Trading Trail #10: A Standalone Stop and a Stop Order to Buy

Nov 11, 2011 at 5:20 pm in Trading Diary by

Before I move onto today’s main features — A Standalone Stop and a Stop Order To Buy– I’ll tell you about the rest of today’s trading.

When I told you that I had ‘averaged down’ Technicolor yesterday, I forgot to tell you that the price had nudged up so that I could trail the stop order on my second £1-per-point position to break-even at 1.23p thereby reducing my risk. That second position stopped out this morning, nothing lost and nothing gained, and my original position was still in play with a lower stop level that I was later able to trail up to break-even at 129p. Just before close-of-play today a spike-down from 145p to 129p took me out, so nothing gained but it could have been worse.

I trailed my stop order on Fiberweb to slightly better than break-even at 42.5p today.

I trailed the guaranteed stop order on my Homeserve position up to 243p thereby guaranteeing a profit of £31.60 (minus the costs of the guarantee and the running financing charges).

And now for today’s mean feature(s)…

A Standalone Stop

You know that yesterday I wasn’t happy about the distance to my guaranteed stop order on Admiral. Consequently I created an entirely separate order to sell Admiral at a closer 807p, on the basis that this order would be hit first (thereby closing my position) until I could trail my guaranteed stop order closer. Actually, I had such a standalone sell order in play yesterday, slightly closer, but removed it overnight so as not to have been sold out unfavourably on a morning gap-down this morning. To cut a long story short: the closer sell order executed just after midday, thus taking me out of position at a cost of £21 and thereby banishing Admiral temporarily to my Stop-Out List.

But this is not the end of the story for Admiral.

A Stop Order to Buy

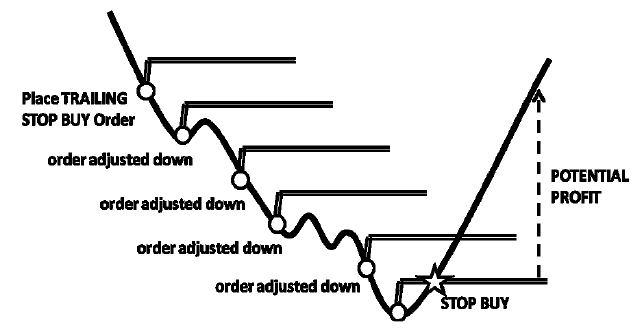

When I noticed that the price had fallen below my last stop-out price of 807p later in the day, I didn’t buy back in immediately as sub-800p. I created a ‘stop order to buy’ at 803p — still lower than my last stop-out price, but with no commitment on my part until the price trend turned upwards. My idea was to trail this ‘stop order to buy’ downwards if the price kept falling, as per the stylistic example shown below (sorry about the quality).

(Figure taken with permission from the book ‘Financial Trading Patterns’ by Tony Loton)

Well, it didn’t keep falling so I “stopped-in” at 803p. I guaranteed a new protective stop order as close as I could at 761p (at a cost of £4.02) because I really can’t afford a massive adverse gap-down, and once again I placed a standalone sell order at a closer 792p.

Tony Loton is a private trader, and author of the book “Stop Orders” published by Harriman House.