In some of my earlier articles I highlighted some of the key figures who have shaped my trading philosophy – trading legends like Nicolas Darvas, Jesse Livermore, and Van Tharp. Among these influences, Michael W. Covel’s seminal book Trend Following holds a special place on my trading bookshelf. Covel’s work not only deepened my understanding of technical analysis but also introduced me to the disciplined mindset required to thrive in the markets. Let’s delve deeper into why his teachings have had such a lasting impact on my trading journey.

A Different Approach to Trading

As I outlined in my previous feature, my trading strategy revolves around identifying trends early. Often, this involves taking positions during price dips or even catching a falling knife, and then holding those positions as the trend develops. My trades are closed automatically when the trend reverses, thanks to the use of stop orders. While this approach differentiates me from a pure trend follower, there are striking similarities between my methodology and the principles espoused in Covel’s book.

The Philosophy of Trend Following

Covel’s Trend Following presents a compelling case for why trading is largely—though not entirely—technical in nature. This philosophy contrasts with the fundamental approach, which relies heavily on financial metrics and broader economic indicators. For shorter-term strategies, Covel’s emphasis on price action and technical indicators such as support and resistance levels is particularly effective. For longer-term position trading, which is my preferred style, his principles still hold relevance. Price action remains my primary motivator when opening or adding to positions, with minimal reliance on fundamental analysis.

One of the standout lessons I learned from Covel is the potential for trading to be partially mechanized. Tools like price-based stop orders and mechanical entry orders allow for a systematic approach, reducing the emotional toll of decision-making. While I still exercise discretion when opening positions or pyramiding into trades, I let my stop orders take over when it comes to exiting positions. This balance between discretion and automation has been instrumental in refining my trading system.

Real-World Examples and Equity Curves

A particularly fascinating aspect of Covel’s book is its exploration of real-world track records from successful trend-following traders. These examples provide invaluable insights into the realities of trading. Many of these traders endured prolonged periods of underperformance and significant drawdowns before achieving substantial and consistent gains. The equity curves presented in the book serve as both a source of inspiration and a cautionary tale.

While these stories highlight the importance of resilience and patience, they also underscore the need for vigilance. It’s easy to rationalize early losses by believing that setbacks are a natural part of the process. However, as with new businesses that overspend on unnecessary expenses, complacency in trading can be dangerous. Not every business—or trading account—recovers from its initial challenges. The key is to remain disciplined and focused on long-term success without allowing initial struggles to spiral into irreversible losses.

Connecting to Trading Legends

Another intriguing element of Trend Following is its mention of Jesse Livermore, one of my personal trading idols. Livermore’s approach to the markets shares commonalities with trend-following principles, particularly in his emphasis on discipline, strategy, and understanding market behavior. Covel’s inclusion of Livermore adds a layer of historical context to the book, bridging modern trading practices with timeless wisdom.

Making Trend Following Accessible

Covel’s writing style and detailed examples make Trend Following accessible to traders at all levels. He doesn’t just focus on theory; he provides actionable insights that readers can incorporate into their own strategies. Whether it’s learning to let profits run, cutting losses quickly, or relying on data-driven decisions, Covel’s lessons are both practical and transformative.

Final Thoughts

Michael Covel’s Trend Following is more than just a book; it’s a framework for approaching the markets with discipline and a clear set of rules. While my trading style isn’t a pure reflection of trend following, the principles outlined in his work have profoundly influenced my mindset and strategy. From emphasizing the importance of technical analysis to showcasing the power of mechanization, Covel’s teachings continue to resonate with me as I navigate the complexities of trading.

For traders looking to develop a systematic approach and gain insights from the successes and failures of others, Trend Following is an essential read. It not only equips you with tools to improve your trading but also provides the inspiration to persevere through the inevitable challenges of the markets.

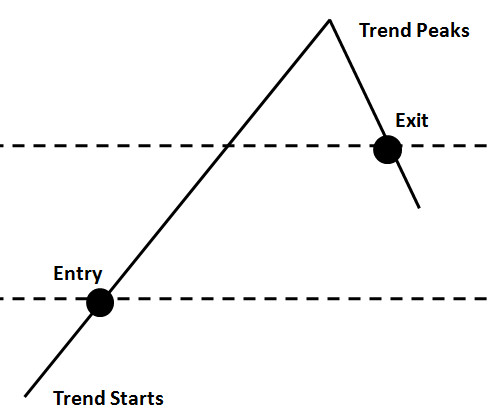

Here’s a descriptive summary for the classic stylistic picture of a trend-following trade based on your input:

The classic trend-following trade is characterized by a disciplined approach to capturing the major portion of a market trend. In this strategy, the focus is not on predicting the exact top or bottom of the trend, but on entering and exiting positions based on clear technical signals. The process often looks like this:

- Entry Point: The trader enters the trade as the trend begins to establish itself, typically confirmed by breaking a resistance level (uptrend) or support level (downtrend).

- Ride the Trend: The position is held as long as the trend remains intact, ignoring minor fluctuations or corrections in price. This phase reflects the principle of letting profits run.

- Exit Point: The trade is closed when a clear reversal is indicated, such as a break of the trendline or hitting a predetermined stop-loss level, ensuring the bulk of the trend is captured.

This method aligns with the principles of Jesse Livermore, who famously focused on the “big swing” rather than short-term price movements. Michael Covel’s visualization of this concept emphasizes the importance of patience and discipline in trend following.