Spread Betting Barclays | Trade Barclays

After all the problems that have gone in the past few years, you might be reticent to have anything to do with the banking industry. After all, it seems that the bosses still seem to manage to find large bonuses for themselves, even while their companies are losing money and requiring government bailouts. But these objections are only truly relevant if you are looking to invest in banking shares, and not if you are spread betting. Whether the shares go up or down, as long as there is good volatility and you have a trading plan that can anticipate the market action, you can score good profits from any financial instrument.

Barclays bank is a global company, operating in 50 countries, but headquartered in London. It is been going for about 300 years, and was the first bank to issue a credit card, the Barclaycard. It was the first with an ATM, and issued the first UK debit card in the 80s. Its history is undoubted, but its future still hangs in the balance. Unlike some other banks, Barclays seems to have survived the economic downturn a little better. Even now, it ranks in the top 25 companies listed on the London Stock Exchange, and it is also listed on the New York Stock Exchange.

It rejected a government bailout, preferring instead to increase its resources from private investors, and by cancelling dividends to shareholders. It also acquired Lehman Brothers in 2008. It has interests in all the normal banking services, including mortgages, and business and personal finance. Barclays was also hit by the payment protection insurance (PPI) scandal in 2012 and it has already set aside £2.2 billion to cover the cost of repayments.

Following a slump from the 700 level down to less than 100, from 2007 to 2009, Barclays is currently on an uptrend, trading above 200. For the technical analyst, there is plenty of information available to choose your spread bet. If you are interested in spread trading on Barclays, it is best if you study the charts for a few weeks to understand the amount of volatility you can expect.

When applying technical analysis to a stock like this, you should also remember to look at the charts on different time scales for clues from past performance. Often support and resistance levels from several years previously are returned to, and you need to use all the information available to you in order to make the best spread trades. With the range of prices that Barclays’ shares have traded at, you have a wealth of information to suggest where the price is going.

Unless you’re prepared to spread trade all day, it is best if you avoid placing any bets around the time that public announcements or dividends are due. The results of announcements can be as you would anticipate, or could be in the opposite direction if the market has already “priced in” the leaked announcement, so this is a dangerous time to hold a trade open. Having said that, following the initial reaction to a dividend or profit announcement you may find it worthwhile to spread bet on the resulting trend.

Shares Trading vs Spread Betting

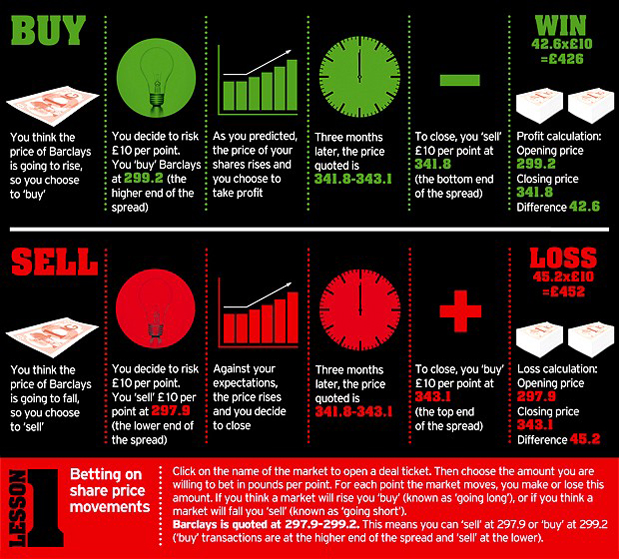

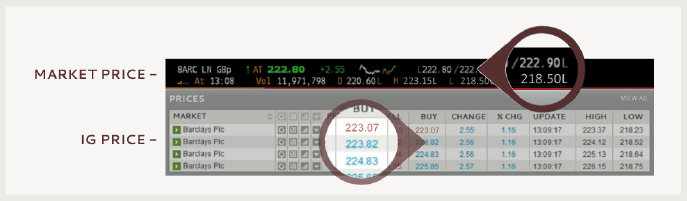

To compare the differences, let’s consider purchasing physical shares in Barclays stock through a broker and then placing the equivalent deal through a spread bet with IG Index.

Buying Shares through a Broker

- You decide to buy 1000 shares in Barclays, at the market price of 222.9p per share.

- You pay 1000 x £2.229 = £2,229 + the broker’s commission, estimated at £10 for this example, and stamp duty of 0.5% which comes to £11.15.

- Your total outlay for this purchase is: £2,229 + £10 + £11.15 = £2,250.15.

- Barclays shares gain 20p over the next three months. At this point you decide to sell your 1000 shares, at their current price of 242.8p.

- You receive 1000 x £2.428 = £2,428; the broker takes another £10 commission, leaving you with £2,418.

- Your profit on this trade is: £2,418 – 2,250.15 = £167.85, but you’ll need to pay tax on this amount.

Dealing through IG

- You decide to spread bet £10 per point on Barclays, at our offer price of 223.82p (£2.2382).

- You plan to hold the position for three months, so you choose the nearest forward contract, which in this example is December 2012.

- We require a 10% margin on Barclays, which means you need to put up 10% of the value of your exposure. At £10 per point, you commit £223.82.

- Barclays shares gain 20p over the next three months. Your bet expires at 242.8p and our 1-point spread is deducted, giving you a closing price of 241.8p – an increase of 17.98p since your opening price.

- Your profit on this deal is: £10 x 17.98 = £179.80, and you pay no tax on this amount.

Even without considering the tax you would have to pay on the physical shares transaction, in this example dealing via the spread bet made you 7% more, while putting up only 10% of the capital.

It is important to remember that spread betting is a leveraged product and can result in losses exceeding your initial deposit. If the market had moved against you, you would have lost £10 for every point it fell below the opening price of 223.82 until you closed the position or any stops came into place.

Spread Betting on Barclays

The current price for a rolling daily bet on Barclays is 233.22 – 233.68. This means you can place a buy spread bet at 233.68 if you think that the price will go higher, or a sell bet at 233.22 if you favour a fall in price. Say you think that the shares will continue to go up, you could stake £35 per point in this direction.

Assume the price does go up, and you decide to sell and take your profit when it gets to 237.75 – 238.21. Here is how you can work out how much you won.

- Your long bet was placed at 233.68

- Your bet closed at 237.75

- The difference in these prices is 237.75-233.68

- This works out to 4.07

- Your bet was for £35 per point

- So the total you have won is 4.07 times £35

- Your total winnings are £142.45

No matter how well you analyze a stock price, you will have a fair share of spread bets that do not move in the right direction, where you have to close the bet and accept your loss. Say in this case the price fell to 232.45 – 232.91, and you decided to close the trade.

- Your long bet was placed at 233.68

- Your bet closed at 232.45

- The difference in these prices is 233.68 – 232.45

- This works out to 1.23

- Your bet was for £35 per point

- So the total you have lost is 1.23 times £35

- Your losses total £43.05

You might instead think that the share price will go down, and choose to place a short or sell bet on this stock. The selling price is 233.22, and you could bet £100 per point on it falling. If it goes down, you could close your bet and collect your winnings when it reached 231.30 – 231.76.

- Your short bet was placed at 233.22

- You closed your bet when it reached 231.76

- That means you have gained 233.22-231.76

- Which is 14.6 points

- You staked £100 per point

- Which means you have gained £146

Once again, you should never place a bet without considering the consequences if you have read the market wrong, and it finishes up going in the wrong direction. One of the secrets to being a successful trader or spread better on the financial markets is that you make a profit by winning more than you lose. This may seem obvious, but it is surprisingly easy to hang onto a losing position, hoping it will turn around, compared to the difficult task of closing the losing position quickly, and accepting at your losses. Suppose the price goes up to 233.75 – 234.30 and you have to close to protect your principal.

- Your short bet was placed at 233.22

- You closed your bet when it reached 234.30

- That means you have lost 234.30 less 233.22

- Which is 1.08 points

- You staked £100 per point

- Which means you have lost £108

Note: Barclay’s (BARC) growth has historically come from its investment banking operations. These are now struggling, although are expected to bounce back once macroeconomic conditions improve and its disposal of toxic assets programme completes.

Join the discussion