Continuation Patterns

Although at first sight continuation patterns may appear to be unnecessary and not useful for trading, they can provide you with a clue about whether to stay in the market or to take your profit. Candlestick patterns are used much more for reversals, but continuation patterns have their place.

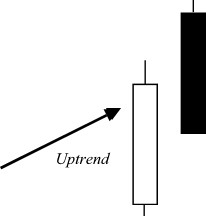

This is an example of the Bullish Thrusting continuation pattern –

As you can see, this looks similar to the Dark Cloud Cover which is a reversal pattern. So what makes this a continuation pattern? The points to look for are that the gap from the close of the first day to the opening of the second, that is the jump from the top of the white body to the top of the black body, is large; and that the close of the second day, while well into the white body, does not go down below half way, as is the case with the Dark Cloud Cover. You can find a similar Bearish Thrusting candlestick pattern in a downtrend.

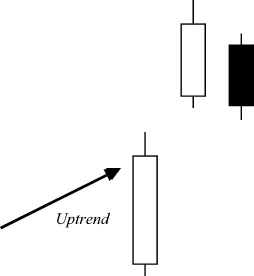

A three-day continuation pattern is the Upside Tasuki Gap –

Here there is a gap between the first two bullish white candlesticks, which in itself suggests strength. However, on the third day the opening price is within the body of the second day and the closing price is down into the gap, though not closing it. The interpretation is that, despite the strength of the gap the market needed a little breather in the uptrend. Because the gap is not closed, the trend should continue on the next day.

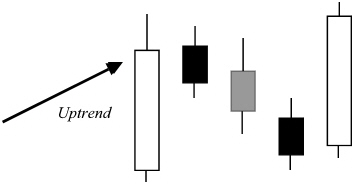

Here is the Rising Three Method –

In an uptrend, the first candlestick is a long white day. The next three days have small bodies, and may be either color, but the pattern is stronger with black candles. The important point is that they do not go outside the entire range including shadows of the first day. The fifth candle resumes the trend and concludes the pattern, opening above the previous close, and closing higher than the first day. This pattern is interpreted as the market taking a rest, perhaps because some traders feel the trend cannot continue. The fact that the middle candles only have short bodies, and do not push below the first day then inspires the bulls to take up the trend again. There is a similar Falling Three Method which occurs in downtrends.

There are a number of other continuation patterns, although not as many as the number of reversals. If you’re interested in them, there are many good books on the market.

Join the discussion