The first and most important question to ask when getting started with financial spread betting is, “Do I really want to?”. The wealth warnings the spread companies display prominently on their promotional material and websites are more than just a grudging compliance with financial regulations.

Do I Really Want to Do This?

- Spread betting isn’t for everyone. The risks are substantial, and losses can be unlimited if you’re unprepared.

- Reality Check:

- Have you read the wealth warnings displayed by spread betting companies?

- Are you comfortable with the possibility of losing your capital?

- Do you understand the risks and rewards?

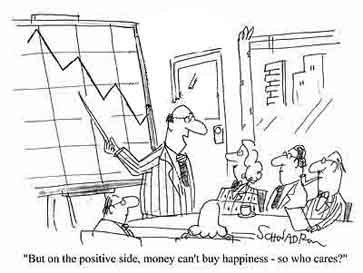

There are considerable risks associated with spread betting and the unwary and unprepared can, even in the more benign market conditions that have been seen of late, soon find themselves exposed to unlimited and substantial losses. The rewards may be high, but so too are the risks.

The spread companies have no interest in luring unsuspecting clients into their lair. They are well aware that their image will be tarnished by tales of personal financial woe and customers who cannot afford to pay their debts are bad for business. That is why they are more than happy to help potential clients to understand exactly what it is they are letting themselves in for when they open an account.

Once you have convinced yourself that you wish to start spreadbetting, and have set aside a capital sum you are prepared to lose, the next step is to understand how margin works…

Margin can be a very good thing and margin is one of the fundamential reasons why cfd trading and spread betting exist. The margin rates set up for the individual spread betting markets depend on the volatility and liquidity of the underlying instrument of the trade. However, if you decide to deposit only the initial margin down, which is required for the trade, then even a small movement of the price in the underlying in the wrong direction will mean that you may have to pay additional funds as the position goes against you and this is what puts off most investors – the thought of being asked to deposit more funds because they have only deposited the minimum to open the trade. But it shouldn’t be this way – if you treat your positions like shares and don’t over-leverage yourself, then spread betting can be very much similar to shares trading.

The Key to Spread Betting: Margin

- What is margin?

- Margin is the amount required to open a position. It’s central to how spread betting works.

- Why does margin matter?

- Margin rates depend on the market’s volatility and liquidity.

- Important Tip: Avoid over-leveraging! Treat your positions like shares to minimize risk.

- What happens if the market moves against me?

- A small adverse price movement may trigger a margin call, requiring you to deposit more funds.

Ask Yourself:

- How much capital can I afford to lose?

- Am I willing to deposit more funds if required, or should I start with a safer approach?

Next, you need to open an account and with which firm or firms. The choice is wider than ever. There are now more than 15 firms specialising in financial spreads and one more has just been launched. Competition is increasing, which can only be good for customers. The range of products and services is expanding and spreads are tightening as the firms pursue a relatively small client base.

It is easy to say that all the firms are the same. They are not. It is important to establish what kind of trading pattern you wish to undertake.

Choosing the Right Spread Betting Firm

With over 15 firms in the market, competition has made spread betting more accessible and user-friendly. But choosing the right firm requires careful consideration.

Questions to Evaluate Spread Betting Firms:

- Trading Style:

- How often will I trade?

- Will I trade online or via phone?

- Product Offering:

- What financial products interest me (e.g., forex, stocks, commodities)?

- Which firms offer the best spreads and lowest fees for these products?

- Customer Support:

- How responsive is their support team?

- What hours are they available?

- Account Terms:

- Are there hidden fees or costs I should know about?

- What are the minimum stake requirements?

- Reputation and Transparency:

- Does the firm provide clear information about risks and trading conditions?

- How do other traders rate their experience with the firm?

How often will you trade? How will you trade – on the phone or over the internet? What kind of financial products interest you? What type of account will suit you? Who offers the keenest spreads on the products which appeal to you? Are there any hidden costs? What is the maximum stake you wish to place and how does this square with the minimum stakes imposed by many of the firms? What level of customer support is on offer? What are the trading hours? What are the settlement arrangements? These are important questions that will help you make up your mind on which firm to choose.

All the firms have their own websites and these provide an easy starting point to allow you to get a feel for the character and service and product levels each offers.

However, the best way is to phone the firms that interest you most and speak directly to their staff. Although many encourage trading over the internet, direct contact by phone is still favoured by many traders. How each one handles your inquiries will give a flavour of the kind of relationship you are likely to develop in the future.

Most firms offer two basic types of account. Although specific details will vary, you can either trade through a deposit or a credit account. The deposit account in its simplest form requires you to lodge funds with the firm which allows you to trade as long as any losses do not exceed the amount of your deposit.

Before opening a deposit account, it is important to check with each firm the exact terms and conditions that will govern your trading.

Credit accounts tend to allow you to take more aggressive positions and, as a consequence, require you to provide more detailed information about your personal finances. The spread firms are no different from any other lending institution in this respect and will carry out the usual checks. You will need proof of identity and also have to demonstrate that you have liquid assets to meet your liabilities.

With more clients opening multiple accounts, some of the firms have recently increased their credit criteria and many will now ask you to demonstrate liquid assets equivalent to five times your credit limit.

The ability to meet those liabilities, and the margin calls that you will incur when the markets have moved against you, is important. Spread firms understandably adopt tough credit policies, and if you cannot meet a margin call, your position will be closed down.

Whether or not you need to open more than one account depends on your trading ambitions. All the firms offer the basic product range, but for the more esoteric products you may need to use more than one firm.

Having more than one account also allows you to take advantage of the arbitrage opportunities that sometimes occur when the selling spread limit offered by one firm is higher than the buying spread limit offered by another.

When your account is set up and it is time to place your first bet, there is one golden rule to bear in mind. Do not make that trade until you have mentally calculated the absolute risk you are running.

Placing Your First Trade

Before making your first trade, follow this golden rule:

Calculate the absolute risk you’re taking before placing the bet.

Tips for New Traders:

- Use stop-loss orders to cap potential losses.

- Start small and gradually scale up as you gain confidence.

- Familiarize yourself with trading jargon; ask your dealer for clarification if needed.

Questions to Ask Yourself:

- What’s the maximum loss I can afford on this trade?

- Am I mentally prepared for the risks involved?

- Have I set up safeguards like stop-loss orders?

When you have calculated that and are comfortable with it, you can begin. The dealers will help with the jargon and explain “stop losses” for you.

Final Takeaways

Financial spread betting offers exciting opportunities but comes with significant risks. Success depends on preparation, discipline, and asking the right questions:

Checklist Before Starting:

- Have I assessed my risk tolerance and set aside capital I’m prepared to lose?

- Do I understand margin and how it works?

- Have I researched and chosen a reputable firm that meets my trading needs?

- Am I clear on the terms of my account (deposit or credit)?

- Do I have a risk management strategy, including stop-loss orders?

By answering these questions and following a structured approach, you’ll be better equipped to navigate the dynamic world of spread betting with confidence.