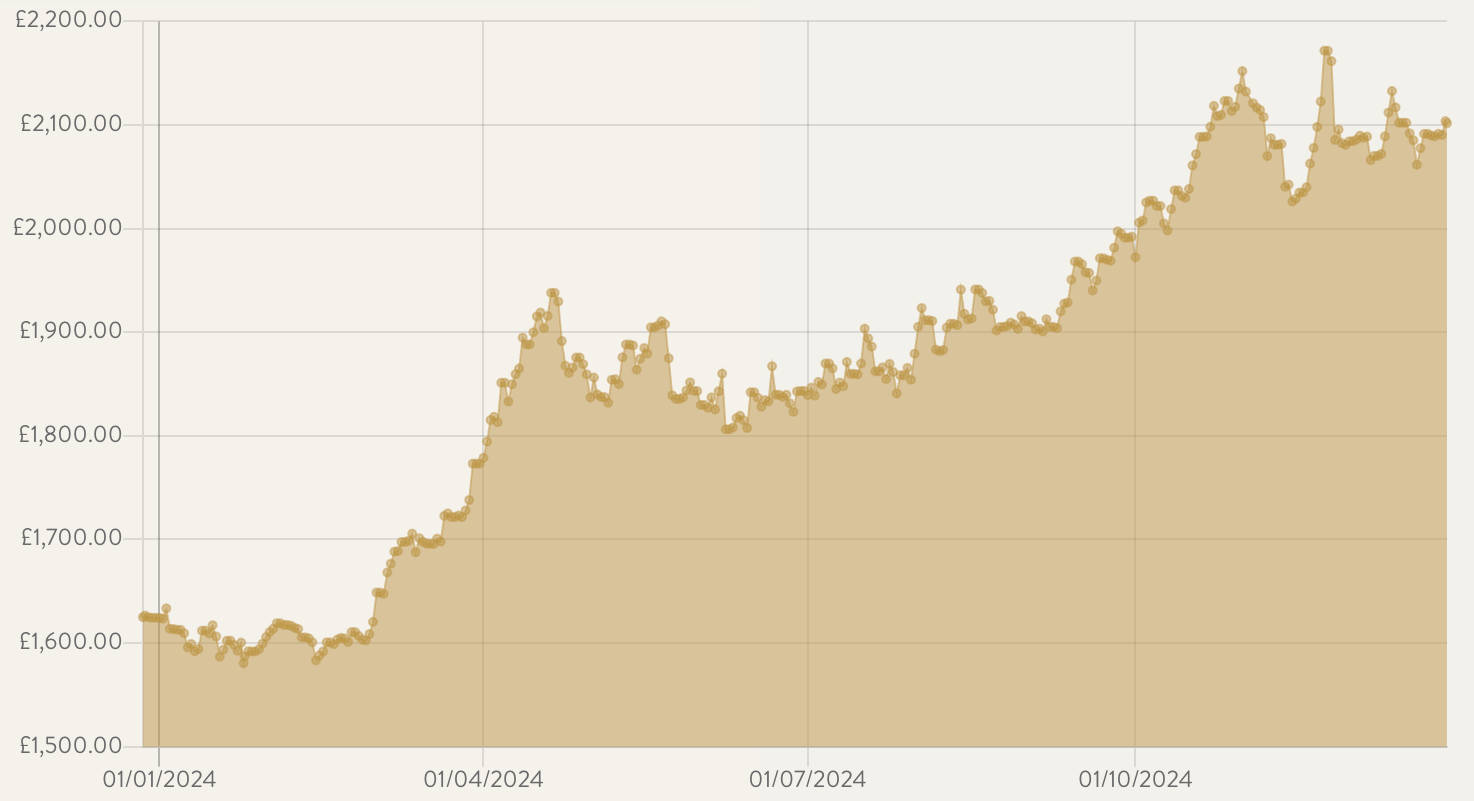

Gold prices have climbed to impressive heights in recent years, fueled by economic uncertainty, inflation concerns, and geopolitical instability. However, gold mining stocks have not mirrored this ascent, underperforming expectations and leaving investors scratching their heads. This disconnect between gold prices and gold miners has raised questions about the factors holding back mining stocks. Adding to the complexity, the rise of alternative assets like Bitcoin has further impacted investor sentiment.

The Operating Leverage Theory

Gold miners are traditionally seen as leveraged plays on gold prices. The idea is that when gold prices rise, the miners’ profit margins should expand at an even faster rate, given relatively stable production costs. For example, if gold is priced at $2,000 per ounce and mining costs are $1,000 per ounce, a 10% increase in gold prices theoretically leads to a 20% increase in profit margins.

Explaining the leverage theory in practice: Imagine you’re running a lemonade stand, and it costs you $1 to make a glass of lemonade, but you sell it for $2. If you suddenly raise the price to $2.20, your profit (or what you keep after paying costs) doesn’t just go up a little—it doubles from $1 to $1.20. That’s what people mean by “operating leverage.” In the gold world, miners (the companies that dig gold out of the ground) are supposed to benefit from this. When gold prices go up, their profits should increase even more because they still spend about the same amount to dig it up. But recently, it hasn’t worked that way. Even though gold prices have risen, miners haven’t made as much extra profit as expected. Why? The costs of things like fuel, steel, and worker wages have gone up, eating into their profits.

Take Barrick Gold, one of the biggest gold mining companies. Its stock (or how much people are willing to pay for a piece of the company) is cheaper now than it has been in almost a decade. Back in 2016, its stock was 40 times its earnings, but now it’s only 13 times. That’s like your lemonade stand being worth less even though you’re selling more lemonade.

The good news? Those rising costs are starting to slow down. If this trend continues, gold miners could start making bigger profits again, which might get investors interested in these companies once more. This could be a big moment for the gold mining industry!

Why Gold Miners Have Lagged

- Cost Inflation Rising production costs have been a significant headwind for gold miners. Key inputs like energy, steel, chemicals, and labor have become more expensive due to global inflation. For instance, diesel fuel—essential for running mining equipment—saw steep price increases, while wage pressures for skilled workers added further strain. These cost hikes have eaten into miners’ profit margins, despite higher gold prices.

- Increasing Taxes and Royalties Governments in several gold-producing nations are increasing taxes and royalties on mining operations, further squeezing miners’ profits. For example, Mali, a significant gold producer in Africa, has recently raised taxes for gold companies, citing the need for more national revenue. Other countries, such as Burkina Faso and the Democratic Republic of Congo (DRC), have also increased royalty rates or imposed stricter financial terms on mining firms. These moves reflect a broader trend of resource nationalism, where governments aim to extract more value from their natural resources. For mining companies, this means higher costs and reduced earnings, even as gold prices climb.

- Operational and Geopolitical Challenges Mining operations often face unexpected hurdles, including lower-than-expected ore quality, equipment failures, and stricter environmental regulations. Many mines are located in politically unstable regions, exposing companies to risks such as government intervention, resource nationalism, or disruptions due to conflict.

- Competition from Bitcoin Bitcoin and other cryptocurrencies have emerged as a new “safe-haven” asset class, competing with gold for investor attention. Bitcoin’s digital nature, ease of transfer, and scarcity (similar to gold’s finite supply) have attracted a new generation of investors. Many younger and tech-savvy investors view Bitcoin as a modern alternative to gold, leading to reduced capital flows into traditional gold-related investments, including mining stocks. While gold remains a reliable store of value for many, Bitcoin’s dramatic price gains and decentralized appeal have drawn speculative and long-term investors alike, weakening demand for miners as a means of gaining exposure to gold.

- Investor Preference for Gold ETFs In addition to Bitcoin, gold exchange-traded funds (ETFs) have grown in popularity. These ETFs track gold prices directly, offering a simpler and lower-risk way to invest in gold. Unlike mining stocks, ETFs don’t come with the operational risks or cost uncertainties associated with mining companies. This has diverted investment capital away from miners.

- Environmental, Social, and Governance (ESG) Concerns Increasing focus on ESG criteria has also weighed on the gold mining sector. Many investors view mining as environmentally damaging and socially contentious. Stricter environmental regulations and rising scrutiny from activists have made mining companies less attractive compared to alternatives like ETFs or Bitcoin.

- Capital Discipline and Limited Growth After years of overexpansion and disappointing returns, many mining companies have shifted toward more cautious capital management. While this approach has strengthened balance sheets, it has also limited production growth, which some investors see as a missed opportunity during a strong gold price environment.

China’s Rise to the Top of Gold Production

The global landscape of gold production has seen remarkable shifts since 1993, with some surprising changes in leading nations. Among the most notable developments is China’s rise to the top spot as the world’s largest gold producer, with its output more than tripling over the past three decades.

In stark contrast, South Africa, which held the crown for many years, has experienced an 83% drop in production, falling significantly in the rankings. Despite this decline, South Africa remains a key player in the industry. However, the continent’s overall influence has grown, as the number of African nations in the top 20 gold producers surged from just three in 1993 to eight in recent years.

Historical Dominance to Diversified Supply In the early 1970s, South Africa dominated global gold production, contributing a staggering 79% of the “free world” gold supply in 1970, according to Krishan Gopaul, senior analyst at the World Gold Council. Even by 1993, South Africa was still a major leader. Today, however, the global gold market is far more diversified, with no single nation accounting for more than 10% of total production. This diversification helps mitigate supply risks tied to any one country.

West Africa’s Rising Prominence In recent years, West Africa has gained prominence in the gold mining sector, with Ghana emerging as Africa’s top producer. This growth underscores the increasing importance of the region and its contribution to the global gold supply. As production spreads across more nations, the gold market’s stability and resilience have improved, ensuring a balanced and steady flow of this precious resource.

A Potential Turning Point for Miners

Despite these challenges, the tide may be turning for gold miners. Cost inflation is beginning to ease, as prices for energy and raw materials stabilize. This relief could help miners recover lost profitability. Furthermore, as concerns about economic instability persist, the demand for gold as a safe-haven asset remains robust, which could eventually draw renewed interest to mining stocks.

Valuations in the mining sector are also becoming increasingly attractive. For instance, Barrick Gold, one of the world’s largest gold producers, is currently trading at its cheapest price-to-earnings ratio since 2015. Such low valuations could lure long-term investors who believe the sector is poised for a rebound.

The Gold vs. Bitcoin Debate

Gold and Bitcoin often compete as stores of value, each with its unique strengths. While Bitcoin has gained ground as the “digital gold,” it is subject to extreme volatility and regulatory uncertainty. Gold, on the other hand, has stood the test of time as a tangible and stable asset. For investors weighing the two, diversification into both assets may be a prudent strategy.

For mining companies, however, Bitcoin’s rise presents an additional challenge: shifting investor capital away from the traditional gold market. To regain investor confidence, miners must address cost inefficiencies, adapt to ESG demands, and communicate their value proposition in a market increasingly dominated by digital alternatives.

Conclusion

Gold miners have struggled to keep pace with rising gold prices due to cost inflation, operational challenges, and competition from alternatives like Bitcoin and gold ETFs. However, with easing inflationary pressures and historically low valuations, the mining sector may be at an inflection point. As the industry works to navigate these challenges, investors should keep a close eye on the evolving dynamics between gold, mining stocks, and emerging competitors like Bitcoin. This interplay will likely shape the future of the gold mining sector.