The investment world is no stranger to trends and fads that rise to prominence with promises of untold wealth, only to fade into obscurity. For some, these fads represent cautionary tales; for others, they’re a nostalgic reminder of speculative excitement. Let’s take a look at some of the most prominent investment fads of past decades and explore where they stand today.

Investment Fads of Years Gone By: Where Are They Now?

1. Tulip Mania (1630s)

Often considered the first recorded speculative bubble, Tulip Mania saw Dutch investors go wild over tulip bulbs, with prices skyrocketing to absurd levels. At its peak, a single bulb could cost as much as a house. When the bubble burst in 1637, fortunes were lost almost overnight.

Where is it now? While tulip bulbs have long since returned to their role as decorative garden plants, the term “Tulip Mania” lives on as a metaphor for market hysteria. Economists and historians often revisit this episode as a lesson in irrational exuberance.

2. Railway Stocks (1800s)

The 19th century was marked by a frenzy over railway investments. Railroads were heralded as revolutionary, promising to connect cities and drive commerce. Investors poured money into railway companies, often without regard for fundamentals like profitability.

Where is it now? The railway industry stabilized after the speculative frenzy subsided, becoming a cornerstone of transportation infrastructure. However, many investors lost fortunes in failed ventures like the Midland Grand Central scheme in England, which collapsed under financial mismanagement and overexpansion. Today, railway companies are steady, dividend-paying investments rather than speculative plays.

3. Gold Rushes (1800s)

Gold rushes, such as those in California (1848) and Klondike (1896), drove thousands of people to prospect for gold, hoping to strike it rich. The excitement led to speculative land sales and mining equipment booms.

Where is it now? While gold remains a valuable asset and a hedge against inflation, modern-day mining operations are far removed from the speculative frenzy of gold rushes. Many prospectors were left penniless, and entire towns, like Bodie in California, became ghost towns when the gold ran out. Gold ETFs and futures are now common ways to invest.

4. Beany Babies and Collectibles (1990s)

While not a traditional financial investment, Beanie Babies captured the imagination of speculators in the 1990s. People bought and hoarded these stuffed toys, expecting their value to appreciate over time.

Where is it now? The Beanie Baby bubble burst, and most of these toys are now worth little more than their original retail price. One spectacular failure was a couple who reportedly spent $100,000 on a Beanie Baby collection, only to find their hoard nearly worthless when the market collapsed. Having said that certain rare editions still fetch high prices among niche collectors.

5. Dot-Com Boom (1990s)

The late 1990s saw a surge in internet-related companies going public, often with little more than a business plan. Investors believed these “dot-com” companies would revolutionize industries. Stock prices soared—and then came the crash of 2000, wiping out billions in market value.

Where is it now? Many dot-com companies went bankrupt, but survivors like Amazon and eBay emerged stronger. However, the era also saw spectacular failures, such as Pets.com, which spent heavily on advertising but failed to build a sustainable business model, and Webvan, a grocery delivery service that burned through cash before shutting down in 2001. These failures serve as cautionary tales about the dangers of chasing unproven business ideas.

6. Day Trading Boom (1990s-2000s)

With the rise of online brokerage platforms, day trading became a phenomenon in the late 1990s and early 2000s. Ordinary people, empowered by access to real-time data, tried to profit from short-term stock movements.

Where is it now? Day trading remains a vibrant part of the market, with many participants continuing to embrace the fast-paced nature of buying and selling stocks. The GameStop short squeeze in 2021 reignited interest in retail trading, showcasing both the opportunities and challenges in this dynamic space. While some have moved to algorithmic trading, day trading still attracts those looking for active engagement in the markets.

7. Commodities Supercycle (2000s)

In the early 2000s, commodities like oil, copper, and soybeans experienced a boom as demand from emerging markets, especially China, surged. Investors flooded into commodities ETFs and futures.

Where is it now? While commodities remain essential to global markets, the supercycle has leveled off. Speculative failures included companies like Enron, which collapsed in 2001 under the weight of fraud, leaving investors devastated. Green energy trends have shifted focus to metals like lithium and cobalt.

8. 130/30 Fund Fanaticism (2000s)

130/30 funds, a hybrid investment strategy allowing managers to go 130% long and 30% short, gained attention in the 2000s. These funds promised to deliver enhanced returns by combining traditional equity positions with short-selling.

Where is it now? The popularity of 130/30 funds has faded, as they often failed to meet expectations in volatile markets. One notable disappointment was the collapse of several high-profile 130/30 funds during the 2008 financial crisis, as their strategies proved too risky in turbulent markets. Today, they’re considered a niche strategy rather than a mainstream investment vehicle.

9. Real Estate Flipping (2000s)

During the early 2000s housing bubble, flipping properties became a nationwide craze. Investors bought homes, made cosmetic improvements, and sold them at inflated prices for quick profits.

Where is it now? After the 2008 financial crisis, real estate flipping cooled but didn’t disappear. It remains a popular strategy among real estate investors, although the risks are better understood now.

10. Cryptocurrency Craze (2010s)

Bitcoin’s meteoric rise from a fringe concept to a household name spurred a frenzy of cryptocurrency investments in the 2010s. Initial Coin Offerings (ICOs) proliferated, and investors scrambled to get a piece of the action.

Where is it now? Cryptocurrencies remain a volatile asset class, but they’ve gained institutional acceptance. Bitcoin is now considered “digital gold,” and blockchain technology has applications far beyond currency. However, spectacular failures like the collapse of Mt. Gox, a major Bitcoin exchange that lost nearly $500 million in customer funds, highlight the risks.

11. Cannabis Stock Craze (2010s)

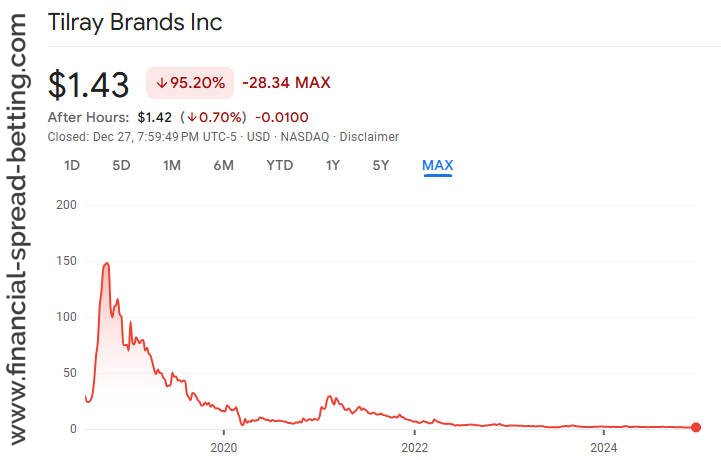

With the legalization of recreational cannabis in parts of North America, cannabis stocks saw a surge in popularity during the 2010s. Investors were lured by the promise of rapid industry growth and enormous market potential.

Tilray’s stock soared to dizzying heights during the cannabis stock frenzy, fueled by legalization optimism and speculative hype, only to come crashing down as market realities and overvaluation took their toll.

Where is it now? While the cannabis industry continues to grow, many early entrants faced operational challenges, regulatory hurdles, and overvaluation. Some high-profile acquisitions, such as Aurora Cannabis’s purchase of MedReleaf and Canopy Growth’s acquisition of Acreage Holdings, have struggled to yield the expected results. Additionally, Altria, the parent company of Philip Morris and producer of Marlboro, took a 45% stake in cannabis company Cronos Group for $1.8 billion, betting that cannabis could replace slowing revenue from cigarettes. These deals, plagued by integration issues and shifting regulatory landscapes, highlight the difficulties in scaling within this nascent industry. The initial hype has diminished, leaving a more cautious and selective market.

12. SPACs (2020s)

Special Purpose Acquisition Companies (SPACs) became a hot trend in the early 2020s, offering a quicker, less regulated route for companies to go public. Investors saw SPACs as a way to access high-growth startups.

Where is it now? The SPAC market has cooled significantly as many high-profile deals underperformed. Spectacular failures, such as the collapse of electric truck startup Nikola—once valued at $34 billion before allegations of fraud surfaced—and Lordstown Motors, which struggled with production delays and financial woes, have left investors wary. Regulatory scrutiny has increased, and investors are now more cautious, but SPACs still play a role in capital markets.

13. NFT Mania (2020s)

Non-Fungible Tokens (NFTs) became a major trend in the early 2020s, with digital art and collectibles selling for millions of dollars. Celebrities and influencers fueled the frenzy.

Where is it now? NFTs have faced significant skepticism and a decline in trading volumes. However, blockchain-backed ownership continues to hold potential in gaming, intellectual property, and ticketing systems. One spectacular collapse was the sale of Jack Dorsey’s first tweet as an NFT for $2.9 million, only for its value to plummet to a fraction of the purchase price within a year.

Lessons Learned

Investment fads are often driven by a mix of hype, fear of missing out (FOMO), and genuine innovation. While some trends evolve into legitimate opportunities, others end in financial disaster. The key takeaway? Always do your due diligence, diversify your portfolio, and remember that if something seems too good to be true, it probably is.

Whether it’s tulip bulbs or SPACs, the stories of past investment fads serve as valuable lessons for navigating the ever-changing world of finance. As new trends emerge, the question remains: will they be the next big thing or just another fleeting fad?