Timing Bands

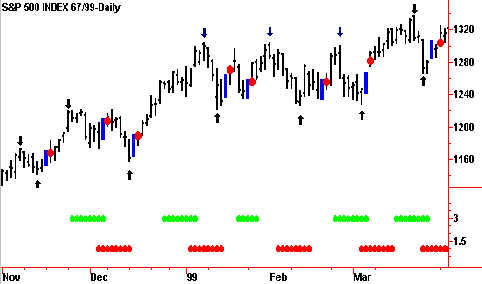

The chart below shows cycle timing bands that forecast time periods for cycle tops and bottoms with 70% accuracy. Knowing that a cycle is most likely to top or bottom in a timing band allows you to wait for a buy or sell signal to occur when prices are in a timing band. You can use the timing bands to forecast tops and bottoms and to enter and exit market positions.

Chart 9

At least 70% of all cycle tops and bottoms occur within a top timing band, or a bottoming timing band. In this chart six of seven cycle tops occurred within the top timing band; six of seven cycle bottomed in the overlap of both bottoming timing bands; the seventh occurred in only one bottoming timing band. Cycle bottoms within timing bands followed by mechanical entry signals are frequently followed by sizeable moves.

The arrows on the timing bands match the cycle arrows on the price bars. The down arrows show trading cycle tops, and the up arrows show trading cycle bottoms. In set #5 the topping band is labeled T, the bottoming bands are B and C. The same formation is followed for every cycle. Six of the seven cycles topped in the topping band for the cycle; and six of the seven cycles bottomed in the overlap of both bottoming bands.

The dots are the entry signals to go long. When a price low in the bottoming bands is followed by an entry signal, the trading cycle low is confirmed. In an uptrend the buy signal is usually followed by a cycle top in the top timing band two to three weeks after entry. Often this top is confirmed by a sell signal. Timing bands work in all markets, all time frames, and are an integral part of all Cycle Trading Patterns and market forecasts.

Join the discussion