Spread Bet on Shire plc

Shire plc, sometimes called Shire Pharmaceuticals to distinguish it from other similarly named companies, is a pharmaceutical manufacturer specializing in certain life altering conditions. It is a comparatively young company, originating in 1986 and becoming listed on the London Stock Exchange in 1996. It was started in Basingstoke, Hants., which is still a major operational location, but in 2008 established a holding company in the Channel Islands and a tax base in Dublin, Ireland, for tax avoidance. Because of the nature of the pharmaceutical industry, there is a significant income from royalties on patents, and Ireland has a better tax policy towards these.

In addition to being listed on the London Stock Exchange, it also has a secondary listing on the NASDAQ market. Its market capitalization is around £12 billion, ranking it in the top 40 companies on the FTSE. It has acquired a number of companies, both in England and in other countries, when these companies have aligned with its niche markets.

The major focus of development is drugs for Attention Deficit Hyperactivity Disorder (ADHD), and it also has interests in gastrointestinal treatments and in genetics.

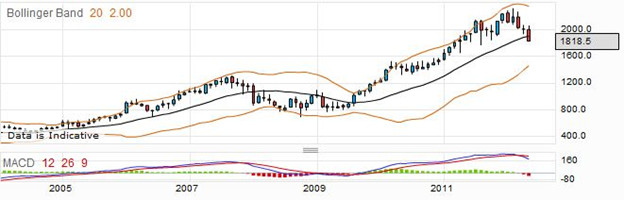

As you can see, the company has been on a reasonable growth path, hesitating only at the global economic crisis. From a spread betting point of view, it can help to think about what matters to the profitability of a pharmaceutical company, and thus will have an effect on the price. The topicality and need for drugs for certain conditions has a direct impact on how the company is perceived, and in this respect Shire seems to have a good position in its chosen niches.

Pharmaceuticals can be volatile. New drugs are developed, then subjected to testing and approval by the relevant authorities. News of their development, likelihood of and subsequent approval or rejection, are all factors that will impact the company’s bottom line. Therefore, depending where the drugs are on the development ladder, the share price can vary. Shire is in a position of having developed successful drugs, and presently enjoys growth from their use.

Shire plc Rolling Daily

Shire is a successful pharmaceutical development company, and its current quotation for a rolling daily spread bet is 1820.2 – 1824.8. If you want to spreadbet on the price going further upwards, you could place a long or buy bet at the price of 1824.8, staking perhaps £4.50 per point.

In this example, assume that you are correct and the price goes up to 2005.2 – 2009.8, at which point you decide to close your spread trade and collect your winnings. Working out how much profit you have made, you note that the bet closed at the selling price of 2005.2, up from the starting price of 1824.8. Taking 1824.8 away from 2005.2, you find you have gained 180.4 points. For your stake of £4.50 per point, that means you have profited by £811.80.

As a further example, you might find that the price went the opposite direction, making this a losing spread spreadbet. Perhaps you closed the spread bet and accepted your losses when the quote was 1693.5 – 1698.1. This time you must work out how much you have lost. The starting price was 1824.8, and the bet closed at 1693.5. That means you lost 131.3 points on this spread trade. For your size of stake, that amounts to a loss of £590.85.

Many spread traders find it difficult to keep an eye on the market all the time, and the stop loss order helps minimize the losses if this is the case. It requires your spread betting provider to close a losing bet, at a level you set, regardless of whether you are watching the market. With a stoploss order, you might find that this trade was closed at a price of 1753.7 – 1758.2. With a starting price of 1824.8, and a closing price of 1753.7, you have lost 71.1 points, which costs you £319.95.

Shire plc Futures Style Spread Bet

Shire plc is a pharmaceutical company, and has specialized in certain niche health products, such as ADHD. The current price for a mid-quarter futures based spreadbet is 1828.4 – 1840.4. If you think that the share price is going down in the next few weeks, then you might want to place a sell or short bet, staking perhaps £2.50 per point.

If you are correct, and the price goes down, you might find that you are closing the bet and collecting your winnings when the quote is 1692.3 – 1704.0. To see how much you have won, first work out the number of points you gained. Your bet opened at the selling price of 1828.4, and it closed at 1704.0 (Short spreadbets always close at the higher, buying price). That means you have gained 1828.4 minus 1704.0 points, which is 124.4 points. You staked £2.50 per point, which means that your winnings are £311.

Often your spread bet will not be a winner, so you must also be able to figure out how much you have lost. Say the price went up after you placed the bet, and you finally closed it and accepted the loss when it reached 1905.2 – 1916.8. The bet was originally placed at 1828.4, and this time it closed at 1916.8. As it was a short bet, and it closed higher, the difference of 88.4 in points is a loss to you. 88.4 times £2.50 is a loss of £221.

Many traders use the stoploss order to rescue their losing bets. With it, they know that the bet will be closed whether or not they’re watching the market. Perhaps in this case with a stoploss order your bet would be exited at 1870.0 – 1881.4. As before, your bet started at 1828.4, and this time it closed at 1881.4. 1881.4 less 1828.4 is 53.0 points, so at your chosen wager size this would have cost you £132.50.

Join the discussion