Japanese Candlestick Charting

Candlesticks are becoming more and more popular in the west. They’ve been around a very long time indeed, but it was the fantastic work of Steve Nison that brought Candlesticks as we know them, to the western focus.

Up until this point in your training, we have been using simple plot line charts. This was deliberate, as I wanted you to not be frightened off, by having to deal with too much information. We needed you to reach a certain level before we could start throwing more information at you.

I do believe that this is where a great deal of courses go wrong – not only in the obvious support aspect, but more so in their teaching methods. I have read many books and attended courses galore over the years and almost at every turn I was inundated with information that I was expected to understand verbatim. Learning trading, isn’t easy at the best of times, and it’s not something that can be learnt as you trade – god forbid. One mistake without knowing what you’re doing and you could be wiped out. Therefore, that is why there is an obvious delay before talking about Candlestick charting. By now, I hope that you have a good idea of the key techniques are that I use, and the following pages will show you additional techniques that I use often, when markets aren’t trending in any real direction. Leaving you at the end of this course with a solid trading foundation to work from.

What are Candlesticks?

Japanese Candlesticks are relatively easy to understand, they do look complex at first, but the more you look at them, the more they make sense. There are two main initial aspects to note in a Candlestick.

- The Shadow – which can be seen as the wick of the Candle and can be visible at the top and bottom of the Real Body.

- The Real Body – you can see this as the wax candle, and the above wick runs straight through it.

Now Candles come in various sorts but the two varieties that you have to know about before we move on are:

- Clear body Candles – these are candles that are showing a positive (upwards/Long) price movement.

- Black or Filled Candles – these are candles that are showing a negative (downward/Short) price movement.

Now let’s move on to how we read a candle…

How to read Candlesticks

Although initially complex looking, they are not as complicated as they first appear. We already know that the shadow,which is the wick of the candle, runs through the real body or the wax candle. If the candle is showing positive trading activity it will be clear. If it is showing negative trading activity it will be filled in.

The shadow represents the day’s extreme low and high. Therefore, a candle with a shadow that extends down to 100 and goes up to 150, is stating that the market for that stock was at its lowest at 100, and its highest at 150. I am sure you have quickly realised that Line charts do not provide this data in any visual form.

The Candle body is interpreted differently as this is dependent on whether the market is climbing or falling. To start with we shall look at a candle body for a rising market.

A positive trading candle real body, the wax candle, will be clear. The bottom of the candle, not the bottom of the shadow/wick, is the price the market opened at. The top of that candle, again not the shadow/wick, is the price the market closed for that stock.

Therefore, using the above example of the shadow showing a trading range of the highest and lowest, the stock was traded at of 100 as the lowest, and 150 as the highest. The positive candle could be placed between the points of say 110 and 140. Effectively we would then have a candle that had a shadow running through it, starting at 100 and ending at 150 – with a clear real body starting at 110 and ending at 140.

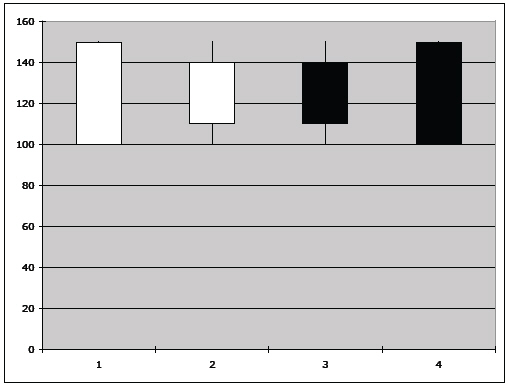

See candle number 2 in the example below:

This would mean; the market opened for this stock at 110, but traded at its lowest point that day at 100. However, the stock was strong and ended up higher than it opened at, as the candle was clear, closing at 140, but did reach 150 at some point during the day.

That is the positive trading example. Now if the market was falling, things will change a little, but it does make sense when you see for yourself.

A negative trading candle will have a filled real body, usually black or red. Now the key difference is the direction in which you read this opposing negative candle. The negative, full, real body is read from the top to bottom of the candle real body (the wax candle). NOT from bottom to top of the candle real body, as for positive trading candles. Using our example then of the shadow (the wick) showing an extreme low of 100 and a extreme high of that day of 150. Now we’re looking at a negative candle we have a full real body (black or red) with the shadow running through it. But this time, the market opened at 130 and closed LOWER at 115. This time, the candle is read from top to bottom, as it’s a full real body coloured black or red. See example candle number 3 in the chart below:

Therefore in our example on a negative candle we can quickly comprehend that the market opened this time at 140, traded at a high that day of up to 150, but had also traded as low as 100, the market on this stock was weak and closed down on the opening price of 130 to a low of 115.

You should be able to easily read any candlestick and quickly see what the lows and highs were, but also the opening and closing points in that market.

Before we move on to the next stage and look at various patterns that candles can form on their own, to indicate sentiment, we must first realise and understand the following.

How do you read a candle that has no shadow and what does that mean?

A candle that has no shadow (wick) has basically opened and closed at the day’s low and high and is read just the same for positive trading candles and negative trading candles.

For example, using our previous price ranges of 100 and 150, if this was a positive trading candle with just a clear real body and no shadow (wick), this would point out that the market opened at 100 and closed at 150 – an incredibly bullish (positive) sign. Read from bottom to top.

See example number 1 in the chart below:

Likewise for a negative candle that has a full real body (coloured red or black) and is read from top to bottom, suggesting in the above example prices that the market opened at 150, but closed at its low of 100 – again an incredibly (bearish) sign.

See example number 4 in the chart below:

You should now have a good understanding of the basics of reading a Japanese Candlestick. Remember I said that at first they appear to be quite complex, but after some thought and application, they are indeed relatively easy to understand and incredible powerful at showing current market sentiment.

It is this market sentiment that we look for within Technical Analysis. It’s not so much foresight, but the ability to second-guess that a certain pattern shown or signal generated by our indicators, is usually followed by a certain event.

Essentially it is a self-fulfilling prophecy, as Technical Analysis is incredibly popular now more than ever. In effect everyone reads the same signals and will trade accordingly to a given situation. It is only those who are skilled at reading those situations that make the money in the markets.

Join the discussion