Oil, crude, brent, light sweet, black gold – whatever you want to call it, one thing’s for certain, it is perhaps the most important of all commodities, one we cannot currently live without, being the source of power for our industry, for our vehicles, in fact for our life in general. Oil is so important to us that sometimes it’s not the economy that influences its price, but its price that influences the economy. In fact, on many occasions oil has actually been the catalyst to a recession – a story truly of the tail wagging the dog.

‘After the gold rush of the 19th Century, humanity discovered another commodity to explore during the 20th century and into the 21st – the Fossil Fuel that is Oil.’

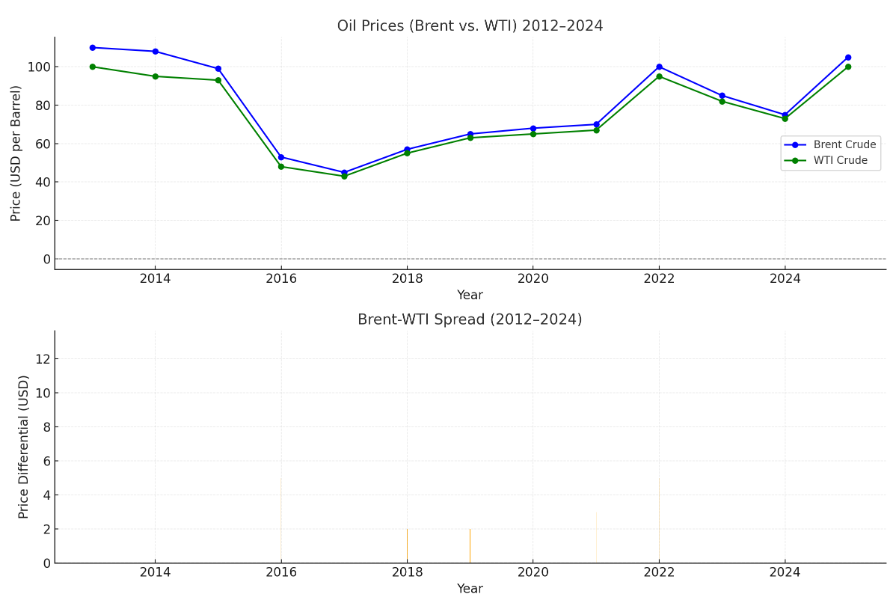

2012 was a pivotal year for the oil market, characterized by high volatility. Prices peaked early in the year, driven by fears of supply disruptions in the Middle East, before declining in the latter half. In the years following 2012, the landscape shifted dramatically. The U.S. shale revolution gained momentum, with production surging due to advances in hydraulic fracturing and horizontal drilling. By the mid-2010s, the U.S. had become the world’s largest oil producer, significantly reducing its reliance on imports and reshaping global energy markets.

This surge in supply, coupled with a slowdown in demand growth from China, caused oil prices to crash in late 2014. Brent and WTI both fell below $50 per barrel, marking the beginning of an era of lower-for-longer prices. OPEC and its allies, including Russia (known collectively as OPEC+), responded by implementing production cuts to stabilize the market.

The COVID-19 pandemic in 2020 marked another historic period of volatility. Global lockdowns decimated oil demand, causing WTI prices to briefly turn negative in April 2020. However, the market recovered as demand rebounded with the global economic recovery and as OPEC+ maintained disciplined production policies.

Following World War II, the price of oil was relatively stable, especially when adjusted for inflation, but in the last 20-25 years, volatility has been immense and the price has risen inexorably. While oil traded around $2.50 and $3.00 between 1948 and 1960, it has been trading between $16.50 and $146.00 in the period between 2000 and 2012.

A Brief History of Oil Prices

After the end of World War II, the price of oil was heavily regulated through both production and price controls in order to keep the commodity relatively stable as its importance in the economy was rising. First, the Texas Railroad Commission was responsible for controlling the output and effectively imposing production quotas to control prices. After OPEC was established in 1960, power changed hands and it soon became clear that the US was no longer in control of the oil market. Let’s take a brief look at what happened through various time subsets:

The Calm After the War – Post World War II Period between 1948 and the End of 1960’s – Stability is the proper word to define this period as oil prices were effectively controlled, simply gyrating between $2.50 to $3.00 — just a 20% rise over almost 20 years. Adjusted for inflation, real prices didn’t change much. In 1960, OPEC was created with five founding members: Iran, Saudi Arabia, Iraq, Kuwait and Venezuela. Fortunately, OPEC members didn’t know at that time how they could influence oil price otherwise we would have had even more geo-political woes during the Cold War period. Even though demand for oil products increased in the post war period, prices didn’t, however, change much.

The Transfer of Control from Texas to OPEC in March 1971 – In 1971 Qatar, Libya, Indonesia, UAE, Nigeria and Algeria joined OPEC giving some extra power to the organization. When, in March 1971, the US ran out of spare production, and so no longer being able to put a cap on oil prices, the power to influence the market definitely shifted to OPEC.

The Yom Kippur War and the Oil Embargo – After an attack on Israel led by Syria and Egypt, several western countries condemned the aggression and the stage was set for serious potential conflict during this worrying period.. Middle East producers reacted by embargoing oil production and prices shot up from $3.50 in 1972 to $12 in 1974. That was the first real sign of the power OPEC could wield.

The Eye of the Storm between 1974 – 1978 – This was a range-bound period for oil prices, during which they oscillated between $12.50 – $14.50. Adjusted for inflation, however, there was even a small decline in prices.

The Iranian revolution and Iraqi attack – Iran not only went through a tough revolutionary period but it was also invaded by Saddam Hussein’s Iraq. Between 1978 and 1981 oil prices rose from $14 to $35 as output was substantially reduced with these two OPEC members at war.

Increase in non-OPEC Production and Fast Decline in Prices — With prices rising, many non-OPEC countries took the opportunity to raise their production significantly. Saudi Arabia also broke ranks, tiring of ineffective production quotas restrictions by other OPEC members, and so increased their own oil production (to increase revenues from the quantity side instead of price). At the same time, the first signs of serious investment and momentum away from oil dependence by Western economies were emerging. The net result was disastrous for the oil price which dipped below $10 in 1986.

Kuwait Invasion and the Gulf War – In 1990, Iraq invaded Kuwait. The oil price spiked, but soon after the US joined forces with Kuwait against Iraq, prices again gradually decreased.

Economic Prosperity through to 1997/98 – Western economies and Asia did particularly well during this period. Demand for oil products increased substantially, and China emerged as a major consumer with its own economy growing more than 10% per year. Oil dependency was at its highest for many years and with Russia experiencing a decline in production, oil prices increased again.

Subsequent Asian Crisis – The quick downfall of Asia in 1997/8 as a consequence of a major borrowing binge and currency crises led oil prices into a renewed downward spiral, but OPEC was able to successfully cut production in order to sustain prices. At the end of 1999, oil price was back near $25 after dipping as low as $10 in early 1999. The slowdown in the global economy continued until 2003, but OPEC was able to keep prices in a tight range, centred around the $30 a barrel level.

Speculation Age – During the last 25 years, commodity markets have been opened to new investors with institutions and hedge funds embracing the ability to speculate on the oil price. This has led to a huge increase in volatility. The oil price has probably changed much more during the last 20 years than over the last 70 years. At the end of 2001, the oil price was around $16.50 a barrel, but with the growth in investment in the sector and the phenomenal leverage available to these investors it embarked on a remarkable rally, hitting a historical high of $146.27 on July 3, 2008 (as measured by the Brent Composite). Oil then had one of its sharpest reversals on record as the leverage was unwound, closing the year quoted at $45.59, an amazing 69% drop in just six months as the chart below pays testimony to.

Why was the Oil Price Rising so Fast and been so Volatile at the Time?

Looking back at the oil market in 2012, the volatility and sharp rise in oil prices can be attributed to a combination of demand outpacing supply, speculative market activity, and global monetary policies. By that time, physical demand for oil had grown substantially, driven by industrial growth in China, India, and other emerging economies. Supply, however, struggled to keep up, partly due to underinvestment and ongoing geopolitical tensions in the Middle East and North Africa (MENA) region.

The speculative nature of the oil market further amplified volatility. Institutional investors, diversifying away from traditional paper assets during the era of quantitative easing (QE), poured into commodities, including oil. The availability of exchange-traded contracts for oil futures far outstripped actual physical deliveries, turning the market into a hotbed of speculation. This dynamic heightened price sensitivity to global events and macroeconomic data.

China’s rapid industrialization, growing at an average of 10% annually at the time, played a central role in driving demand. China’s infrastructure investment boom required vast quantities of oil, while other emerging economies like Brazil and India followed similar trajectories. In this context, OPEC struggled to maintain spare production capacity, leaving the market vulnerable to disruptions.

The Federal Reserve’s monetary policies in the aftermath of the 2008 financial crisis also contributed. By 2012, near-zero interest rates and QE programs had devalued the U.S. dollar, prompting investors to seek returns in tangible assets such as oil and gold. This environment created a feedback loop, where oil became both a hedge against inflation and a speculative asset class.

The Shale Boom and Its Global Impact

By 2012, the shale revolution in the United States was well underway. Advances in hydraulic fracturing and horizontal drilling unlocked vast reserves of oil and gas, particularly in formations like the Permian Basin and the Bakken Shale. This rapid increase in domestic production propelled the U.S. to become the world’s largest oil producer by 2018, reducing its reliance on imports and reshaping global energy geopolitics.

The surge in U.S. production placed downward pressure on oil prices, creating challenges for OPEC and other major producers. In response, OPEC, led by Saudi Arabia, entered into a series of agreements with non-OPEC producers like Russia (forming OPEC+) to curb production and stabilize prices. However, maintaining cohesion within OPEC+ proved challenging, with some members exceeding quotas to address domestic fiscal pressures.

Price Volatility and Geopolitical Tensions

Between 2014 and 2016, oil prices collapsed, falling from over $100 per barrel to below $30. This dramatic decline was fueled by a supply glut, weaker global demand growth, and OPEC’s initial reluctance to cut output. The downturn had profound economic consequences, particularly for oil-dependent economies like Venezuela, which descended into a severe humanitarian crisis.

Geopolitical events continued to influence oil prices during this period. The U.S. re-imposed sanctions on Iran in 2018 after withdrawing from the Joint Comprehensive Plan of Action (JCPOA), tightening global supply. Meanwhile, conflicts in Libya, Yemen, and other regions intermittently disrupted production and exports, injecting further volatility into the market.

The COVID-19 Pandemic and Oil Market Crash

The COVID-19 pandemic in 2020 marked one of the most turbulent periods in oil market history. Global lockdowns and travel restrictions caused an unprecedented collapse in demand. In April 2020, WTI crude futures turned negative for the first time in history, reflecting the acute lack of storage capacity as inventories surged.

In response, OPEC+ implemented historic production cuts, reducing output by nearly 10 million barrels per day to stabilize prices. These cuts, coupled with a gradual recovery in demand, helped Brent and WTI prices recover by late 2020 and into 2021.

Energy Transition and Climate Policies

The push toward renewable energy and decarbonization gained momentum in the 2020s, driven by international agreements like the Paris Accord and commitments from major economies to achieve net-zero emissions. Investment in clean energy technologies surged, and the adoption of electric vehicles (EVs) began to erode long-term oil demand projections.

However, the transition has been uneven. While advanced economies ramped up investments in renewables, many developing nations, particularly in Asia and Africa, continued to rely on oil for energy security and economic growth.

The Ukraine War and Its Ripple Effects

The Russian invasion of Ukraine in February 2022 profoundly impacted global energy markets. Sanctions on Russian energy exports, coupled with disruptions in pipeline flows, caused a spike in oil prices, with Brent crude briefly surpassing $130 per barrel. Europe faced an energy crisis, accelerating its shift away from Russian oil and gas and prompting a renewed focus on energy independence.

The conflict underscored the strategic importance of oil and natural gas, even as countries sought to diversify energy sources. It also heightened discussions about the resilience of supply chains and the balance between energy security and climate goals.

Technological Advances and Market Evolution

By the mid-2020s, technological innovations continued to shape the oil industry. Enhanced oil recovery techniques, AI-driven exploration methods, and digitalization improved efficiency and reduced costs. Meanwhile, the expansion of liquefied natural gas (LNG) infrastructure facilitated the transport of gas as a complementary energy source.

The trading landscape also evolved, with digital platforms and blockchain technology increasing transparency and efficiency in oil markets. Speculative activity remained significant, but regulatory measures implemented after earlier crises sought to reduce extreme volatility.

Oil Price Trends and Key Events (2012–2024)

Key Events Shaping Oil Prices:

- 2014-2016 Oil Price Collapse: Driven by OPEC’s refusal to cut production amidst U.S. shale oil boom.

- 2018: U.S. sanctions on Iran and Venezuelan turmoil tightened supply.

- 2020: COVID-19 pandemic caused oil prices to crash; WTI briefly turned negative in April.

- 2021-2022: Recovery fueled by economic reopening and supply chain constraints.

- 2022-2023: Ukraine war and OPEC+ cuts drove prices above $100.

Brent Crude – WTI Spread Trade Opportunity

One compelling trade opportunity lies in the spread between U.S. WTI Crude and international Brent Crude. Historically, these two benchmarks have traded within a narrow price differential of $1–$2 per barrel, but structural shifts in the market over the past decade have widened this spread significantly.

As of 2024, WTI continues to trade at a discount to Brent, although infrastructure developments have alleviated many of the bottlenecks that once plagued U.S. shale oil distribution. The Trans Mountain Pipeline expansion and additional export terminals in the Gulf of Mexico have improved the flow of U.S. crude to global markets, narrowing the spread to some extent.

Nonetheless, periodic logistical challenges and differences in regional demand dynamics can create opportunities in this spread. Traders could consider a pairs trade—buying WTI contracts and simultaneously selling Brent contracts in equal proportions—when the differential widens significantly beyond historical norms.

While such trades carry less directional risk compared to outright positions on crude prices, they still require vigilance regarding macroeconomic trends, OPEC+ policy decisions, and regional market developments. For long-term investors, the convergence of WTI and Brent prices as U.S. exports continue to rise may present an attractive play.

Conclusion

From 2012 to 2024, the oil market has undergone profound transformations, shaped by geopolitical upheavals, economic cycles, and the accelerating energy transition. While oil remains a cornerstone of the global economy, its dominance is increasingly challenged by renewables and climate-conscious policies. The future of oil hinges on the delicate balance between meeting immediate energy needs and pursuing a sustainable, low-carbon future.

Where Should You Put Your Money Now?

With oil markets remaining highly volatile in 2024, navigating them requires a strategic approach, especially for those seeking short-term returns.

In the near term, fundamentals suggest continued strength in oil prices. While global demand growth has moderated compared to the early 2010s, rising consumption in India, Southeast Asia, and other emerging markets is supporting the market. Geopolitical uncertainties, such as tensions in Eastern Europe and the Middle East, continue to weigh on supply stability, while investment in new oil production remains constrained by ESG pressures and energy transition policies.

OPEC+ has maintained a cautious production strategy, signaling no major supply increases are forthcoming. Meanwhile, U.S. shale production, which once acted as a market balancer, is growing at a slower pace due to investor demands for capital discipline and higher shareholder returns.

Economic indicators are also providing tailwinds for oil prices. The U.S. economy has shown resilience despite higher interest rates, with robust employment numbers and healthy consumer spending. China’s post-pandemic recovery, though uneven, still underpins strong demand for energy commodities. Institutional investors remain drawn to oil and other commodities as hedges against inflation and currency volatility, especially given the ongoing global macroeconomic uncertainties.

While the overall outlook for oil prices is bullish in the medium term, high volatility persists, making it crucial to approach trading with caution and a well-defined strategy.