product that we trade. Next the fundamental tools and techniques, with further tools and techniques to capitalise on virtually any market condition.

For those of you that are less experienced, or entirely new to trading. Don’t panic, what at first may seem very complex, is in fact relatively straight forward. It’s like learning anything new for the first time. It becomes hard work, but the more we apply the techniques, which you will be doing later in the course, the easier and more proficient and skilled a trader you will become.

Before we begin, it is important that you understand the workings of Financial Spread Betting. Therefore, please make sure that you fully understand the majority of trading this way. Especially trading Long and Short on US and UK shares – as this is where we will be making the majority of our trades.

If there is any aspect that is unclear to you, either now or further within the courseware then first re-read the courseware to make sure that you haven’t missed anything, secondly, wait till you get to your courseware module assessment and if none of these help, get in touch with me using the support tool as soon as possible. Remember I am here to help you, but I can only help you if you ask for it.

Trends

What are trends? Trends are long term indicators within a chart that show, over a period of time, that the price movement of that chart is either primarily going up, or down. Spotting these trends isn’t difficult and to be honest is pretty obvious. If over the past 5 years the overall outlook on a chart is downward then not so surprisingly the trend is down and likewise if this going up.

The good thing for us is that it doesn’t matter which way the trends are forming. As we can make money from price movements going up or down. That is possibly one of the best reasons to trade in Financial Spread Betting, but amazingly many still only decide to trade when the market trend is going up.

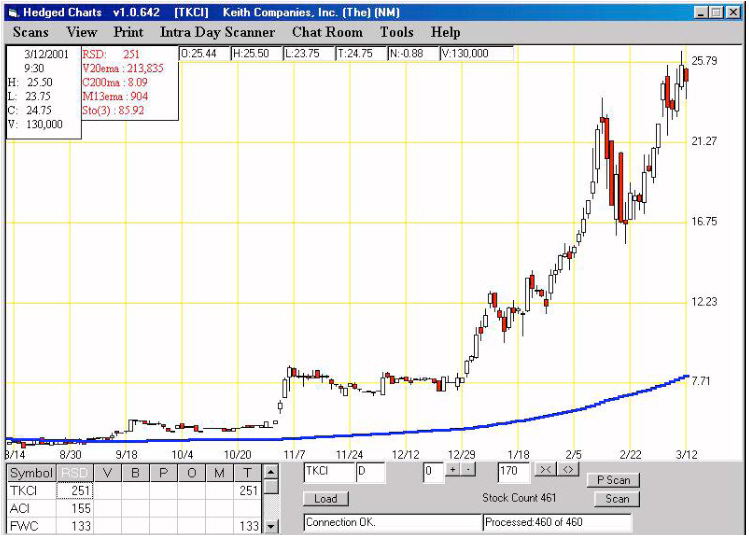

Why do we look for the overall trend in a chart? The overall outlook of a chart tells us that the general trend is either up/down or sometimes even sideways (consolidation). That doesn’t initially mean that we look to trade either up or down, there are many other tools and techniques that the chart has to pass before we even decide to look to trade. What this does allow is the ability to view many charts very quickly. There are many charts, thousands in fact. You can set up any online services or software programs that allow you to view those, which are rising or falling. But you are best using your eyes to scan through those, which you have narrowed down. All the charts that I look at are initially scanned by eye very quickly.

Now I realise that you may at first be thinking, ‘how on earth can I scan thousands of stocks? Well, I don’t. I only scan perhaps several hundred based within each Index. Ideally you want to concentrate on looking at those charts that are common throughout the majority of the spread betting broker sites, and the surest bet (excuse the pun) is to stay within the bounds of the common indices – FTSE100, FTSE250, NASDAQ, DJIA30, S&P100, S&P500. There are just over 1000 charts in total within these combined indices. The key though is to start scanning the FTSE100, wet your feet there. Then move onto the FTSE250, eventually you will find that you won’t be scanning all the stocks within the indices – god forbid! You will find though that you will concentrate on two indices. For example, I tend to focus on the FTSE250 and the S&P500. These take me about an hour a day to quickly scan and create short lists as follows.

To make your selection process as simple and as speedy as possible, you need to either use a good quality online service – for example ShareScope, complete with its own charting application and portfolio manager. Here’s what you need to do. In your portfolio section create three folders -:

We need to set up three folders as follows:

Folder 1 called: 1st Stage Selection

Folder 2 called: 2nd Stage Selection

Folder 3 called: Trading

Here is what each folder is for:

- 1st Stage Selection

This is where you place the chart or Epic codes (Epic codes are short names usually consisting of initials of the company, that the exchange uses to refer directly to that company – for example, Microsoft is MSFT), of each stock that you have quickly glanced through. See this as a pre-analysis. It’s your first view of the stock, based initially on the trend and the other indicators that we use. It’s your quick short list of stocks to analyse in greater detail later.

- 2nd Stage Selection

After you have gone through the index of your choice (for example FTSE100), you then start to look at those stocks in your 1st Stage Folder in greater detail. This is where we take a good hard look at the stocks that we wish to move onto in our final trading folder. It’s where we make decisions. We look closer at the trend, the indicators and which technique or combination of techniques will be best suited to that chart. By using the techniques, which we are going to cover shortly, you will then be empowered to make an informed decision to move that stock to the ultimate rank of ‘Trading’.

Trading

This folder is used for those stocks that we are trading, Long or Short.

Using the above three-folder technique for managing your trading activity, will save you an awful lot of time. You can easily refer back to any folder over your trading week, as some stocks may have not initially met certain criteria to move onto the next folder, but by referring back to each folder, you can check which ones are meeting that criteria and move them onto the next folder as and when.

Eventually you will reach a stage where you will have a list of quality stocks that you can refer back to and analyse. Of course, you must be mercenary and remove a stock from any section if it’s not performing as expected. Additionally, you must update all sections by completing regular weekly scans of your chosen index to update with potential new charts to add to your 1st Stage Selection and so on.

How long in terms of years, months etc. should we be looking. For the overall view of a chart I look at just the past 3-6 months initially. This gives me enough information to get a general medium term view as to that chart’s position, Long or Short. Sometimes there are charts that seem to trade one way then the next, they seem not to be able to make their minds up, if we spot these, as these can be profitable also we place them in our 1st Stage Selection folder and move from there.

Most charting services and software programs allow you to save collections of charts based on criteria or save them to folders, sections or portfolios. There is an exhaustive list of services both within the resources section and within the links directory. Don’t feel as though you have to splash out on some ‘state of the art’ service or software.

There are many free services that you can initially use, even if you have to make a note of the *Ticker Symbol/Epic Codes first. I want you now to go to a charting service: This can be our own charting application service within Trade Focus or one of the Internet such as www.marketwatch.com (for US and other countries) and www.advfn.com (for UK/Europe) and within each website there should be a list of current movers & shakers. Now you have to remember that we are interested in shares that are going down as well as up and the majority of the online services tend to concentrate on growing shares. Take a look at each of the charts they show and make an overall assumption as to its yearly trend and either make a note of the stock/index etc. or create an account (usually free) to save within the above named folders.

If you don’t want to bother with using online services, you can download free charting demos from www.download.com, just search for ‘Financial Charting Software’. Remember at present we are just training, so it doesn’t really matter that the data we are looking at isn’t that up to date, but most online services are up dated daily if not every 15 minutes. The free software downloads tend to be out of date to a degree. Either way it doesn’t matter as all I want you to get used to is looking at charts and spotting this initial trend. From there I want you to place each within the folders outlined.

Our next step will be talking about spotting the types of trend that we find and what they mean.

From the last page you should by now have a range of charts. It is these charts that I want you to begin working with, so you become familiar with the charts themselves, the tools we use and maybe even the companies that the chart represents.

As I said previously, we look for an initial trend over a 3 to 6 month period, we then place that chart within one of the above folders, or make a note of the ticker. It doesn’t matter if you don’t have many charts saved or details available. Just a couple of each is adequate – Long (Trading Upwards) and Short (Trading Downwards) and if you can find one, a chart that is neither trading up or down but looks like it is Zig Zagging (up/down) a great deal.

So we now have a collection of charts that we have scanned by eye for an initial take on the general, overall trend of that chart. Now I want to explain a theory to you, don’t panic or get too concerned. I believe that it is only fair that I explain to you some of the theories that I have read, as these do have a degree of influence on what I look for in charts and how I look for profitable price movements. Again note that this is just a small part, an influence, not something I live and die by.

Join the discussion