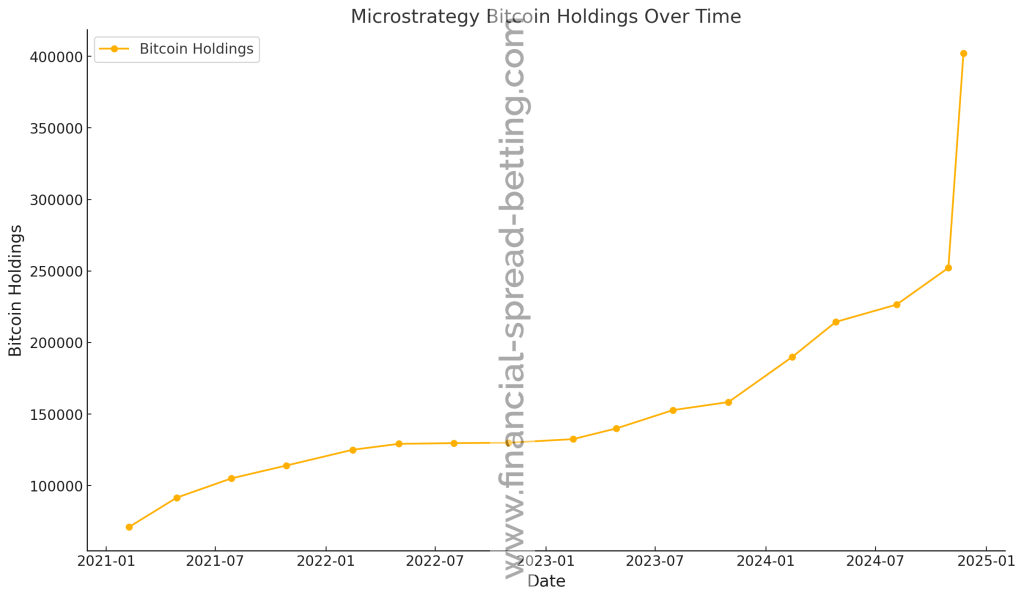

So in 2022, at the lows, $MSTR grew its Bitcoin holdings by only 15%, but just last month they increased their holdings by almost 60%…?!

The irony in MicroStrategy’s Bitcoin acquisition strategy is striking when you compare its actions during the lows of 2022 to its recent activity. In 2022, when Bitcoin prices were hovering near multi-year lows, MicroStrategy expanded its holdings by a modest 15%. This relatively cautious increase came during a time when the broader crypto market was reeling from a wave of liquidations and pessimism. Many would argue that this was the perfect opportunity to “buy the dip,” yet the company’s accumulation during that period was remarkably subdued given its pro-Bitcoin stance.

Fast forward to November 2024, and it’s a completely different story. In just one month, MicroStrategy increased its Bitcoin stash by almost 60%. This aggressive move came after Bitcoin had already bounced back significantly, pushing the average cost of their entire portfolio to over $58,000 per coin. While this reinforces their faith in Bitcoin’s future, it also raises some big questions. Why hold back when prices were low, only to double down after the rebound?

It’s a move that reflects the challenges of navigating markets, even for a company that’s made Bitcoin central to its strategy. Maybe their 2022 approach was shaped by other financial priorities, or maybe they misread the moment. Either way, their recent buying spree shows just how high their conviction is—but it also highlights the unpredictable and sometimes ironic nature of market behavior.

“Diamondhand” Michael Saylor buys #BTC with YOUR (shareholders’) money but sells $MSTR all day, everyday, with his OWN money. 109 transactions, 109 sales, $409m proceeds.

Michael Saylor: Is History Repeating Itself with Bitcoin?

Michael Saylor is a guy who’s taken some pretty big risks in his career—and not all of them have worked out. Back in the late 1990s, he was one of the biggest names in tech, running a company called MicroStrategy. Things were going great for him during the dot-com boom (you know, when everyone was freaking out about the internet being the next big thing). But then, everything came crashing down.

What Happened During the Dot-Com Bubble?

So, here’s what went down. Saylor’s company, MicroStrategy, was doing really well because it made software for businesses. But then, he started chasing after internet-related projects that seemed like a guaranteed win at the time. Lots of companies were doing this—basically betting big on anything with “dot-com” in the name.

But in 2000, two things happened:

- Accounting Trouble: MicroStrategy had to fix some financial numbers it had reported. That’s a big no-no in the business world.

- The Bubble Burst: The dot-com bubble popped, meaning all those companies everyone thought would be gold mines turned out to be duds.

MicroStrategy’s stock price fell like a rock, losing over 90% of its value. Saylor himself lost billions of dollars on paper almost overnight. It was bad – like, really bad.

Now, He’s All About Bitcoin

Fast forward to today, and Saylor’s got a new obsession: Bitcoin. He’s turned MicroStrategy into one of the biggest Bitcoin investors out there. Basically, instead of keeping cash in the bank, his company is putting billions into Bitcoin because he thinks it’s the future of money.

Saylor talks about Bitcoin like it’s the best thing since sliced bread. He calls it a “store of value” (which means it keeps its worth over time) and says it’s a way to fight inflation (when prices for stuff go up). He’s super confident about it.

But not everyone’s buying it. Some people say his enthusiasm feels a lot like how he hyped up internet projects during the dot-com bubble. Back then, it sounded great until it didn’t work out. Could the same thing happen with Bitcoin?

What’s With the Bitcoin Hype?

Here’s where it gets a little weird. Saylor talks about Bitcoin almost like it’s a religion. He says stuff like “Bitcoin will save the world,” and he seems to think people who don’t agree just don’t get it. Critics say this is a little “cult-like”—you know, like when someone believes in something so much that they won’t listen to other opinions.

The big problem? Bitcoin is super risky. The price goes up and down like crazy. If things go south, MicroStrategy could lose a lot of money, and Saylor’s big gamble could backfire.

Will History Repeat Itself?

Saylor’s story is a great example of how big risks can go either way. He’s betting everything on Bitcoin, and if it works out, he could be seen as a genius. But if it doesn’t, people might say he made the same mistake he did 20 years ago—getting caught up in the hype and losing big.

So, is Saylor a visionary or just repeating history? Only time will tell. But one thing’s for sure: he’s not afraid to take a gamble, even if the stakes are sky-high.