Psychology

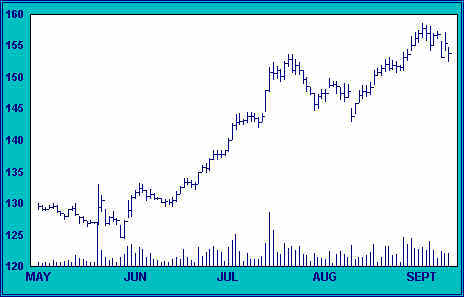

Distribution is only possible when the mass of traders are positive on the market. Published editorials and reports from July to September give us some insight into traders’ outlook and mood during this period. All of the following excerpts are from the Wall Street Journal.

July 8: “According to one observing broker there is less actual speculation on the stock exchange than at any time in history. The theory is based on the following: great absorption of stocks by investment trusts; purchase of stocks by employees under profit-sharing plans; increased stock ownership by institutions; safer margins; increases in credit balances of customers.”

July 31: “There is nothing in the business picture to discourage high market prices. The industrial pace is much faster than usual at this season. Earnings for the first six months are record-breaking, and volume is expanding. Prospects for the third quarter are particularly bright. Because of these facts it is the general view that whatever reaction has occurred in the stock market was technical only.”

August 5: “Probably the most impressive feature is the high-grade character of advancing issues.A long list of seasoned stocks reached the highest levels in history.”

August 8: “Bulls maintain that never before have underlying conditions been as sound as at present.”

August 21: “Stocks derived further powerful impetus on the upside yesterday from simultaneous new highs in the Dow Jones industrial and railroad averages. According to the theory evolved by the late Charles Dow, which has stood the test of more than 50 years’ market experience, this development reestablished the major upward trend. It also afforded strong reason for believing that reactions which develop at this stage will prove to be technical setbacks rather than the start of a prolonged decline.”

August 24: “Many observers feel that the market is safeguarded against the development of a major reaction so long as the buying power of investment trusts remains unimpaired. August set a new record in the sale of trust securities. This situation creates a huge backlog of buying that is waiting opportunities to pick up stocks on corrections. Such powerful support underlying the market is unprecedented in history and is the principal reason why the current market cannot be judged by the standards of the past.”

August 31: “In recent months there has been considerable discussion of possible technical corrections. But instead of the general list suffering a sharp decline, individual issues and groups have corrected when they became overbought. Thus there has been little disturbance of the general market, for while some stocks were correcting others advanced.”

September 6: “Leading commission houses advised clients against indiscriminate selling, insisting that the market had been strengthened by liquidation of weak long accounts.These firms are advising the purchase of stocks on any further correction.”

September 7: “Leading observers were impressed by the manner in which the market recovered after its sharp break and insisted that the reaction had purged the market sufficiently to permit substantial rallies in many issues.”

September 9: “The principal reason for the break was an impaired technical position in the general list. Prices had advanced without interruption for 19 successive sessions, leaving the leading issues in an overbought position. Thursday’s shakeout resulted in important strengthening of the market’s internal condition, reflected in an immediate and vigorous recovery.”

September 9: “The reason General Electric advances almost continuously is not hard to find. Anyone who has ever bought this stock for investment never had a good reason for selling. It seems that just as fast as market profits accumulate, there is some new development in the form of stock split, higher dividend, valuable rights or some new line of business to make the stock more attractive.

“Although it has been among the most consistent gainers, it is apparent that GE has only scratched the surface of its potential.The demand for the company’s products is expanding constantly.With the most elaborate research and experimental facilities known to industry, new uses and applications are evolving almost daily.”

September 11: “Past experience in the financial markets has shown that each succeeding price level has sooner or later been followed by one much higher. So long as the United States continues to progress financially and industrially, the securities which represent its commercial and financial life will continue to set new high standards of value and show profit to those who have confidence in its future.”

Join the discussion