Testing Support 2

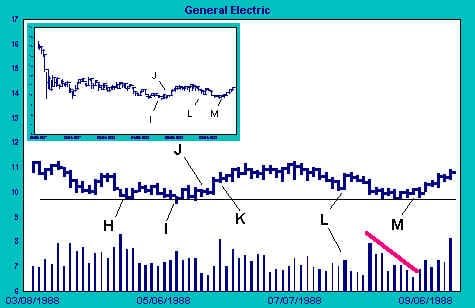

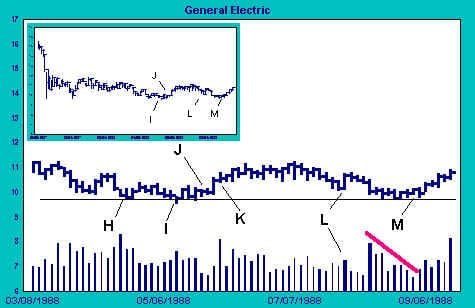

Our initial position in GE was taken in two parts, the first just after the evidence of a shakeout at I and the second at J. Our approach to accumulating a position is to make adjustments based on the evidence of the tape. Shares are added only when evidence builds that strong-handed buying interests are in control. On the other hand, evidence that sellers are gaining the upper hand may cause us to reduce our position.

We want to take positions as close to strong support as possible in order to limit risk. Should support break down in a way that suggests control by sellers, we will immediately eliminate or reduce our long position to control losses. Strong support in this case is identified at points H and I, at 9 1/2 to 9 3/4.

After the action at I and J, the stock rallies to 11, where a stalemate between buyers and sellers develops. Strong hands may be mopping up residual supply at this level prior to advancing the stock, so we maintain our position. The dip to L, appears to be a normal test of support, but adds little to our evidence for the bullish case. We do nothing.

Four periods later, the price drops on high volume, breaking minor support at L. Little in the prior action of the tape has prepared us for this development; the high volume comes out of the blue. It is likely that some bit of negative news has spooked weak-handed traders into selling. Whatever the reason for the selling, the action of the tape puts us on full alert. Support is about to be tested again.

After the flurry of selling, the tape on GE settles down to narrow trading near support. Volume tapers off quickly. Available shares around support are getting scarce fast, as evidenced by narrow spreads accompanied by the sharp drop in volume. The way the stock hugs the lows on decreasing volume and narrowing high-low spread tells us that the struggle for control is over for now. This is the quiet after battle. But who is in control?

Consider that sellers have launched a number of attacks on support around 10 over the last year. Each time, selling forces suffered attrition, as evidenced by declining volume with each attempt. The ranks of sellers are thinning as their shares are absorbed by strong hands. This action demonstrates that buyers are in firm control around support. We conclude that the stock is set up to advance.

For months, GE has been building a base. The energy coiled up over that period is substantial. Point and figure targets now suggest that the stock is a potential double. With the stock very close to support, there is new evidence that control has moved back into strong hands. We decide to add incrementally to our position, at M.

We have now taken in all the stock we are willing to at these levels. If the stock disappoints by breaking down, we will sell quickly and take our losses. On the other hand, we are willing to add to our long position once the stock demonstrates an ability to rally beyond supply at 11.

Join the discussion