Spread Bet on Tullow Oil Shares

Sector: Oil & Gas Producers

Sub-sector: Exploration & Production

Business: Exploring for hydrocarbons

Tullow Oil (TLW) is a story of an entrepreneur who less than 30 years ago saw an opportunity. It is now the 30th largest company on the London Stock Exchange with a market cap of £11 billion cap, and has secondary listings on the Ghana Stock Exchange and the Irish Stock Exchange. The company was founded by Aidan Heavey in 1985 when North Sea oil exploration was in its heyday. He found out that in the excitement, there were many small oil fields in Africa which were being ignored. Though he had no background in the oil or gas industry, Heavey went to work, signing a license agreement in Senegal in 1986, commencing production and listing its shares in 1987.

Though it has projects in 13 countries, Africa is still the major source of income. In fact this year alone (2013) is planning to explore multiple sites in Kenya, French Guiana and Mauritania. Tullow also works in the UK, Spain, Italy, Pakistan, India, Mauritania, Uganda, and many other places. The named Tullow is simply that of a small town in Ireland, where the company was conceived.

There was a major expansion in size in 2004, principally because of acquisitions which cost the company more than $1 billion in that year. Tullow in particular has a knack for acquiring other companies and turning them into cash cows. Case-in-point were the 2004 and 2006 acquisitions of Energy Africa and Hardman Resources which Tullow picked up the Ghana and Uganda acreage which went on to yield the huge Jubilee and Kingfisher fields.

Tullow is as such the leading independent oil company in Africa, and is also one of the largest independent oil and gas exploration and production companies in Europe. It has operations in South Asia and South America as well; the company aiming to find at least 400 new potential targets each year.

Tullow Oil has recently acquired oil explorer Spring Energy which has 28 licenses off the coast of Norway. Tullow estimates that this portfolio alone has over 230 million barrels of oil equivalent (mmboe) of risked prospective resources and has existing reserves and resources of 24 mmboe.

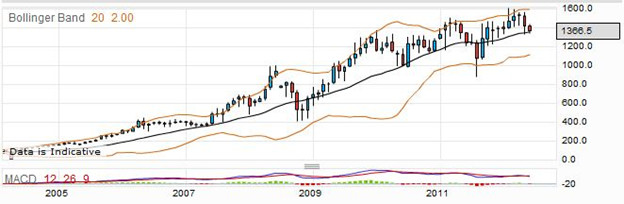

Unlike many companies that grow to be large enough to be included in the FTSE 100, the founder Heavey is still in control, as the Chief Executive Officer, and such involvement usually means that the company is still being carefully nurtured. The company employs a large and experienced team of geologists and drilling specialists to ensure a healthy flow of prospects and leads. You can see from the monthly price chart above that growth is sustained, with only minor retracements, even during the global economic crisis of 2008. Bearing in mind that the major expansion was in 2004, on the left of this graph, the subsequent growth is astonishing, rising from around 150 in 2005 to over 1600.

Spread Betting: Tullow Oil Rolling Daily

Tullow is a successful independent oil and gas exploration and delivery company. The current quotation for a daily rolling spread bet is 1362.6 – 1365.4. This means that if you think the price is going higher, you can take out a bet at the buying price of 1365.4, staking perhaps £6.50 per point of movement.

Suppose that the price goes up to 1486.2 – 1489.0. Experienced spread traders will tell you that you need to make the most you can out of every winning trade, and assuming that you think this is as far up as it will go, you decide to close the spread bet. Working out what you have won, you note that your closing price is 1486.2 and the starting price was 1365.4. That means you have won the difference, 120.8 points. When you multiply this by your stake, you find you have won £785.20.

On the other hand, suppose that the price falls after you place your bet. This can happen, and no one can predict the markets with certainty. Perhaps the price goes down to 1258.5 – 1261.2, and you decide that you have to close the bet and accept your loss before it drops any further. This time the bet closes at 1258.5, down from 1365.4, for a loss of 106.9 points. Multiplying this by £6.50, your total loss works out to £694.85. Incidentally, with a rolling daily bet there may be additional charges made to your account each evening when the bet is rolled over, but these are usually not large.

Many traders decide to use stop loss orders to control their bets. With a stoploss order, you do not have to watch the prices, as your spread betting provider will close the bet if it reaches a certain level of loss. Perhaps your bet closed with the stop loss order at 1298.6 – 1301.2. This time the bet opened at 1365.4, and closed at 1298.6, a difference of 66.8 points. Multiplying this times your stake, you find you have lost £434.20.

Tullow Oil Futures Style Bet

If you expect the shares of Tullow Oil to go up in the next few weeks or months, you may be tempted to place a futures style bet on this product. The current price for the far quarter is 1366.7 – 1378.7, so you decide to place a buy bet at £5 per point.

The markets are hard to predict and the price could go up or down. Assume firstly that the price goes up, and you decide to close your bet and take your winnings when the quote is 1478.3 – 1490.1. Working out how much you have won, your bet was placed at the buying price of 1378.7, and it closed at the selling price of 1478.3, a difference of 99.6 points. As you staked £5 per point, that would amount to a profit of £498.

Considering the other case, if the price went down after you had placed your spreadbet you would have to decide when to close the bet and accept your loss. Say this was when the price dropped down to 1289.3 – 1299.7. Your bet would close at the selling price of 1289.3. As you started at 1378.7, you have lost 1378.7 minus 1289.3 points, which is 89.4 points. At £5 per point, this would cost you £447.

Some traders find it a help to place a stop loss order when they open their bet. This way, even if they are away from the computer, if the price falls too far the spread bet will be closed for them anyway. If you chose to use a stop loss, you might find that the bet had closed at a price of 1323.5 – 1335.1. Once again, it closes at the selling price which is 1323.5. Taking that away from the starting price of 1378.7, you have lost 55.2 points which amounts to £276.

Join the discussion