Spread Betting: Trading EUR/CHF

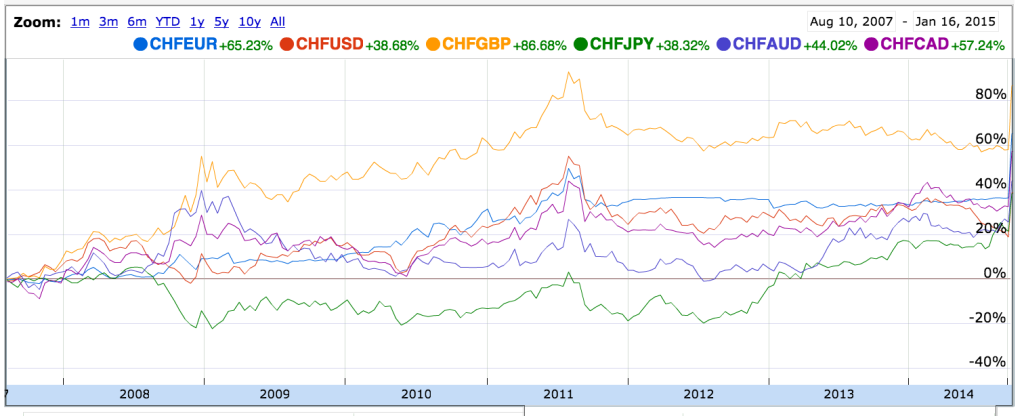

If you spread bet on the EUR/CHF, then you are making a bet on how the euro does against the Swiss franc. The Swiss franc has a history going way back to 1798 when its exchange rate was pegged to silver and the French franc – in fact it is said that it was Napoleon that established the Franc on the confederation of Swiss cantons. Traditionally, the Swiss franc has been very stable, with little inflation, and this is constantly monitored by the Swiss National Bank which intervenes when necessary. In fact, the bank was endeavouring to maintain a currency exchange rate of 1.20 with the euro so capping Swiss franc strength, although it allowed it to drift a little recently.

If you spread bet on the EUR/CHF, then you are making a bet on how the euro does against the Swiss franc. The Swiss franc has a history going way back to 1798 when its exchange rate was pegged to silver and the French franc – in fact it is said that it was Napoleon that established the Franc on the confederation of Swiss cantons. Traditionally, the Swiss franc has been very stable, with little inflation, and this is constantly monitored by the Swiss National Bank which intervenes when necessary. In fact, the bank was endeavouring to maintain a currency exchange rate of 1.20 with the euro so capping Swiss franc strength, although it allowed it to drift a little recently.

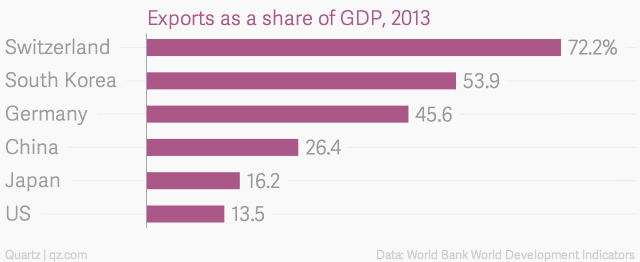

Because a withdrawal to the high-grounds of the Alps will not be beneficial for the export-oriented economy and its big firms in pharmaceuticals, chemicals, machinery and watches. Nor for tourists visiting the beautiful country nor for its own citizens facing price swings in the supermarkets and other stores.

Switzerland is landlocked and surrounded by big Euro trading partners including Germany, France, Italy and Austria. The country has fewer natural resources than many other countries, and is heavily dependent on imports and exports. This means that the value of the Swiss franc is vital to the health of the economy, and the bank has to control price inflation and work towards economic stability so that exporters and importers are able to trade without worrying too much about currency fluctuations. The Central Bank also has to control the strength of the franc so as to keep Swiss exports competitive. The country has a huge export sector with big firms in pharmaceuticals, chemicals, machinery and watches and millions of tourists visit the beautiful country every year. The interest rate is the main weapon of central banks in controlling currency exchange rates, and the European rate is often higher than that of the Swiss. The result is that the currency pair is fairly volatile, although it doesn’t approach the Japanese yen for the fluctuations. Switzerland is the last European country to keep the franc, as the others with this name for their currency adopted the euro.

EUR/CHF Forex Trading by Brenda Kelly of IG Index

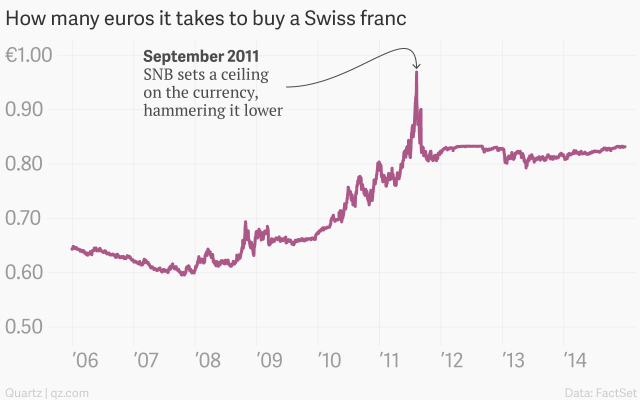

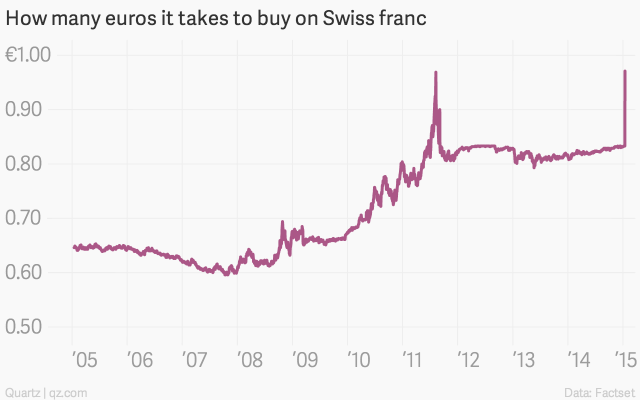

Don’t underestimate the effects of central bank intervention. The Swiss National Bank had introduced a €1.20 ceiling for the Swiss franc against the euro in September 2011 to prevent the “Swissie” from surging in value. In 2015 when a lot of speculators were short in EUR against the CHF, the Swiss Central bank abruptly announced that it would no longer hold the Swiss franc at a fixed exchange rate with the euro. This caused pain and probably wiped out many small-time traders.

In the midst of the eurozone debt crisis, demand for the Swiss franc increased sharply, which pushed it further up.

That kind of appreciation hurts exports…

A strong franc hurts the local Swiss economy as it makes exports more costly for foreign consumers, and Switzerland has a huge export industry.

The Swiss National Bank reacted by placing a peg on the franc’s strength.

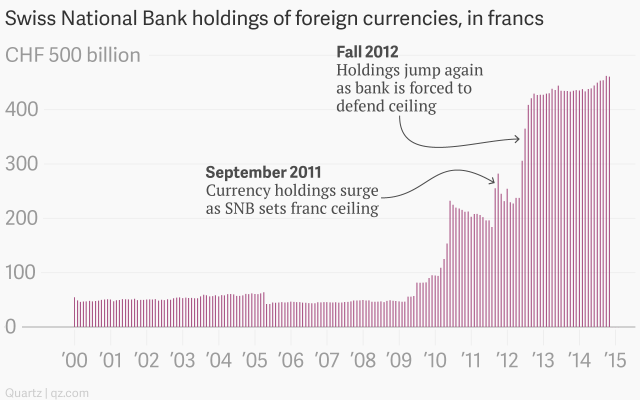

In September 2011, the Swiss National Bank placed a limit or peg on the Swiss franc, stating that it would intervene and print money and use that money to acquire ‘unlimited quantities’ of foreign currency to prevent the Swiss franc from appreciated too much.

However, because the SNB was issuing new francs and utilising them to buy euros, the Swiss National Bank foreign holdings expanded hugely. In the USA, the Federal reserve is buying one of the safest perceived instruments in the world, USA government bonds. As such it can keep holding those bonds until the maturity date with the peace of mind that it will be paid back. In contrast the Swiss National Bank is simply acquiring huge amounts in foreign currencies that can go up and down in value, potentially exposing the bank to big losses.

So the Swiss National Bank threw the towel and abandoned the ceiling on the franc on the 15th January 2015 due to outside market forces including pending ECB quantitiative easing moves and elections in Greece. As a consequence, the Swiss franc rose sharply on that very same day, causing carnage in the markets and a shopping spree as Swiss shoppers crossed the border to hunt for bargains.

In a dramatic central bank move, the Swiss National Bank (SNB) unexpectedly scrapped a three-year cap on the value of the franc against the euro on the 15th January 2015. At the time Switzerland was concerned that a sharp appreciation of its currency would harm exporters and lead to deflation in its economy. The Swiss central bank scrapped its three-year policy of retaining minimum exchange rates of 1.20 Swiss francs a euro due to economic policy and escalating risk from its euro-buying operations which would have increased pressure on the currency to keep rising against the euro. To maintain the peg a central bank would buy the other currency although in practice central banks find it hard to defend a peg for protracted periods of time but the Swiss National Bank was able to do so for 3 years as it was helped by falling prices. Having said that, the Swiss central bank has already spent billions defending the currency cap which was introduced in September 2011 during the Eurozone crisis to curb the flow of cash flowing into Switzerland; a country which most traders and investors consider as a safe haven. The prospect of outright money-printing by the European Central Bank – which devalues a currency finally forced the SNB’s hand to let the currency float freely. It would have been futile for the ECB to start its money printing and put more euros in circulation only for the Swiss National Bank hoover them all up again. In any case global markets are bigger than central banks, and markets will go where they want to go in spite of central bank interventions, which can only be temporary.

As well as permitting the Swiss franc to trade freely against the euro, the Swiss National Bank lowered interest rates well into negative territory, from -0.25% to -0.75%. This is not unlike a bank charging its clients to deposit their money there as opposed to paying them interest. The news caught the markets by surprise and the negative interest rate wasn’t enough to stem an immediate sharp rally in the Swiss franc which soared by almost 30% on the news. For Swiss companies the rally in the Swiss franc is bad news since most export products and might be forced to cut prices to stay competitive. The tourism sector and multinational Swiss exporting companies like Nestle, Novartis, Roche and Swatch are also likely to feel the pinch as the Swiss franc rallied sharply in the wake of the news.

Switzerland’s top banks like UBS and Credit Suisse are also likely to suffer from this turmoil. The SNB’s move resulted in exceptional volatility and extreme lack of liquidity and a number of traders and hedge funds were likewise caught by surprise by the announcement as they were hoping that other currencies like the British Pound and USD Dollar would appreciate against the CHF as this was pegged to the EUR. Meanwhile banks who issued Swiss-franc-denominated home loans to Central and Eastern European borrowers will face more bad loans as clients struggle to pay their increased debts.

Currency losing value is not necessary bad, it is fantastic for companies who export overseas as well as traders and manufacturers. It also creates employment. Why do people automatically assume it such a bad thing?

Analyzing the euro can be both complex and simple. It is complex because there are 17 countries with a whole range of economies, from the prosperous and thriving German economy to the near bankruptcy of Greece. It is difficult to know how this mixture will average out. But on the other hand, having so many different economies affecting the value of the euro means that there is a lot of momentum, so it is less likely that any single country can make the euro move quickly.

Both currencies are affected by major statistical releases, such as the balance of trade, and unemployment. In the past, the Swiss have been known to have a cavalier attitude toward migrant workers, dispensing with them when necessary to maintain higher indigenous employment; but such operations are difficult to undertake in the 21st century. Switzerland has traditionally managed to prosper thanks to its healthy private banking industry but with recent international tax agreements, the Swiss franc may not hold the same advantages to the country that it represented in the past and is sometimes even considered a liability.

The Swiss franc is traditionally a ‘safe haven’ currency and has been a very popular trade against the euro in recent years. However, the currency is susceptible to Swiss National Bank intervention and one can reasonably expect the Swiss to make efforts to prevent further strengthening of the Swiss franc, and in this respect the Swiss National Bank may well act without warning. This has somewhat discouraged currency speculators from taking further short positions on the EUR/CHF but some traders remain upbeat, even though it frequently does not finish up changing as much as initially expected.

Apart from fundamental factors such the economic data which points to the state of the economies, you should also use technical analysis to detect the underlying mood of traders on the markets. As much of the price movement will be caused by investors and traders, rather than by the banks, you can learn a lot about the short term fluctuations by studying the charts together with your preferred technical indicators. If you are interested in betting on the EUR/CHF, you should try to avoid times when the central bank is expected to make a move, as this may cause large price changes that are not favourable; and trade at times when the market is acting naturally.

Spread Betting the EUR/CHF

Looking at the quotation for the forward EUR/CHF, for five months away, the price is 12,048.3 – 12,060.3. That means you can bet on the euro to go up and/or the Swiss franc to go down at a price of 12,060.3; or you can bet on the euro to fall and/or the Swiss franc to go up at a price of 12,048.3. This is a futures style bet, which means you can hold on to these bets right up to the expiration date with no further cost – or you can cash them in tomorrow if they work out.

If you think that the euro will fall, you could place a bet for £3.50 per point at the price of 12,048.3. Assuming it does fall, you might close your bet for a profit when the price reaches 11,856.4 – 11,868.4. The short bet closes at the higher price of 11,868.4.

You have gained 12,048.3 minus 11,868.4 points. That is a total of 179.9 points. For your bet of £3.50 per point, your winnings are £629.65.

If your bet did not win, and the price rises, you might have to close the bet and accept the loss before it got too large. Say the price went up to 12,098.5 – 12,110.5. Once again, a sell bet closes on the higher price, in this case 12,110.5.

The points now count against you. 12,110.5 minus 12,048.3 is 62.2. For the stake of £3.50 per point, the bet has cost you £217.70.

This example demonstrates one of the principles of successful betting. If the bet goes against you, you must close it quickly to keep the losses down, and not hang on in hope that it will turn around.

If you choose to place a daily rolling bet, then you get a better (smaller) spread, usually. The current price is 12,071.9 – 12,073.9, a spread of just 2 points. The downside is that you are charged a small amount of interest on long bets every evening when the bet is rolled over to the next day. Taking out a short bet, you may get a credit, but with interest rates as low as they are, it is insignificant.

Assume you make a sell bet for £2 per point, so you are looking for the Swiss franc to improve against the euro. If it does, the price quoted for this currency pair will fall, as the franc is second. Perhaps it will drop to 11,852.7 – 11,854.7.

If you close your bet now, you will have gained 12,071.9 minus 11,854.7, which is 217.2 points. With a stake of £2 per point, this amounts to a total of £217.20.

Again, you must consider the case where the price does not go in the right direction for your bet. Say it went up to 12,096.8 – 12,098.8, and you closed the bet to minimise your losses.

Your short bet was opened at 12,071.9 and closed at 12,098.8. That means you lost 26.9 points. For your chosen stake of £2 per point, your total loss is £53.80.

Join the discussion