Spread Betting Facebook Shares | FB Shares Trading

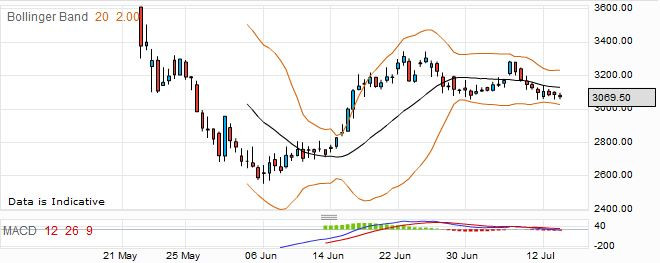

I am sure you know what Facebook is, and that its initial public offering took place fairly recently, in May 2012. Most analysts predicted a valuation coming at over $100 billion – reminding many more of the dot-com boom than the 5th year of a persisting recession. Given the reaction that this received, there may be many opportunities for profitable spread betting on this stock. Here is a price chart, based on four hourly prices: –

The Facebook IPO (FB:NYSE) for the world’s most popular online social network was launched at $38 per share, which price valued the company at more than $100 billion. Note that many shares were not available for sale, but remained with key people, for instance Mark Zuckerburg, the founder, kept 28.4% of the shares.

A sell-off on equity markets the previous day had already lowered expectations from the $40 top-end estimate, and, on the day, technical issues dogged the first few hours of trading on the Nasdaq, and the stock only just clung on to close above its $38 IPO price, leading to accusations that the underwriter Morgan Stanley had offered too much stock at too high a price.

The initial public offering was plagued by technical issues, as well as a disappointing reception by traders, some of whom claimed to have only learned of decreased earnings expectations after they had committed to the purchase. The underwriter Morgan Stanley was even accused of having offered too many shares at too high a price at the time. The next day after flotation Facebook shares were trading $5 lower and hit a low of $17.73 in September. Perhaps the enthusiasm of those who feel that an IPO should always be underpriced and give those lucky enough to “get in” an instant profit is misplaced. Many analysts believed that a fair price was in the lower 30s, which is the level at which it subsequently settled.

Facebook was originally established in 2004, and has nearly 1,000,000,000 active users. It is open for membership by anyone over 13 years old, and it remains to be seen clearly how it intends to monetize its customers effectively. However it is actively pursuing alliances and acquisitions, and offering advertising, in an endeavour to identify viable income streams to generate realistic profit.

Facts: December 2013

User Growth: The active Facebook daily user base is still growing but this doesn’t necessarily mean an increase in profits. In fact active daily Facebook user base increased by some 41% in the last quarter but their profits were still down by some 12%. Currently, Facebook has about 900 million signed up to its service, which equals about half of the global internet base.

Acquisitions: Facebook acquired Instagram (which is just about two years old) but this isn’t generating any substantial revenues or profits. This looked like a measure to ward off rivals like Twitter.

Monetization: Facebook is still struggling to make money from its social system. Facebook end users are more interested in socialising than acting as consumers on a site like Facebook.

Value: Facebook is comparable to Google on a number of levels including size. Facebook IPO launched at a valuation of about 25 times revenue and 100 times earnings while Google currently trades at 5 times revenues and 20 times earnings. Google also has $50bn in cash (trades at about 5 times cash) reserves while Facebook might have about $11bn (trades at about 10 times cash) currently.

Upsides: The problem is that Google is currently making about $30 per user while Facebook still makes $5 per user per year. If Facebook can improve its margins per user its game on! And of course Facebook can be very innovative and their past successes are living proof of this. Facebook has significant cash reserves which if it injects into the right companies, could considerably help earnings.

I’m too good for LinkedIn. 😉 More seriously though chums on it have found it a pita, and research shows that social media is generally just a time suck for business. It’s about click thrus and the length of time spent online. Apparently Instagram scored highest because people can glance at an update and click-through to wherever. I hear that people are now finding that checking Facebook has become much like opening the fridge door and staring at the contents when not really hungry.

In any case Facebook is in a market sector where you can expect great volatility in the price, and thus is desirable from a spread betting point of view. Recently the company’s revenues have been boosted by strong performance in advertising income from its mobile offering and Facebook shares have rallied to reach back their IPO valuation. How well the company fares in the future will depend on the effort and imagination of the management team in coming up with new and modified ways to use the platform. Research company eMarketer is forecasting that Facebook will be able to increase mobile advertising revenues to $2 billion in 2013 (that’s a 4-fold increase!). So where next for Facebook? With the stock price at a considerable premium to the IPO float price, investors have to decide whether to take their profits or increase their holdings further. But one thing is for sure – the share is now trading at a triple digit Price/Earnings ratio and Facebook will need to continue beating analysts forecasts markedly to justify such expectations.

Facebook Shares Trading Example: Facebook Rolling Daily

The rolling daily price for spread betting on Facebook is currently 3069 – 3075. Since the company only “went public” a couple of months ago, it is difficult to identify any overall trends, but at least there is enough data to be able to use technical indicators. If you think that the price is going to go down, then you might want to place a sell bet at £3 per point.

If you are correct, and the price goes down to 2856 – 2862, then you could close your bet and collect your winnings. As a short bet, the opening price was 3069, and the bet was closed at 2862. Working out the difference, 3069 minus 2862 is 207 points. You staked £3 per point, which means you would have won £621.

On the other hand, the price might have gone up, and you would be faced with the prospect of closing your bet or facing greater losses. Perhaps the price went up to 3226 – 3232 before you exited your trade. In this case the opening price was 3069, and the bet closed at 3232. The difference in points is 163, which multiplied by your stake means you lose £489.

When you spread bet on a volatile stock, you may want to consider placing a stoploss order when you open your bet. Some spread betters use them on all their trades. A stoploss order tells your spread betting broker to close the losing bet at a certain level, and it can save you from large losses, particularly if you cannot be watching the market all the time. Say you had a stoploss order and it closed your bet at 3168 – 3174.

This time your bet closed at 3174, so taking away your starting price of 3069 you have lost 105 points. Using a stoploss order you have kept your losses down to £315.

Facebook Futures Style Spreadbet

It is generally reckoned that futures based spread bets are worth taking if you think you will be holding the position open for some weeks or months. The futures bets have a larger spread, costing you a little more with the broker, but they do not have any ongoing charges, such as you may find with a rolling daily bet. The current price for the far quarter spread bet on Facebook is 3071 – 3104.

Suppose you take a bullish view of Facebook, betting that the price will go up in the next month or two, and staking £2.50 per point. It may be that you are proved correct, and the price goes up to 3289 – 3315. If you think this is as far as it will go this time, then you could close the bet and collect your winnings.

Your initial bet was placed at 3104, and it closed at 3289. The difference between these is 185, the number of points that you gained. With your bet of £2.50 per point, that means you have won £462.50.

Some of the time your bet will not be successful, and the price will go in the opposite direction to the one you choose. Say this time the price dropped to 2956 – 2985, and you decided that you needed to close the bet to prevent any further loss. Your bet opened at 3104, and closed at 2956, giving you a loss of 148 points. For your chosen stake, this amounts to £370.

Many spread traders use a stop loss order, as this means that their spread betting broker will watch the market price for them, and close the bet if the losses get too high. Perhaps with these your bet would have closed at 3036 – 3066, and you would not have lost so much. 3104 minus 3036 is 68 points, so your losses would have been kept down to £170.

Update September 2012: Facebook’s stock market debut was hotly anticipated following the success of LinkedIn, which has seen its shares rise 12% since its appearance July 2011. However, Facebook’s initial price of $38 per share has now almost halved. Reportedly, one punter who shorted Facebook when it launched its IPO in May 21 netted a profit of almost $3 million after placing a down bet at $8000 a point! The bet was so big that when the spread betting provider reached its broker to hedge its exposure, its broker insisted that the bet had to be unwound on that same day. In that one trading session the whale made returns in excess of $400,000 an hour!

Facebook has shown impressive growth in recent years, and now states it has around a billion users. The world’s leading social network is struggling to translate its online dominance into profits. Also, critics point out that many accounts may not be genuine and user numbers could drop quickly if tastes change. Questions also remain about the firm’s business model: the percentage of total revenue from advertising on Facebook fell from 98% in 2009 to 85% in 2011, with General Motors pulling their ads from the site two days before the IPO.

The end of the first lock-up period in August accelerated Facebook’s downturn, as the company’s early backers were allowed to sell some of their holdings. Expiry of a similar lock-up period for employees in November could have a comparable effect.

Nevertheless, Facebook retains the backing of many famous investors, including George Soros, and there seems a genuine desire among the Facebook ‘family’ to make a success of its IPO. It is interesting to note that 604 million of Facebook’s 1.01 billion users now access its site using a mobile handset.

Join the discussion