Corrections: Triangles

Triangles are the final type of corrective pattern you’ll see. They signify a relative balance between buyers and sellers. You’ll usually find that the triangle forms with lessening volume. They often occur in the fourth wave of the five wave move, just before the final push of the fifth wave, and can also occur as the B correction in an ABC correction. If you see them in an uptrend, then keep in mind that they are a temporary bullish indication, before the final wave, but a longer-term bearish signal because of the impending reversal. Here are the types of triangle corrections that you should look for, and because of their intricacy I have illustrated both bullish and bearish corrections.

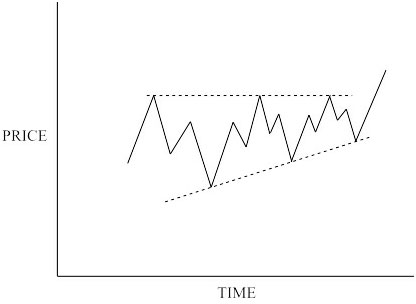

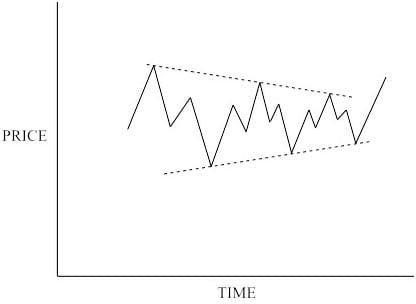

This is a bull market ascending triangle, which has a flat top and the bottom rising.

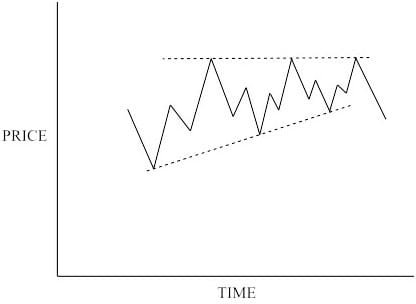

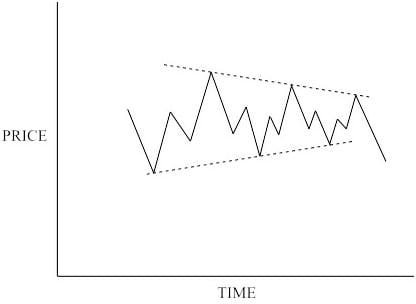

The bear market ascending triangle correction is shown below.

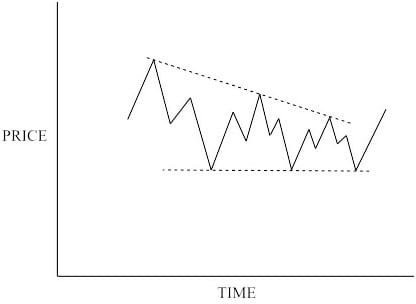

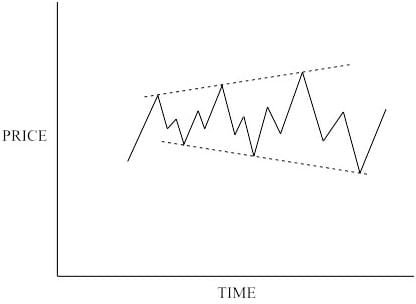

Again in a bull market, this is called the descending triangle as it has the top line going down, and the base line horizontal.

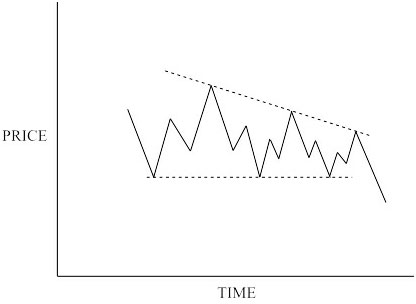

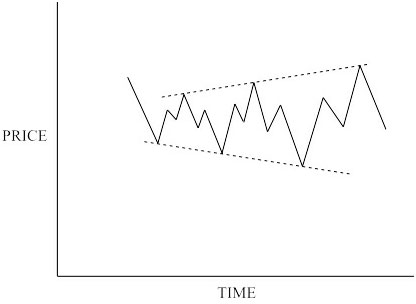

The bear version of the descending triangle is shown below.

This is the bull market symmetrical triangle, with the top line going down, and the bottom line rising.

As you may expect, there is a bear market equivalent of the symmetrical triangle, shown below.

Finally, you can also see a reverse symmetrical triangle, with the top line rising and the bottom line declining. Above is the bull market version, the bear market one is shown below

Now this isn’t the first time that you have seen this sort of pattern. If you remember in module 4 we introduced the ascending, descending, and symmetrical triangles, and the broadening formation. These were introduced as continuation patterns, which is precisely the interpretation which Elliott’s work puts on them. The only difference is that I show more wave detail on these. You may also remember something else — the base of the triangle was said to be a measure of how high the breakout from the triangle was going to be. Elliott agreed with this, and Prechter went further and said that the triangle can give an indication of timing. The apex of the triangle, where the two lines meet in the future, often gives the timing for completion of the fifth impulsive wave.

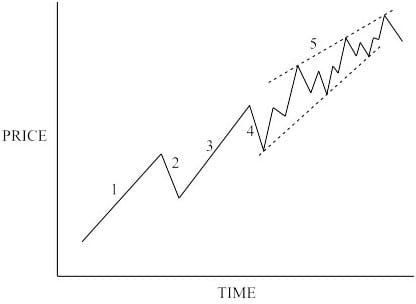

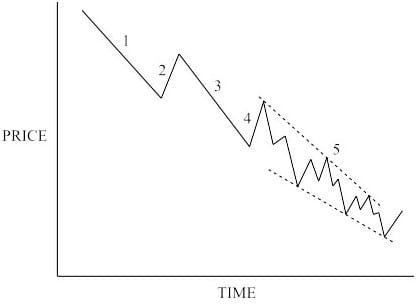

These eight triangle patterns are the classical ones, but an additional type has been defined, and that is the diagonal triangle, which can also appear during an impulsive move. They most frequently happen in wave 5 of an uptrend or downtrend, and this is how they appear.

These diagonal triangles are also known as wedges. Often when they appear in an uptrend they will be followed by a retracement to about the base of the wedge. Similarly, in a downtrend the price may retrace the entire height of the wedge as a correction, before prices continue downwards

Join the discussion