To many people, a stop order looks like a very simple thing, represented as it often is by a single input box labeled “stop” on a spread bet trading ticket. The purpose of a stop order is also regarded by many as very simple: to stop a loss. Yet stop orders are not as simple as they first appear, and they come in many varieties, as follows.

Limit Sell Order

How It Works:

- Setting the Price: The trader specifies the minimum price they are willing to accept (the limit price).

- Execution: The order will only execute if the market price reaches or exceeds the limit price.

Example:

- Current Price: $50

- Sell Limit Price: $55

- If the market price rises to $55 or higher, the sell limit order is triggered, and the asset is sold at $55 or a better price.

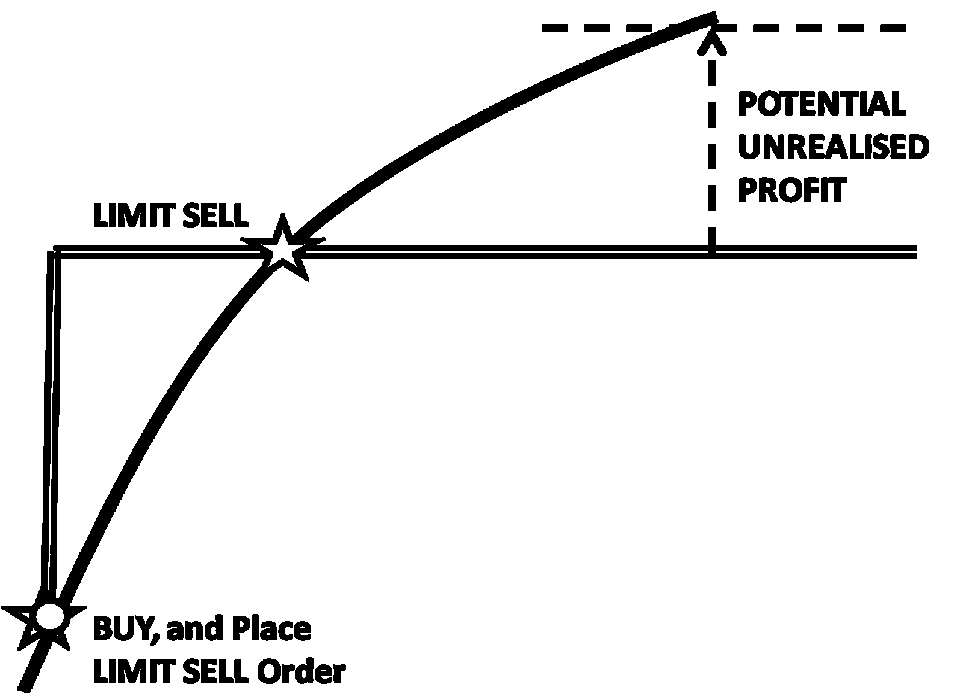

The following figure shows the most obvious failure scenario, in which the price continues to rise after the order executes. There is additional potential profit, which we fail to realize by selling out too soon.

Key Features:

- Price Control: Ensures the asset is sold at the specified price or higher.

- No Guarantee of Execution: If the market price does not reach the limit price, the order will remain unfilled.

- Good for Exiting Positions: Used to sell at a desired profit level.

When to Use a Sell Limit Order:

- Profit-Taking: To lock in profits when the price reaches a favorable level.

- Strategic Selling: To sell assets during a market rally or at resistance levels.

- Avoiding Undesirable Prices: To prevent selling for less than your target price.

It contrasts with a market order, which executes immediately at the best available price, regardless of the target.

A conventional stockbroker will offer a specific LIMIT SELL order type, or will provide an order form via which you can specify the order type (as LIMIT) and the order direction (as SELL).

A spread betting order ticket may allow you to specify your order as a LIMIT order, or this may be inferred from the fact that an order to sell at a price above the current price must be a LIMIT SELL order.

In all cases you specify a target price at which you wish your chosen stock or other financial instrument to be sold or sold short. The sell order will not be executed until the price rises to the specified level. Where the spread betting order ticket obliges you to specify this as a LIMIT order to SELL, you will likely encounter an error message if your target price is not above the current market price.

The Stop Order To Sell

The most familiar stop order to sell is designed to execute sometime in the future when the price of a financial instrument falls to a level that you specify. This kind of stop order may be attached to a specific long trade, in which case its purpose may be to stop a loss or secure a profit. Alternatively, it might be a standalone stop order that opens a new short trade when a price begins to fall.

The Stop Order To Buy

The less familiar stop order to buy is the mirror image of the stop order to sell, and it is designed to execute sometime in the future when the price of a financial instrument rises to a level that you specify. This kind of stop order will likely be used to open a new long position when a price starts trending upwards, but it might also be attached to a specific short position as a mechanism for stopping a loss or securing a profit on that short position.

NAME

STOP BUY

DEFINITIONS

A STOP BUY order is an order to BUY a security when the price rises to a specified level.

PARAMETERS

STOP BUY Trigger Price.

OBJECTIVE

The objective is to buy a rising stock or other financial instrument.

MOTIVATION

Momentum traders believe that a rising stock will continue to rise, and that it is even possible to ‘buy high, sell higher’. Alternatively, as expressed in the following scenario, the STOP BUY pattern allows you to ‘buy low’ as with LIMIT BUY, but without the potential loss.

SUCCESS SCENARIO(s)

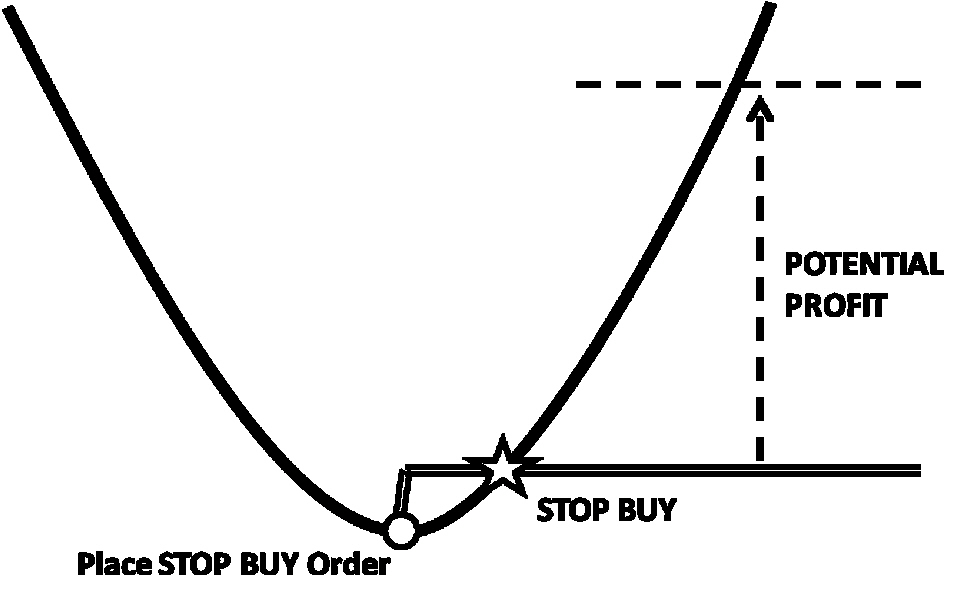

The following figure shows the STOP BUY success scenario. When we think the stock price has stopped falling, and is about to rise, we place a STOP BUY order to buy the stock if it rises to a specified level.

If the price continues to rise after the STOP BUY order has executed, we have a potential profit.

You will recognize this scenario as similar to the LIMIT BUY scenario, in the sense that we are looking to benefit ultimately from a price rise, but there’s an important difference. If the price falls immediately after we place the STOP BUY order, the order does not execute and we do not stand to make a loss.

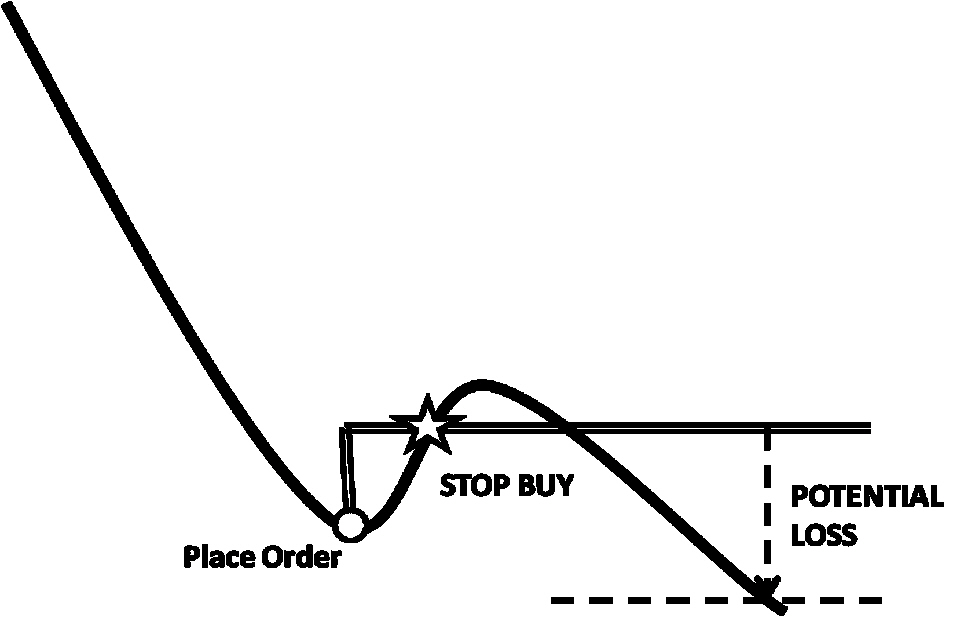

FAILURE SCENARIO(s)

The following figure shows the most obvious failure scenario, in which the trend reverses and the price falls after the STOP BUY executes. This results in a potential loss.

This is not the only failure scenario. Another failure scenario is the one in which the price does not rise, but falls after we place the STOP BUY order. We do not make a loss, but we fail to realize additional profit if the price does eventually recover from a new low point up to our STOP BUY point.

APPLICATION

Your stockbroker should offer a STOP BUY order type, which executes when the price rises to a specified level, or will provide an order form via which you can specify the order type (as STOP) and the order direction (as BUY).

A spread betting order ticket may allow you to specify your order as a STOP order, or this may be inferred from the fact that an order to buy at a price above the current price must be a STOP BUY order.

In all cases you specify a target price at which you wish your chosen stock or other financial instrument to be bought long. Where the spread betting order ticket obliges you to specify this as a STOP order to BUY, you will likely encounter an error message if your target price is not above the current market price.

The Trailing Stop Order

The trailing stop order allows you to specify a stop distance rather than a stop level, thereby allowing you to lock in even more profit or suffer less and less loss as the price moves in your favor. Theoretically (though usually not offered in practice), a trailing stop order could even help you to enter a position at an increasingly better price.

NAME: TRAILING STOP BUY

DEFINITIONS

A TRAILING STOP BUY order is an order to BUY a security when the price rises by a specified amount above the prevailing market price. A TRAILING STOP BUY tracks a falling price.

PARAMETERS

STOP BUY Trigger Distance.

OBJECTIVE

The objective is to buy at a low price at the onset of an uptrend.

MOTIVATION

One of the failure scenarios for the STOP BUY, STOP SELL pattern was as follows:

When we set a STOP BUY above the current price, the price might fall significantly, not triggering our order. If the price subsequently rises all the way back up to our STOP BUY level, we buy-in having missed the additional profit potential of the fall-and-rise. In other words: although we have bought at the onset of an uptrend, we have bought at a higher price than necessary.

SUCCESS SCENARIO

The following figure shows the success scenario in which the TRAILING STOP BUY helps us to buy on an uptrend, at a low price.

With the price trending down, we place a TRAILING STOP BUY order with a trigger price above the current price. As the price falls, the TRAILING STOP is adjusted downwards at the same rate. At some point the trend reverses sufficiently to trigger the STOP BUY order.

The advantage of this pattern is that we don’t need to guess when we might be at the end of a downtrend and the beginning of an uptrend. The TRAILING STOP order tracks the price down until the trend reverses from its lowest point.

FAILURE SCENARIO(s)

The following figure shows the most obvious failure scenario, in which the price falls dramatically soon after our TRAILING STOP BUY has executed.

Although we stand to make a loss in this scenario, at least we bought-in at what we consider to be a low price. Another failure scenario is the one in which our STOP BUY order executes at the original trigger price soon after we place it, without having fallen first, and then the price falls dramatically.

APPLICATION

Some stockbrokers and spread betting companies provide a dedicated trailing stop facility that fully automates this trading pattern. In this case you would specify an amount by which you want the price to rise before the order executes.

If your provider does not offer trailing stops, you can still trail the stops yourself by adjusting the trigger price of your non-trailing STOP order periodically, in line with the falling stock price. Some traders will prefer trailing their stop orders manually because this allows them to consider other factors such as technical support and resistance levels.

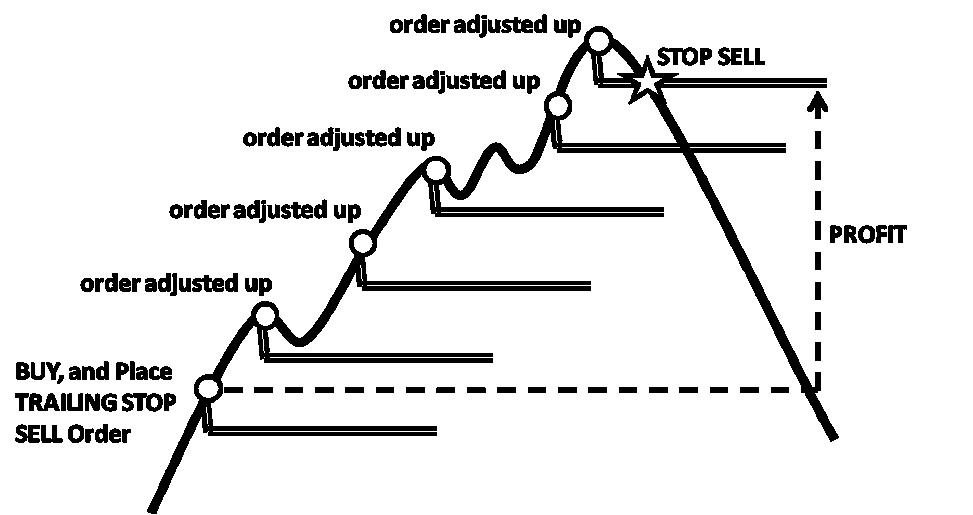

NAME: TRAILING STOP SELL

DEFINITIONS

A TRAILING STOP SELL order is an order to SELL a security when the price falls by a specified amount below the prevailing market price. A TRAILING STOP SELL tracks a rising price.

PARAMETERS

STOP SELL Trigger Distance.

OBJECTIVE

The objective is to sell at a high price at the onset of a downtrend.

MOTIVATION

One of the failure scenarios for the STOP BUY, STOP SELL pattern was as follows:

When we set a STOP SELL below the current price, the price might rise significantly, not triggering our order. If the price subsequently falls all the way back up to our STOP SELL level, we sell-out having missed the additional profit potential of the rise-and-fall. In other words: although we have sold on a downtrend, we have sold at a lower price than necessary.

SUCCESS SCENARIO(s)

The following figure shows the success scenario in which the TRAILING STOP SELL helps us to sell on a downtrend, at a high price. With the price trending up, we place a TRAILING STOP SELL order with a trigger price below the current price. As the price rises, the TRAILING STOP is adjusted upwards at the same rate. At some point the trend reverses sufficiently to trigger the STOP SELL.

Trailing Stop Sell

You might remember that something similar was demonstrated in this article. Technically it wasn’t a trailing stop in that article because we placed a second STOP SELL order at the higher price, rather than adjusting the original order upwards.

FAILURE SCENARIO(s)

The failure scenarios for this pattern are the exact mirrors of those for the TRAILING STOP BUY, i.e.:

- The price rises dramatically soon after the STOP SELL order executes, so we sold out too soon.

- The STOP SELL order executes at the original trigger price soon after we place it, without rising first, and then the price rises dramatically.

APPLICATION

Some stockbrokers and spread betting companies provide a dedicated trailing stop facility that fully automates this trading pattern. In this case you would specify an amount by which you want the price to fall before the order executes.

If your provider does not offer trailing stops, you can still trail the stops yourself by adjusting the trigger price of your non-trailing STOP order periodically, in line with the rising stock price. Some traders will prefer trailing their stop orders manually because this allows them to consider other factors such as technical support and resistance levels.

The Guaranteed Stop Order

A guaranteed stop order (which you usually have to pay for) guarantees the price at which you will stop out in the event of a market price gap. It allows you to transfer the risk of stopping out unfavorably—which can happen because stop orders usually “guarantee execution but not price”—to the trading platform provider. Use a guaranteed stop order if you can’t afford the risk.

The “Good Until” Stop Order

Many trading platforms allow you to specify a stop order that is “good until” a particular time. You might want your stop order to stop you out of (or into) a position only if it can be done within the trading day, or within a month, rather than defaulting to the indefinite good-till-canceled.

Other Variants of Stop Orders

Depending on the instruments you’re trading and the platform on which you’re trading them, you might find that other variants of stop orders are made available to you. For example:

- One-Cancels-Other (OCO): This type allows you to hedge your bet on which way you think the market will go.

- Stop-with-Limit: Acts as a substitute for guaranteed stop orders on some stockbroker trading platforms.

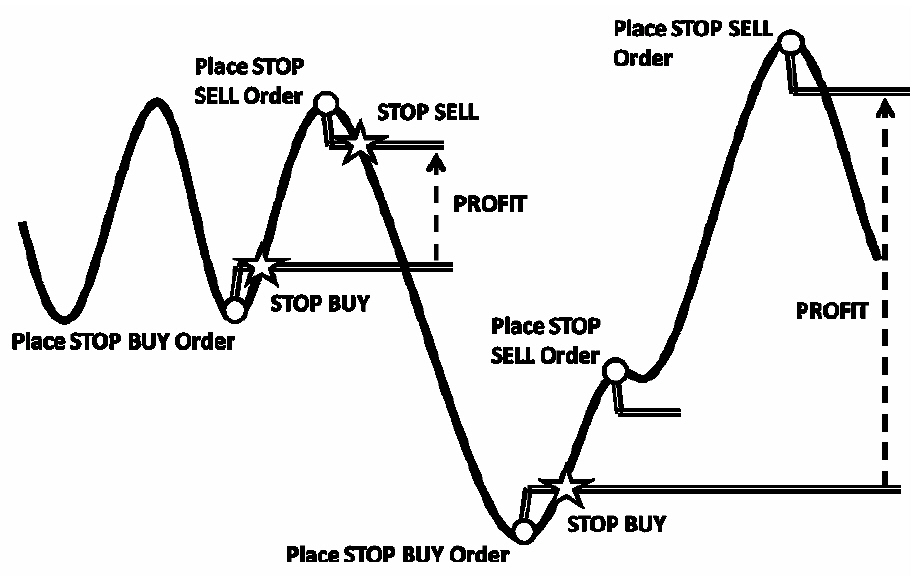

STOP BUY, STOP SELL

Here I combine two previously-defined trading patterns in order to create a more complex composite trading pattern.

NAME

STOP BUY, STOP SELL

DEFINITIONS

A STOP BUY order is an order to BUY a security when the price rises to a specified level.

A STOP SELL order is an order to SELL a security when the price falls to a specified level.

OBJECTIVE

The objective is to buy at the onset of an uptrend, sell at the onset of a downtrend.

MOTIVATION

This pattern could be used for the same purpose as the LIMIT BUY, LIMIT SELL pattern; i.e. to buy low and sell high. By using STOP orders rather than LIMIT orders we benefit because:

- We buy when the price is rising and is therefore (we assume) more likely to continue rising.

- We only sell when the price starts to fall, not when it reaches an arbitrary level below the true profit potential.

This pattern might also be used for momentum trading. That is: buy a rising stock high, sell it even higher.

SUCCESS SCENARIO(s)

The following figure shows two success scenarios in one:

- In the first scenario we observe a trading range. At the bottom of the range we Place a STOP BUY order, which is executed on the upturn. At the top of the range we Place a STOP SELL order, which is executed on the downturn; thus securing a profit. Compare this scenario with the LIMIT BUY, LIMIT SELL scenario for swing trading.

- In the second scenario, we observe that the price is at a low point. We Place a STOP BUY order, which is executed on the upturn. When we think the trend is reversing we Place a STOP SELL order, which is not executed because the uptrend re-establishes. The price rises considerably and at the next anticipated trend reversal we Place a STOP SELL Order; which is executed, thus securing a profit.

In the second success scenario you will have noticed that we placed two STOP SELL orders in succession, the second one at a higher level. In effect we’ve used a TRAILING STOP, which is the next pattern that we’ll consider.

FAILURE SCENARIO(s)

There are several possible failure scenarios, combining the failure scenarios for the separate STOP BUY and STOP SELL patterns presented earlier. A selection of the failure scenarios are as follows:

- The trend might reverse immediately after our STOP BUY triggers, taking us into loss.

- The trend might reverse after triggering our STOP SELL, so that that we miss out on further profit potential.

- When we place the STOP BUY order, the price might fall significantly, rather than rising and triggering our order. If the price subsequently rises all the way back up to our STOP BUY level, we buy-in having missed the additional profit potential of the fall-and-rise.

- When we place the STOP SELL order, the price might rise significantly, rather than falling and triggering our order. If the price subsequently falls all the way back down to our STOP SELL level, we sell-out having missed the additional profit potential of the rise-and-fall.

The first two failure scenarios result in whipsaw losses, which can be minimized by placing additional (contingent) protective stop orders. The second two failure scenarios can be mitigated through the use of TRAILING STOP orders.

APPLICATION

This pattern is implemented by combining the STOP BUY and STOP SELL financial trading patterns.

As described here, this trading pattern implies a “long” strategy of using a STOP BUY order to enter a position and a corresponding STOP SELL order to exit the position. A spread bettor — but not a regular retail stock holder — could turn this trading pattern entirely on its head by using a STOP SELL order to enter a short position and a corresponding STOP BUY order to exit the short position.

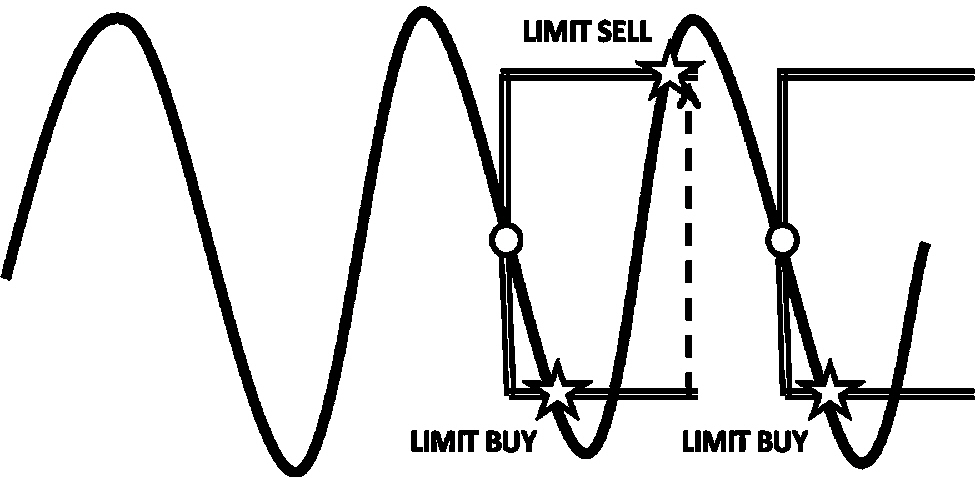

LIMIT BUY, LIMIT SELL

This is the first example in which I will combine two of the previously-defined financial trading patterns — LIMIT BUY and LIMIT SELL — so as to create a composite pattern called LIMIT BUY, LIMIT SELL.

NAME

LIMIT BUY, LIMIT SELL

DEFINITIONS

A LIMIT BUY order is an order to BUY a security when the price falls to a specified level.

A LIMIT SELL order is an order to SELL a security when the price rises to a specified level.

PARAMETERS

LIMIT BUY Trigger Price.

LIMIT SELL Trigger Price.

OBJECTIVE

The objective is to buy low, sell high.

MOTIVATION

Swing traders in particular want to “buy low” at the bottom of a trading range and “sell high” at the top of a trading range, possibly repeatedly.

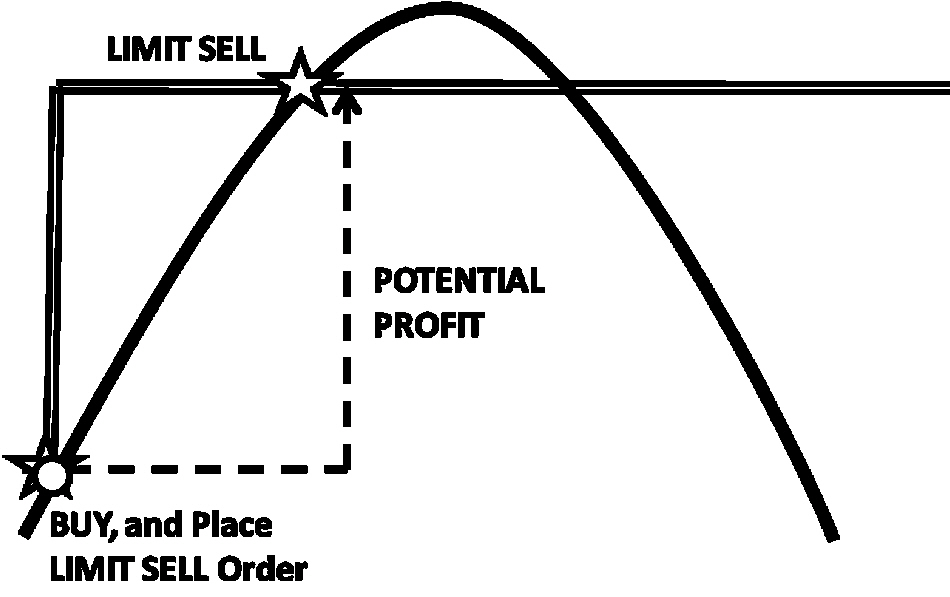

SUCCESS SCENARIO(s)

The following figure shows a stylistic representation of the LIMIT BUY, LIMIT SELL swing trading success scenario.

After witnessing a few regular peaks and troughs, we identify what we consider to be a financial instrument’s trading range. We place a LIMIT BUY order to buy-in near the bottom of the trading range, and a LIMIT SELL order to sell-out near the top of the trading range.

If all goes according to plan, our profit is the difference between the LIMIT BUY and LIMIT SELL prices. We can repeat the pattern as long as the price continues to oscillate within the trading range.

FAILURE SCENARIO(s)

There are several possible failure scenarios for this pattern as follows:

• The trading range breaks down and the price continues to fall after the LIMIT BUY executes, resulting in increasing loss.

• The trading range breaks down and the price continues to rise after the LIMIT SELL executes, resulting in unrealized profits (or increasing loss if net short).

• The trading range narrows, so the orders do not execute.

The first two failure scenarios can be mitigated by placing protective stop orders above and below the trading range.

APPLICATION

You implement this pattern using your stockbroker’s LIMIT BUY and LIMIT SELL order types, and for each order, you specify a price at which you wish the order to execute.

In a spread betting account you may be able to place both orders simultaneously, whereas in a regular stockbroker account you will likely only be able to place a LIMIT SELL order on a stock that you actually hold – i.e. after the LIMIT BUY order has executed.

The spread bettor’s use of this pattern might include going “net short” at the top of the cycles, by placing a LIMIT BUY order at £1-per-point and an opposing LIMIT SELL order at £2-per-point.

Can’t Find Your Favorite Variant?

The kinds of stop orders vary from platform to platform, and you might not be able to find the variant you want. In some cases, you might want to switch to another platform, and in others, you might prefer to create your own manually. For example:

- Implement your own trailing stop order by manually adjusting the level of your non-trailing stop order periodically.

- Create a “good until” stop order by setting a reminder to remove it when you feel that it has outstayed its welcome.

- Employ a “time stop” by stopping out of a position manually if the price goes nowhere within a specific period of time.

Mixing Up the Variants

I use the word “variants” rather than “types” of stop orders because we’re talking about properties of stop orders that are not mutually exclusive. For example, it is possible (though not on all platforms) to mix variants to create a stop order that is to sell, trailing, and guaranteed to be good until a time of your choosing.

And you thought stop orders were simple one-dimensional mechanisms for merely stopping a loss. Think again!