Mechanical Trading Systems

A mechanical trading system that can consistently beat the market – this is the Holy Grail for some traders. The idea of automatic profits is obviously attractive, but is it possible? In short, it is, but its not easy to do.

A systems or mechanical spread trader is one who utilised a trading system or a set of rules on when to enter and exit a trade. This trader would have everything worked out in a system before putting in a spread trade. A system will include rules about: how much to allocate per trade, when to enter trade, when to exit a trade and how much to risk on each trade.

Blackbox Trading Systems

What Is A Mechanical Trading System?

Simply put, it is a technique that makes trading decisions for you! You input the trading data, and your system generates a response that indicates the appropriate action. You buy, sell, or do nothing depending upon the formulas that your system uses. And youre left with no decision to make, except how to spend your profits of course! But we’re a long way away from that stage yet.

How Do They Work?

Mechanical systems are reactive by design. They assume that if a market acted in a certain way before, it will continue to act that way in the future. Now this wont always be the case, but the aim is to find a pattern that repeats itself frequently enough in the future that your system will profitable overall.

How To Create A Mechanical Trading System

Your own system can be as basic or advanced as you like. Crucially you can adapt it your own situation and needs. The process of developing one should follow these general steps:

Step 1: Select timeframe

Step 2: Define entry rules

Step 3: Define exit rules

Step 4: Backtesting

Step 1: Select timeframe

First choose the price timeframe for your system. The seven major timeframes for traders are 1min, 5min, 10min, 15min, 30min, 60min and daily. I recommend that you choose only one of these timeframes instead of trying to work your system though all of them.

As a general rule, the shorter the timeframe, the lower the average profit per trade, the lower the risk and the greater the number of trades. It’s up to you to decide which timeframe suits you the best. For example, a day-trading pro may trade off a 5min system but someone who can only make it to the trading screen once a day may prefer a daily system.

Step 2: Define entry rules

There are literally millions of different entry rules that you could concoct. But they all fall into two broad groups: trend following rules and reversal rules.

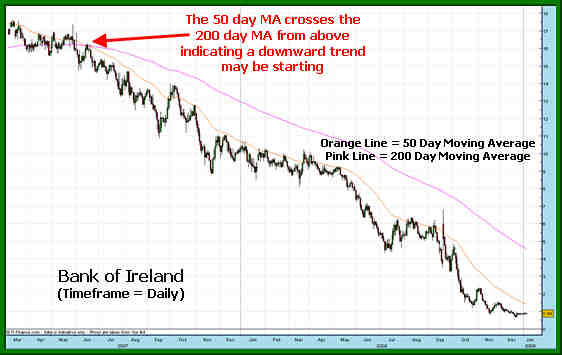

Trend following systems try to capitalise upon an established trend in a market, and might be based on indicators like Moving Averages (MA) and Directional Movement. An example rule could be to go long when the 50 period MA crosses the 200 period MA from below and go short when the 50 period MA crosses the 200 period MA from above. The logic here is that a potential trend is starting if the fast moving MA crosses the slow moving MA from below.

Reversal systems, on the other hand, try to identify a change in the direction of a market and capitalise upon this. Oscillators such as RSI and Stochastics are often used here. A simple rule could be to go long when the RSI hits 25 and go short when the RSI hits 75. The thinking behind this is that if the RSI hit such an extreme level, then it would be oversold/overbought and prime for a reversal.

Compared to trend following systems, reversal systems tend to have a shorter trade duration and more of them. Reversal systems tend to be more suited to people who are more active in the market.

To find potential entry rules that are suited to you, you could test out the many indicators that are on any of the spread betting providers’ charts

Step 3: Define exit rules

Now that youre in a trade, you need to define rules to get back out of it. There are two general rules that you need – a stop loss order rule to protect your capital and a limit profit order rule to realise profits.

Five basic methods for setting exit rules are:

- Fixed euro amount (e.g. €2,000),

- Percentage of capital (e.g. 5% of funds),

- Percentage of the current price (e.g. 1% of the entry price),

- Percentage of volatility (e.g. 100% of the average daily movement),

- Time (e.g. exit after 3 days).

Getting into more detail, you could combine these methods. Maybe set a stop loss order at 3% of capital, a limit profit order at 3% of the entry price and a time rule to close the trade after two days if neither of the orders have been hit.

Step 4: Backtesting

Now that the rules of the mechanical trading system have been clearly defined, you should backtest it over historical data to see if it is any good. The results obtained from backtesting will provide an indication of the system’s profitability over time.

A starting place to backtest is the Capital Spreads charts. Manually look through different charts on your chosen timeframe and have a look for places where your entry rules are hit. Then follow that trade until one of your exit rules is hit. Jot down your profit/loss and start looking for another time your entry rule was hit. After a while of doing this, you should have a good indication of whether your system will be profitable or not. If you want to develop more complicated rules and automate your testing, you may want to get some backtesting software e.g. AmiBroker.

You can also slightly tweak your rules in the backtesting stage to improve them. For example this could mean changing your stop loss order to 4% of capital instead of 3%. But don’t get lured into trying to “curve-fit” your system!

Increasingly, and particularly in the Forex field, we are seeing a lot more ‘black box’ systems that purportedly generate reliable buy and sell signals, or even trade for you. They can be programmed to follow sound principles, and may even have good results for a time, but they are no substitute for sound judgment and thinking. Technical analysis is the art of interpreting a number of different and reliable scientifically derived indicators, and mechanical systems are scientifically derived indicators. There has never been a perfect mechanical trading system and there never will be.

Mechanical systems can be useful in two ways. The first way of using them is to take the results from the mechanical trading system and use them as just one more indicator in the decision-making process. In this way, they are a filter for the other factors.

Secondly, you can tell a mechanical trading system to take action on every signal, and with a well-thought-out system this may generate profits over time. There will be winning and losing trades, but if you choose to censor these you introduce the risk of emotional decisions, and lose the benefits of the mechanical approach. The strength of a mechanical system is to remove emotion from trading.

As mechanical systems are based on historical data, they will not necessarily perform acceptably in the future, as market conditions can change. It’s generally not worth fine-tuning the system for a perfect fit to past events, and you shouldn’t invent special rules to accommodate history. A system based around good general principles should give a reasonable performance. You can use your software to design and backtest the system to give reliable consistent results.

Advantages of Mechanical Systems

The chief advantage of a mechanical system is that it removes emotion by automatically giving the signal. For example, there may be bad news, but if it is already factored into the price the mechanical system will ignore it whereas a novice trader may take a short position, expecting a price drop.

Benefits Of A Mechanical Trading System:

- They are simple to use. No need for complicated interpretation or judgment – it’s all done for you.

- Many traders don’t have that much time to monitor and digest all the information out there. A pure ‘mechanical system’ approach removes the need to do that.

- Emotions hinder the performance of most traders, including me and (probably) you. No trader has been able to conquer the market without first controlling their emotions. A mechanical system takes most of the emotions away.

- They allow you to trade with more conviction. If you have backtested your system comprehensively, you can be confident that your trading will be profitable and sustainable in the long run. So fewer sleepless nights worrying about a position left open.

Many traders lose money in the markets because they lack discipline. A mechanical system makes it easier to apply discipline, as all you need is a commitment to follow the system. Sometimes an indicated move is counter intuitive, but the mechanical system looks at what is actually there, not what we believe should be there.

Using a well-defined mechanical system will usually achieve more consistency than a system where the trader makes buying and selling decisions. The consistency is achieved by cutting losses without hesitation as well as by being on the right side of trades, and cutting losses is one of the problem areas for many traders.

Mechanical systems are usually designed to trade with the trend, which is the lower risk method of trading, and they will always let profits run in the event there is a strong trend, and not be tempted to take profits early. A mechanical trader would normally have the trading system backtested using historical data to test the profitability of the rules.

Disadvantages of Mechanical Systems

No system works all the time, and if the market is not showing a trend the mechanical system is likely to produce mediocre results. As markets may trend less than half the time, this is a serious disadvantage.

The best mechanical systems are trend following, and they rely on major trends in the market to make them profitable. If the system cannot recognize the lack of a trend, which most cannot, then money will be wasted by the system trying to trade while the market is moving sideways.

Why Not Just Buy A Profitable System?

At this stage, you may be thinking about just buying a profitable one on the internet. Caveat emptor! There are lots of systems for sale on the internet that claim to be wildly profitable. Buying one is an option, but it’s not one that I recommend – at least not before extensive research into the system’s rules and logic.

You see, most mechanical systems on the internet have been subjected to ‘curve fitting’. Curve fitting is the tweaking and fitting of data to give systems seemingly extraordinary profits. One trader describes it as shooting holes in a barn door, and then drawing circles around every hole to make each shot a bull’s eye! Needless to say, going forward, these systems are unlikely to repeat their previous extraordinary performance.

For a look at thousands of legitimate internet mechanical systems check out Collective2. But beware, they can be expensive.

Summary

Mechanical systems are great when it comes to eliminating emotion, which is the downfall of so many traders. They should not be relied upon to trade your account without your intervention, but to take advantage of them you should not intervene on the basis of emotion, but only for rational reasons. It’s an interesting exercise to learn to write expert advisors in your software.

However, I think that the real key to sustainable profits through systems trading is to learn computerised research to build your own customised robust system. There’s a lot of initial homework and education that goes into finding a system that works. But the potential profits and satisfaction at the end is quite a motivator. Mechanical trading suits some people very well, especially those who don’t have time to read all the information and / or feel like they get overloaded. But they may be no good for someone who loves exercising discretion and putting his wits against the market.

Even if you don’t use mechanical trading, there are some aspects that you can take away, like defining you entry and exit points and giving yourself a set time to be proved right.

At the end of each module there is a quiz. You can take a quiz at any point, but we suggest you view each module before taking the quiz. When you’re ready to start the quiz, click the take quiz ‘Start’ button below -:

The Masters Certificate in Technical Analysis - Module 11

Congratulations - you have completed The Masters Certificate in Technical Analysis - Module 11.

You scored %%SCORE%% out of %%TOTAL%%.

Your performance has been rated as %%RATING%%

Join the discussion